Investments

2442Portfolio Exits

448Funds

67Partners & Customers

10Service Providers

2About Accel

Accel is a venture capital firm. It invests in financial technology companies, healthcare organizations, logistics companies, and more. The company was founded in 1983 and is based in Palo Alto, California.

Expert Collections containing Accel

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Find Accel in 15 Expert Collections, including Direct-To-Consumer Brands (Non-Food).

Direct-To-Consumer Brands (Non-Food)

37 items

Startups selling their own branded products directly to consumers via online/mobile channels, rather than relying on department stores or big online marketplaces.

Restaurant Tech

20 items

Hardware and software for restaurant management, bookings, staffing, mobile restaurant payments, inventory management, and more.

HR Tech

65 items

E-Commerce

22 items

Store tech (In-store retail tech)

55 items

Startups aiming work with retailers to improve brick-and-mortar retail operations.

Beauty & Personal Care

65 items

Startups in the beauty & personal care space, including cosmetics brands, shaving startups, on-demand beauty services, salon management platforms, and more.

Research containing Accel

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Accel in 8 CB Insights research briefs, most recently on Jul 14, 2023.

Latest Accel News

Nov 8, 2023

The Bengaluru- and San Francisco-based startup offered plug-and-play artificial intelligence-based copilots for software, teams and individuals to improve productivity at the workplace. Founded in 2020 by Shoaib Khan and Ankit Pansari, OSlash is backed also by Accel Partners among others, who invested about $2.5 million in September 2021. The company had started out with OSlash shortcuts, which failed to find any commercial success, the blog post said. However, “on popular demand, we augmented the product with a text expander — OSlash snippets — that helped users automate repetitive typing”, it added. “While the problem we tackled remains pressing, we failed to reach a product-market fit even after a couple of pivots and build a sustainable business model. Though disheartening, we accept this outcome with grace,” it said. Discover the stories of your interest The three-year-old startup added that it will stop accepting new OSlash registrations effective immediately. But for existing users, it will release an open-source extension, from where they can download and export all existing shortcuts. “We urge you to do this latest by 29th November, 2023… All user data will be permanently deleted from our servers by November 30th as we shut down completely,” the blog post said. After OSlash last raised funding in March 2022, it had plans to set up hiring in the US and Europe, and grow a search tool that pulls together information from different applications. Back then OSlash was used by over 3,000 teams including Cred, Khan Academy and Twitch. Experience Your Economic Times Newspaper, The Digital Way! Wednesday, 08 Nov, 2023

Accel Investments

2,442 Investments

Accel has made 2,442 investments. Their latest investment was in Integration.app as part of their Seed VC on November 07, 2023.

Accel Investments Activity

Date | Round | Company | Amount | New? | Co-Investors | Sources |

|---|---|---|---|---|---|---|

11/7/2023 | Seed VC | Integration.app | $3.5M | Yes | Cortical Ventures, Crew Capital, Jeremy Achin, Seedcamp, Tom de Godoy, and Undisclosed Angel Investors | 2 |

11/2/2023 | Seed VC | Fibmold | $10M | Yes | 2 | |

10/26/2023 | Seed VC | viso.ai | $9.17M | Yes | 2 | |

10/16/2023 | Seed VC | |||||

10/12/2023 | Series B |

Date | 11/7/2023 | 11/2/2023 | 10/26/2023 | 10/16/2023 | 10/12/2023 |

|---|---|---|---|---|---|

Round | Seed VC | Seed VC | Seed VC | Seed VC | Series B |

Company | Integration.app | Fibmold | viso.ai | ||

Amount | $3.5M | $10M | $9.17M | ||

New? | Yes | Yes | Yes | ||

Co-Investors | Cortical Ventures, Crew Capital, Jeremy Achin, Seedcamp, Tom de Godoy, and Undisclosed Angel Investors | ||||

Sources | 2 | 2 | 2 |

Accel Portfolio Exits

448 Portfolio Exits

Accel has 448 portfolio exits. Their latest portfolio exit was Tessian on October 30, 2023.

