CoinDCX

Founded Year

2018Stage

Series D | AliveTotal Raised

$244.4MValuation

$0000Last Raised

$135M | 3 yrs agoRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-46 points in the past 30 days

About CoinDCX

CoinDCX is a cryptocurrency investment platform that operates in the financial technology sector. The company offers a crypto exchange with a focus on user experience and security, providing access to a variety of crypto-based financial products and services. CoinDCX caters to the needs of the Indian crypto community by offering solutions for crypto investing, trading, and literacy. It was founded in 2018 and is based in Mumbai, India.

Loading...

Loading...

Research containing CoinDCX

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned CoinDCX in 1 CB Insights research brief, most recently on Sep 10, 2022.

Sep 10, 2022

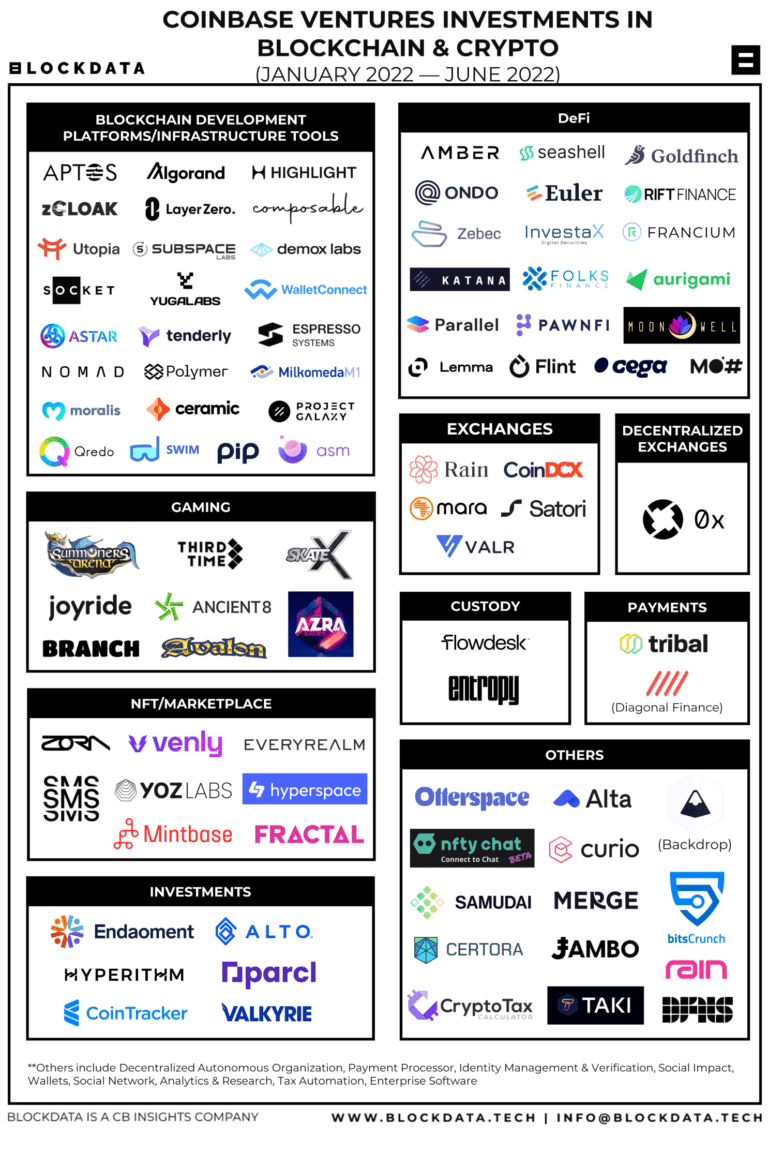

Where Coinbase Ventures is investingExpert Collections containing CoinDCX

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

CoinDCX is included in 4 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,286 items

Blockchain

9,699 items

Companies in this collection build, apply, and analyze blockchain and cryptocurrency technologies for business or consumer use cases. Categories include blockchain infrastructure and development, crypto & DeFi, Web3, NFTs, gaming, supply chain, enterprise blockchain, and more.

