Crypto.com

Founded Year

2016Stage

Angel | AliveRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+13 points in the past 30 days

About Crypto.com

Crypto.com is a cryptocurrency trading platform and financial services provider in the fintech sector. The company provides services for buying, selling, and trading Bitcoin, Ethereum, and over 350 other cryptocurrencies, as well as decentralized finance services like staking and various crypto financial products. Crypto.com serves individuals and businesses involved in cryptocurrency transactions and investments. Crypto.com was formerly known as Monaco. It was founded in 2016 and is based in Singapore.

Loading...

ESPs containing Crypto.com

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The crypto wallets market provides software and hardware solutions for storing, managing, and transferring cryptocurrencies. These wallets offer secure digital asset storage through mobile apps, web applications, browser extensions, and physical hardware devices. Key features include private key management, multi-currency support, and integration with decentralized applications. Solutions range fr…

Crypto.com named as Leader among 15 other companies, including Coinbase, Ledger, and Blockchain.com.

Crypto.com's Products & Differentiators

Crypto.com App

Crypto.com App allows users to buy and sell crypto with their fiat wallets or with a credit or debit card, send crypto without fees and track crypto performance. Within the App, users can access our Earn and Credit products. Earn lets users deposit cryptocurrencies and earn interest, and Credit allows users to deposit cryptocurrencies as collateral to borrow a crypto loan.

Loading...

Research containing Crypto.com

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Crypto.com in 4 CB Insights research briefs, most recently on Dec 14, 2023.

Dec 14, 2023

Cross-border payments market map

Mar 29, 2023

Market Trend Report: Crypto payments for SMB leadersExpert Collections containing Crypto.com

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Crypto.com is included in 3 Expert Collections, including Blockchain.

Blockchain

9,824 items

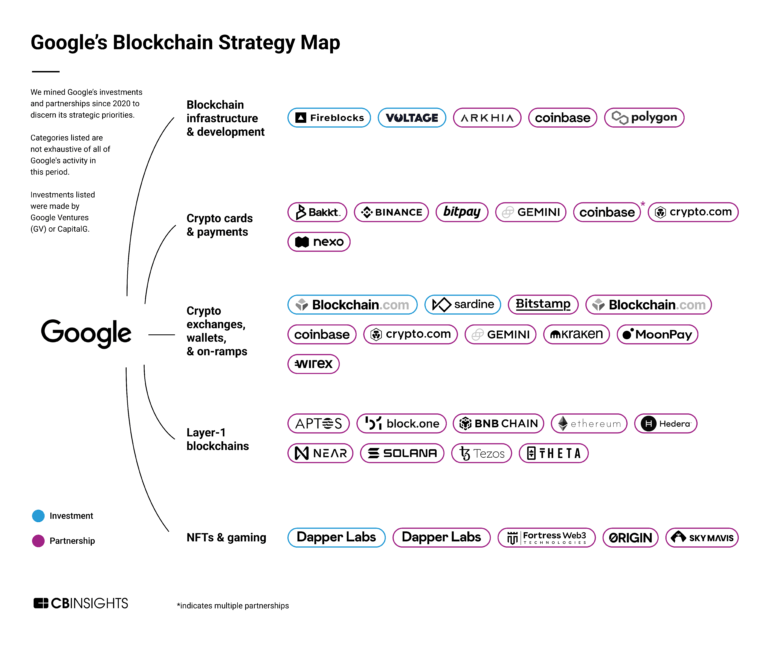

Companies in this collection build, apply, and analyze blockchain and cryptocurrency technologies for business or consumer use cases. Categories include blockchain infrastructure and development, crypto & DeFi, Web3, NFTs, gaming, supply chain, enterprise blockchain, and more.

SMB Fintech

1,648 items

Payments

3,199 items

Companies in this collection provide technology that enables consumers and businesses to pay, collect, automate, and settle transfers of currency, both online and at the physical point-of-sale.