Date | Exit | Companies | Valuation Valuations are submitted by companies, mined from state filings or news, provided by VentureSource, or based on a comparables valuation model. | Acquirer | Sources |

|---|---|---|---|---|---|

10/30/2023 | Acquired | 4 | |||

9/21/2023 | Acquired | 3 | |||

9/20/2023 | IPO | Public | 2 | ||

Date | 10/30/2023 | 9/21/2023 | 9/20/2023 | ||

|---|---|---|---|---|---|

Exit | Acquired | Acquired | IPO | ||

Companies | |||||

Valuation | |||||

Acquirer | Public | ||||

Sources | 4 | 3 | 2 |

Accel Acquisitions

6 Acquisitions

Accel acquired 6 companies. Their latest acquisition was Qualtrics on June 28, 2023.

Date | Investment Stage | Companies | Valuation Valuations are submitted by companies, mined from state filings or news, provided by VentureSource, or based on a comparables valuation model. | Total Funding | Note | Sources |

|---|---|---|---|---|---|---|

6/28/2023 | Series C | $400M | Take Private | 4 | ||

6/18/2015 | ||||||

9/7/2009 | Series C | |||||

3/22/2004 | Other Venture Capital | |||||

6/12/1996 | Growth Equity |

Date | 6/28/2023 | 6/18/2015 | 9/7/2009 | 3/22/2004 | 6/12/1996 |

|---|---|---|---|---|---|

Investment Stage | Series C | Series C | Other Venture Capital | Growth Equity | |

Companies | |||||

Valuation | |||||

Total Funding | $400M | ||||

Note | Take Private | ||||

Sources | 4 |

Accel Fund History

67 Fund Histories

Accel has 67 funds, including Global Later-Stage Fund.

Closing Date | Fund | Fund Type | Status | Amount | Sources |

|---|---|---|---|---|---|

6/21/2022 | Global Later-Stage Fund | $4,000M | 1 | ||

3/2/2022 | Accel India VII | $650M | 2 | ||

6/29/2021 | Accel XV | $650M | 2 | ||

6/29/2021 | Accel Europe VII | ||||

6/29/2021 | Accel Growth VI |

Closing Date | 6/21/2022 | 3/2/2022 | 6/29/2021 | 6/29/2021 | 6/29/2021 |

|---|---|---|---|---|---|

Fund | Global Later-Stage Fund | Accel India VII | Accel XV | Accel Europe VII | Accel Growth VI |

Fund Type | |||||

Status | |||||

Amount | $4,000M | $650M | $650M | ||

Sources | 1 | 2 | 2 |

Accel Partners & Customers

10 Partners and customers

Accel has 10 strategic partners and customers. Accel recently partnered with Cognite on October 10, 2020.

Date | Type | Business Partner | Country | News Snippet | Sources |

|---|---|---|---|---|---|

10/27/2020 | Partner | Norway | Cognite Partners with Accel to Transform Industry and Define New Industrial Software Category OSLO , Norway -- -- Cognite , a global leader in industrial software innovation , announced today that it has signed a partnership agreement with leading global venture capital firm Accel . | 2 | |

1/29/2019 | Partner | United States | Accel-KKR invests $16m in Australia's Humanforce Accel-KKR , a US-based private equity firm created by Accel Partners and KKR , has invested A$ 22.5 million in Australian workforce management solutions provider Humanforce . | 1 | |

8/23/2018 | Partner | United States | 1 | ||

2/3/2016 | Partner | ||||

1/26/2016 | Partner |

Date | 10/27/2020 | 1/29/2019 | 8/23/2018 | 2/3/2016 | 1/26/2016 |

|---|---|---|---|---|---|

Type | Partner | Partner | Partner | Partner | Partner |

Business Partner | |||||

Country | Norway | United States | United States | ||

News Snippet | Cognite Partners with Accel to Transform Industry and Define New Industrial Software Category OSLO , Norway -- -- Cognite , a global leader in industrial software innovation , announced today that it has signed a partnership agreement with leading global venture capital firm Accel . | Accel-KKR invests $16m in Australia's Humanforce Accel-KKR , a US-based private equity firm created by Accel Partners and KKR , has invested A$ 22.5 million in Australian workforce management solutions provider Humanforce . | |||

Sources | 2 | 1 | 1 |

Accel Team

18 Team Members

Accel has 18 team members, including current Chief Financial Officer, Anne Rockhold.