Fintech

14,013 items

Excludes US-based companies

Fintech 100

499 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Latest CoinDCX News

Aug 25, 2025

The first day of the 4th edition of Money Expo brought together 80+ high-profile speakers and 8,000 participants from 10+ countries, spotlighting emerging trends and innovations shaping India’s financial ecosystem. Written By: Copied The 4th edition of the country’s premier fintech and trading platform conference, Money Expo India 2025, being held at Mumbai’s Jio World Convention Centre, Mumbai witnessed over 8,000 strong attendance by aspiring financial knowledge seekers, industry thought leaders and various experts. The two-day event, starting today till August 24th, will bring together 10,000+ attendees, 100+ brands, 80+ high-profile speakers, and participants from more than 10 countries including investors, retail traders, HNIs, fintech founders, and institutional leaders for two focused days of insights, innovation, and opportunity. The conference is exploring key themes through interactive workshops, keynote sessions, and expert-led panels, covering topics such as In a keynote panel session ‘Equity Edge – ’, Dr Tirthankar Patnaik, Chief Economist, National Stock Exchange highlighted India’s financial prowess and becoming a leader in raising capital. He said, “Companies get listed to raise capital. Last year, India was one of the world’s highest markets in raising capital to the tune of $20 billion and when we compare it with market like NASDAQ is quite an achievement. This is in some sense a reflection of India’s growth story.” Mr Dilip Chenoy, Chairperson, Bharat Web3 Association delivered a keynote session and highlighted India’s dynamic financial landscape. He said, “Trading used to be on the floor and today it is computer-based, algorithm based and introduction of futures and options with India being one of the largest markets. This expo is a learning platform for ordinary and new investors where one can appreciate the nuances of the financial world and take their journey ahead with proper knowledge.” Additionally, one of the highlights was the panel discussion on ‘How Commodity Trading Compliment ’, moderated by Mr Amit Jain, Founder (CEO), Intelisys Ventures Private Limited in participation with Mr Ajay Kedia, Director, Kedia Advisory and Mr Jigar Pandit, Senior Vice-President and Business Head – Commodity and Currency, Mirae Asset Sharekhan. The panel dabbled in the concept and utility of algorithm-based trading in the commodity segment. Mr Pandit highlighted that this has helped investors to make practical decisions, away from human emotions, giving individuals insightful knowledge even after considering any geopolitical events which can cause fluctuations in the market. Furthermore, Mr Kedia explored how the basis of equity stock comes from commodities, providing real-life examples of growth of equity shares from rise in demand of any commodity. Money Expo India 2025 also explored the rise of digital payments, breaking barriers and boundaries and introduction of AI in the finance sphere. Mr Takeo Ueno, CEO, NTT Data Payment Services India, in a panel session titled ‘Global Payments: Seamless Interoperability for a Connected World’, highlighted some synergies. He said, “Many countries from India to Japan have their own digital infrastructure. The way forward for the industry is providing interoperability between lenders and customers, individual payment apps, which can benefit merchants and retailers.” Acknowledging this view, Mr Manoj Varma, Director, Lyra Network, spoke about cross-cultural challenges and regulatory mandates which need to be considered. For participants exploring the realm of finance, fintech and digital financial solutions, provided a host of avenues for one-on-one interactions, with live demos, product showcases, and networking activations from top fintech and trading brands including JustMarkets, MondFX, GTC Prime, CMS Prime, My MAA Markets, FxPro, Trive, XS.Com among many others, presenting the latest solutions and platforms designed to empower India’s financial and trading community. With algo-trading and being hot topics globally, Mr Archit Mittal, Algo Consultant and Mr Hasmukh Prajapati, Trading Consultant, Coin DCX hosted a keynote session showcasing the company’s tech-enabled solution. Speaking about Money Expo, Mr Mittal said, “At CoinDCX, we are committed to empowering traders with advanced automation tools that redefine how fintech markets are accessed and operated around the clock. Our participation at Money Expo India 2025 provides an exceptional platform to engage with aspiring and seasoned investors alike—facilitating open learning, sharing the latest in algorithmic trading, and enabling deep dives into strategies like mean reversion and perpetual futures.” Money Expo has become India’s premier event and is the nation’s largest and most influential event for the finance, investment, and fintech ecosystem. Since its inception, the event has brought together thousands of professionals, including traders, investors, brokers, fintech providers, and financial institutions.

CoinDCX Frequently Asked Questions (FAQ)

When was CoinDCX founded?

CoinDCX was founded in 2018.

Where is CoinDCX's headquarters?

CoinDCX's headquarters is located at Andheri Kurla Road, Near Metal Estate, Andheri street, Marol Naka, Mumbai.

What is CoinDCX's latest funding round?

CoinDCX's latest funding round is Series D.

How much did CoinDCX raise?

CoinDCX raised a total of $244.4M.

Who are the investors of CoinDCX?

Investors of CoinDCX include Polychain Capital, Coinbase Ventures, B Capital, Kindred Ventures, Cadenza Ventures and 20 more.

Who are CoinDCX's competitors?

Competitors of CoinDCX include Deribit, Binance, Bitstamp, Nomoex, Kraken and 7 more.

Loading...

Compare CoinDCX to Competitors

BurjX provides cryptocurrency trading exchange and broker-dealer solutions. It develops a platform for trading digital assets, managing digital asset wallets, and facilitating financial transactions. It was founded in 2022 and is based in New York, New York.

Kraken focuses on digital currency exchange. The company provides a platform for trading various digital currencies, including bitcoin. Kraken primarily serves the financial technology industry. It was founded in 2011 and is based in San Francisco, California.

Metallicus works as a company building a digital asset banking network using blockchain technology. Its offerings include digital asset banking services, a stablecoin index treasury called Metal Dollar and a proprietary blockchain named Proton that allows for payment solutions. Metallicus serves individual users, corporations, and banks seeking integration with digital assets and blockchain. It was founded in 2016 and is based in San Francisco, California.

Binance develops a cryptocurrency exchange platform. It specializes in trading various digital assets. The company offers services such as spot market trading, futures and options trading, as well as peer-to-peer transactions. Binance also provides tools for margin trading, automated trading bots, and educational resources. It was founded in 2017 and is based in George Town, Cayman Islands.

Crypto.com is a cryptocurrency trading platform and financial services provider in the fintech sector. The company provides services for buying, selling, and trading Bitcoin, Ethereum, and over 350 other cryptocurrencies, as well as decentralized finance services like staking and various crypto financial products. Crypto.com serves individuals and businesses involved in cryptocurrency transactions and investments. Crypto.com was formerly known as Monaco. It was founded in 2016 and is based in Singapore.

CEX.IO is a cryptocurrency platform operating within the financial technology sector. The company provides services for buying, selling, exchanging, storing, and earning cryptocurrencies, including Bitcoin and Ethereum. CEX.IO serves individuals and businesses involved in cryptocurrency trading and investment. It was founded in 2013 and is based in London, England.

Loading...