Investments

220Portfolio Exits

13Funds

2About 468 Capital

468 Capital is a venture capital firm that focuses on investing in founder-led technology companies within various sectors. The firm provides early-stage funding and long-term investment support, specializing in identifying and backing startups with the potential to lead their categories. 468 Capital primarily invests in artificial intelligence (AI) & Automation, Infrastructure & Enterprise Software, Energy Transition & Climate, and consumer sectors. It is based in Berlin, Germany.

Research containing 468 Capital

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned 468 Capital in 1 CB Insights research brief, most recently on Aug 7, 2025.

Aug 7, 2025

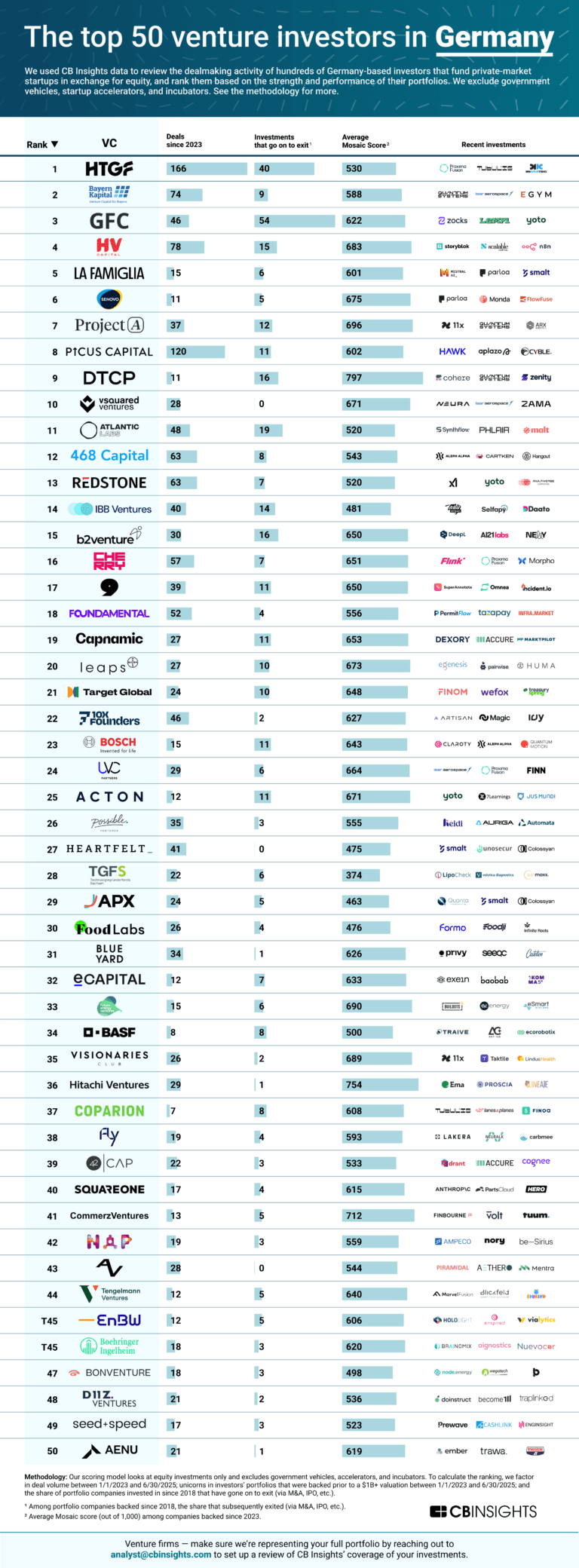

The top 50 venture investors in GermanyLatest 468 Capital News

Aug 7, 2025

Led by Peak XV Partners, Alaan's funding round also saw participation from the founders of 885 Capital, Y Combinator, 468 Capital, and Pioneer Fund. According to the company, the round was oversubscribed and included both primary and secondary funding. Additionally, the Series A received support from regional operators, including the founders of Tabby, Careem, Pleo, KAM, Talabat, and Aspora, among others. How will Alaan leverage the capital? With the newly acquired funds, Alaan plans to expand its presence in Saudi Arabia and enable the next phase of its growth, focused on AI-driven finance automation. The company mentioned that the category has reflected significant product-market fit in the MENA region, with it aiming to continue its growth trajectory across the area. Furthermore, commenting on the announcement, representatives from Alaan highlighted that the funding will help their company go deeper in the Kingdom of Saudi Arabia (KSA) while supporting it to solidify its presence in the United Arab Emirates (UAE). As part of its development strategy, Alaan intends to build a finance ops platform for businesses in the region. While its existing AI agents are performing tasks such as receipt matching, manual reconciliation, and VAT extraction to save resources, including time and money, the company now aims to focus on scaling its product offerings to take more manual work away from finance teams and equip them with complete control. As detailed by Alaan, the company's spend management platform has saved finance teams substantial hours of manual work. Alaan is also working on hiring new employees in sales, customer success, and compliance in Saudi Arabia and entering into local partnerships to better serve the Kingdom's business ecosystem. In addition to collaborating with local companies, Alaan also teamed up with Visa in March 2024 to utilise the latter's payment network, VisaNet, along with its AI-driven spend management system to provide improved financial control and visibility to businesses across the region, aligning with the cashless society initiatives of the UAE and Saudi Arabian governments.