Latest Crypto.com News

Sep 5, 2025

September 05, 2025 08:30 ET Trump Media to Exchange Cash and Stock for Cronos (CRO) as Part of New Strategic Partnership SARASOTA, Fla., Sept. 05, 2025 (GLOBE NEWSWIRE) -- Trump Media and Technology Group Corp. (Nasdaq, NYSE Texas: DJT) ("Trump Media"), operator of the social media platform Truth Social, the streaming platform Truth+, and the FinTech brand Truth.Fi, announced today it has closed its recently announced purchase agreement with Crypto.com. The agreement provides that Trump Media will acquire 684.4 million Cronos (CRO) tokens at a price of approximately 15.3 cents per token as part of a 50% stock, 50% cash exchange with Crypto.com. The tokens represent approximately 2% of the current circulating CRO supply (in addition to approximately 19% of the CRO circulating supply to be acquired by Trump Media Group CRO Strategy, Inc, as described below). Trump Media will secure its CRO with Crypto.com Custody, Crypto.com’s institutional-grade custody offering, which will enable Trump Media to stake it for additional revenue generation. The Trump Media shares and CRO tokens exchanged in the deal will both be subject to a lockup period. Trump Media's CEO and Chairman Devin Nunes said, “Trump Media is pleased to close this agreement and quickly begin to fulfill our strategic partnership with Crypto.com. We’re convinced that CRO has tremendous potential to spread widely as a versatile utility token and a superior form of safe, fast payment and money transfer, and we’re excited to add this innovative asset to our balance sheet.” Crypto.com Co-Founder and CEO Kris Marszalek said, “This is the first of many steps to driving utility and value for CRO and the Cronos blockchain. We are proud to provide support to Trump Media with our best-in-class custody solution and generate additional value through CRO’s staking model.” The agreement is a part of partnership that includes a mutual cooperation agreement, which enables the CRO token to be integrated into the Truth Social and Truth+ platforms as part of a pioneering rewards system using Crypto.com’s digital wallet infrastructure. This strategic partnership follows the separate announcement of a newly formed entity, Trump Media Group CRO Strategy, Inc., which has entered into a definitive agreement for a business combination with Yorkville Acquisition Corp (Nasdaq: YORK), a special-purpose acquisition company (SPAC) sponsored by Yorkville Acquisition Sponsor LLC, to form a digital asset treasury company focused on acquisition of CRO. Cronos is a high performance, interoperable blockchain designed for speed, scalability, and seamless connectivity between networks, making it a strong foundation for the future American digital economy. It enables low-cost, high-speed smart contract deployment and smooth integration with other major blockchain ecosystems, unlocking widescale adoption of decentralized applications in finance, commerce, and public infrastructure, without the congestion or costs of legacy networks. With its proof-of-authority consensus, robust validator set, and enterprise-grade security, Cronos delivers the performance and reliability needed to power mission-critical applications at scale. Crypto.com is a long-time supporter of the open-source Cronos blockchain project, and has incorporated the CRO token and the Cronos protocol into various offerings provided to its customer base to provide exposure to blockchains and the benefits in how they operate in a safe, secure, and regulated environment. About Trump Media The mission of Trump Media is to end Big Tech's assault on free speech by opening up the Internet and giving people their voices back. Trump Media operates Truth Social, a social media platform established as a safe harbor for free expression amid increasingly harsh censorship by Big Tech corporations, as well as Truth+, a TV streaming platform focusing on family-friendly live TV channels and on-demand content. Trump Media is also launching Truth.Fi, a financial services and FinTech brand incorporating America First investment vehicles. About Crypto.com Founded in 2016, Crypto.com is trusted by millions of users worldwide and is the industry leader in regulatory compliance, security and privacy. Our vision is simple: Cryptocurrency in Every Wallet™. Crypto.com is committed to accelerating the adoption of cryptocurrency through innovation and empowering the next generation of builders, creators, and entrepreneurs to develop