Name | Work History | Title | Status |

|---|---|---|---|

Anne Rockhold | Silicon Valley Bank, Vanguard Ventures, American Basketball Association, Interlink Computer Sciences, Ross Systems, and Ernst & Young | Chief Financial Officer | Current |

Name | Anne Rockhold | ||||

|---|---|---|---|---|---|

Work History | Silicon Valley Bank, Vanguard Ventures, American Basketball Association, Interlink Computer Sciences, Ross Systems, and Ernst & Young | ||||

Title | Chief Financial Officer | ||||

Status | Current |

Compare Accel to Competitors

Kleiner Perkins Caufield & Byers (KPCB) is a venture capital firm based in Menlo Park, CA that primarily focuses its global investments in practice areas including technology and life sciences.

Pioneer Square Labs is a venture studio that creates its startups. It engages its venture capital and angel investor base to provide initial funding for these spin-outs. The company was founded in 2015 and is based in Seattle, Washington.

Lightspeed Venture Partners operates as an early-stage venture capital firm. It focuses on accelerating disruptive innovations and trends in the enterprise and consumer sectors. It was founded in 2000 and is based in Menlo Park, California.

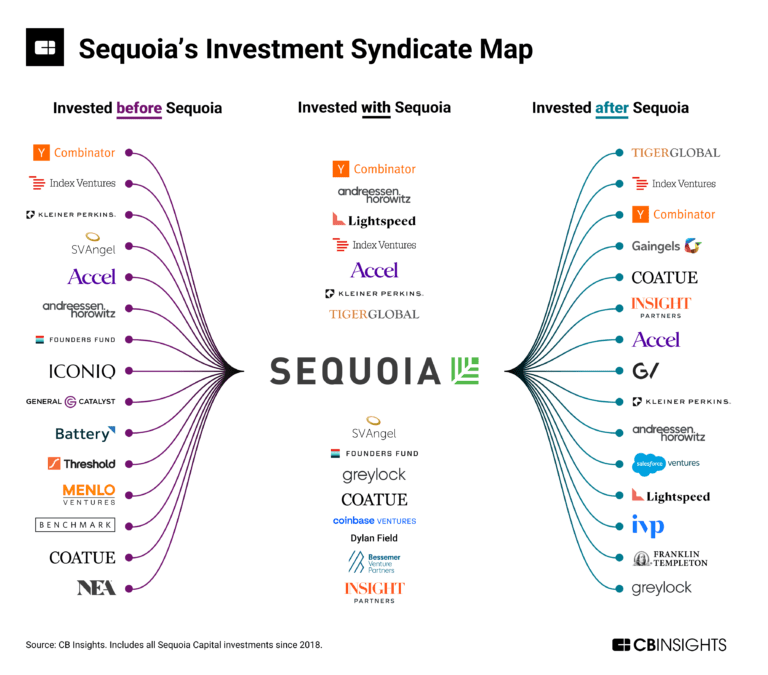

Sequoia is a venture capital firm. It seeks to invest in companies operating in the information technology, healthcare, manufacturing, mobile, nanotechnology, financial service, internet, energy, media, and retail sectors. The company was founded in 1972 and is based in Menlo Park, California.

General Catalyst is a venture capital firm that makes early-stage and transformational investments. It back entrepreneurs who are building technology companies and businesses, and invests in seed-stage, early-stage, later-stage, and growth-stage companies operating in consumer, enterprise, fintech, crypto, health assurance, software, transportation, big data, and technology sectors. The company was founded in 2000 and is based in Cambridge, Massachusetts.

SyndicateRoom is an online equity crowdfunding platform that allows its members to co-invest in exciting companies with seasoned investors.

Loading...