468 Capital Investments

220 Investments

468 Capital has made 220 investments. Their latest investment was in Motion as part of their Series C - II on September 08, 2025.

468 Capital Investments Activity

Date | Round | Company | Amount | New? | Co-Investors | Sources |

|---|---|---|---|---|---|---|

9/8/2025 | Series C - II | Motion | $8.07M | No | Fellows Fund, HOF Capital, Leonis Capital, SignalFire, Valor Equity Partners, and Y Combinator | 3 |

8/20/2025 | Seed VC | Sre.ai | $7.2M | Yes | Aito Capial, Allen Wu, Chris Smoak, Crane Venture Partners, David Perry, Jeremy Rocher, JJ Fliegelman, Juan Abundes, Othman Laraki, Ravi Shedge, Richard Aberman, Robin Choy, Salesforce Ventures, Sohaib Abbasi, Transpose Platform, and Y Combinator | 3 |

8/6/2025 | Seed VC | BlindPay | $3.3M | Yes | Acacia Venture Partners, Bitso, Caetano Lacerda, Jawed Karim, Kulveer Taggar, Raphael Dyxklay, Transpose Platform, Undisclosed Investors, and Y Combinator | 3 |

8/5/2025 | Seed VC | |||||

8/5/2025 | Series A |

Date | 9/8/2025 | 8/20/2025 | 8/6/2025 | 8/5/2025 | 8/5/2025 |

|---|---|---|---|---|---|

Round | Series C - II | Seed VC | Seed VC | Seed VC | Series A |

Company | Motion | Sre.ai | BlindPay | ||

Amount | $8.07M | $7.2M | $3.3M | ||

New? | No | Yes | Yes | ||

Co-Investors | Fellows Fund, HOF Capital, Leonis Capital, SignalFire, Valor Equity Partners, and Y Combinator | Aito Capial, Allen Wu, Chris Smoak, Crane Venture Partners, David Perry, Jeremy Rocher, JJ Fliegelman, Juan Abundes, Othman Laraki, Ravi Shedge, Richard Aberman, Robin Choy, Salesforce Ventures, Sohaib Abbasi, Transpose Platform, and Y Combinator | Acacia Venture Partners, Bitso, Caetano Lacerda, Jawed Karim, Kulveer Taggar, Raphael Dyxklay, Transpose Platform, Undisclosed Investors, and Y Combinator | ||

Sources | 3 | 3 | 3 |

468 Capital Portfolio Exits

13 Portfolio Exits

468 Capital has 13 portfolio exits. Their latest portfolio exit was CustomCells on July 03, 2025.

Date | Exit | Companies | Valuation Valuations are submitted by companies, mined from state filings or news, provided by VentureSource, or based on a comparables valuation model. | Acquirer | Sources |

|---|---|---|---|---|---|

7/3/2025 | Asset Sale | Undisclosed Investors | 4 | ||

2/4/2025 | Acquired | 5 | |||

11/20/2024 | Shareholder Liquidity | 2 | |||

Date | 7/3/2025 | 2/4/2025 | 11/20/2024 | ||

|---|---|---|---|---|---|

Exit | Asset Sale | Acquired | Shareholder Liquidity | ||

Companies | |||||

Valuation | |||||

Acquirer | Undisclosed Investors | ||||

Sources | 4 | 5 | 2 |

468 Capital Fund History

2 Fund Histories

468 Capital has 2 funds, including 468 Capital Fund II.

Closing Date | Fund | Fund Type | Status | Amount | Sources |

|---|---|---|---|---|---|

1/31/2022 | 468 Capital Fund II | $400M | 1 | ||

468 Capital |

Closing Date | 1/31/2022 | |

|---|---|---|

Fund | 468 Capital Fund II | 468 Capital |

Fund Type | ||

Status | ||

Amount | $400M | |

Sources | 1 |

468 Capital Team

1 Team Member

468 Capital has 1 team member, including current General Partner, Florian Leibert.

Name | Work History | Title | Status |

|---|---|---|---|

Florian Leibert | General Partner | Current |

Name | Florian Leibert |

|---|---|

Work History | |

Title | General Partner |

Status | Current |

Loading...