a fairer and more equitable digital ecosystem. Additional Information and Where to Find It Yorkville Acquisition Corp. intends to file with the Securities and Exchange Commission (the “SEC”) a Registration Statement on Form S-4 (as may be amended, the “Registration Statement”), which will include a preliminary proxy statement of Yorkville Acquisition Corp. and a prospectus (the “Proxy Statement/Prospectus”) in connection with the Business Combination. The definitive proxy statement and other relevant documents will be mailed to shareholders of Yorkville Acquisition Corp. as of a record date to be established for voting on the Business Combination and other matters as described in the Proxy Statement/Prospectus. Yorkville Acquisition Corp. will also file other documents regarding the Business Combination with the SEC. This communication does not contain all of the information that should be considered concerning the Business Combination and is not intended to form the basis of any investment decision or any other decision in respect of the Business Combination. BEFORE MAKING ANY VOTING OR INVESTMENT DECISION, SHAREHOLDERS OF YORKVILLE ACQUISITION CORP. AND OTHER INTERESTED PARTIES ARE URGED TO READ, WHEN AVAILABLE, THE PRELIMINARY PROXY STATEMENT/PROSPECTUS, AND AMENDMENTS THERETO, AND THE DEFINITIVE PROXY STATEMENT/PROSPECTUS AND ALL OTHER RELEVANT DOCUMENTS FILED OR THAT WILL BE FILED WITH THE SEC IN CONNECTION WITH YORKVILLE ACQUISITION CORP.’S SOLICITATION OF PROXIES FOR THE EXTRAORDINARY GENERAL MEETING OF ITS SHAREHOLDERS TO BE HELD TO APPROVE THE BUSINESS COMBINATION AND OTHER MATTERS AS DESCRIBED IN THE PROXY STATEMENT/PROSPECTUS BECAUSE THESE DOCUMENTS WILL CONTAIN IMPORTANT INFORMATION ABOUT YORKVILLE ACQUISITION CORP. AND THE BUSINESS COMBINATION. Investors and security holders will also be able to obtain copies of the Registration Statement and the Proxy Statement/Prospectus and all other documents filed or that will be filed with the SEC by Yorkville Acquisition Corp., without charge, once available, on the SEC’s website at www.sec.gov or by directing a request to: Yorkville Acquisition Corp., 1012 Springfield Avenue, Mountainside, New Jersey 07092; e-mail: YORK@mzgroup.us . NEITHER THE SEC NOR ANY STATE SECURITIES REGULATORY AGENCY HAS APPROVED OR DISAPPROVED THE BUSINESS COMBINATION DESCRIBED HEREIN, PASSED UPON THE MERITS OR FAIRNESS OF THE BUSINESS COMBINATION OR ANY RELATED TRANSACTIONS OR PASSED UPON THE ADEQUACY OR ACCURACY OF THE DISCLOSURE IN THIS COMMUNICATION. ANY REPRESENTATION TO THE CONTRARY CONSTITUTES A CRIMINAL OFFENSE. Participants in the Solicitation Yorkville Acquisition Corp. and its respective directors, executive officers, certain of its shareholders and other members of management and employees may be deemed under SEC rules to be participants in the solicitation of proxies from Yorkville Acquisition Corp.’s shareholders in connection with the Business Combination. A list of the names of such persons, and information regarding their interests in the Business Combination and their ownership of Yorkville Acquisition Corp.’s securities are, or will be, contained in Yorkville Acquisition Corp.’s filings with the SEC. Additional information regarding the interests of the persons who may, under SEC rules, be deemed participants in the solicitation of proxies of Yorkville Acquisition Corp.’s shareholders in connection with the Business Combination, including the names and interests of Yorkville Acquisition Corp.’s directors and executive officers, will be set forth in the Registration Statement and Proxy Statement/Prospectus, which is expected to be filed by Yorkville Acquisition Corp. with the SEC. Investors and security holders may obtain free copies of these documents as described above. No Offer or Solicitation This communication and the information contained herein is for informational purposes only and is not a proxy statement or solicitation of a proxy, consent or authorization with respect to any securities or in respect of the Business Combination and shall not constitute an offer to sell or exchange, or a solicitation of an offer to buy or exchange the securities of Yorkville Acquisition Corp., or any commodity or instrument or related derivative, nor shall there be any sale of any such securities in any state or jurisdiction in which such offer, solicitation, sale or exchange would be unlawful prior to registration or qualification under the securities laws of such state or jurisdiction. No offer of securities shall be made except by means of a prospectus meeting the requirements of the Securities Act or an exemption therefrom. Investors should consult with their counsel as to the applicable requirements for a purchaser to avail itself of any exemption under the Securities Act. Forward-Looking Statements This communication contains certain forward-looking statements within the meaning of the U.S. federal securities laws with respect to the Business Combination involving Yorkville Acquisition Corp., including expectations, hopes, beliefs, intentions, plans, prospects, financial results or strategies regarding Yorkville Acquisition Corp. and the Business Combination and statements regarding the anticipated benefits and timing of the completion of the Business Combination, the assets to be acquired by Yorkville Acquisition Corp., the price and volatility of Cronos, Cronos’ prominence as a digital asset and as the foundation of a new financial system, Yorkville Acquisition Corp.’s listing on any securities exchange, the macro conditions surrounding Cronos, the planned business strategy, plans and use of proceeds, objectives of management for future operations of Yorkville Acquisition Corp. and Trump Media Group CRO Strategy, Inc., the upside potential and opportunity for investors, Yorkville Acquisition Corp.’s and Trump Media Group CRO Strategy, Inc.’s plan for value creation and strategic advantages, market size and growth opportunities, regulatory conditions, technological and market trends, future financial condition and performance and expected financial impacts of the Business Combination, the satisfaction of closing conditions to the Business Combination and the level of redemptions of Yorkville Acquisition Corp.’s public shareholders, and Yorkville Acquisition Corp.’s and Trump Media Group CRO Strategy, Inc.’s expectations, intentions, strategies, assumptions or beliefs about future events, results of operations or performance or that do not solely relate to historical or current facts. These forward-looking statements generally are identified by the words “believe,” “project,” “expect,” “anticipate,” “estimate,” “intend,” “strategy,” “future,” “opportunity,” “potential,” “plan,” “may,” “should,” “will,” “would,” “will be,” “will continue,” “will likely result,” and similar expressions. Forward-looking statements are predictions, projections and other statements about future events or conditions that are based on current expectations and assumptions and, as a result, are subject to risks and uncertainties. Many factors could cause actual future events to differ materially from the forward-looking statements in this communication, including, but not limited to: the risk that the Business Combination may not be completed in a timely manner or at all, which may adversely affect the price of Yorkville Acquisition Corp.’s securities; the risk that the Business Combination may not be completed by Yorkville Acquisition Corp.’s business combination deadline; the failure by the parties to satisfy the conditions to the consummation of the Business Combination, including the approval of Yorkville Acquisition Corp.’s shareholders; failure to realize the anticipated benefits of the Business Combination; the level of redemptions of Yorkville Acquisition Corp.’s public shareholders which may reduce the public float of, reduce the liquidity of the trading market of, and/or maintain the quotation, listing, or trading of the Class A ordinary shares of Yorkville Acquisition Corp. or the shares of Class A common stock of Yorkville Acquisition Corp.; the lack of a third-party fairness opinion in determining whether or not to pursue the Business Combination; the failure of Trump Media Group CRO Strategy, Inc. to obtain or maintain the listing of its securities on any securities exchange after closing of the Business Combination; costs related to the Business Combination and as a result of becoming a public company; changes in business, market, financial, political and regulatory conditions; risks relating to Trump Media Group CRO Strategy, Inc.’s anticipated operations and business, including the highly volatile nature of the price of CRO; the risk that Trump Media Group CRO Strategy, Inc.’s stock price will be highly correlated to the price of CRO and the price of CRO may decrease between the signing of the definitive documents for the Business Combination and the closing of the Business Combination or at any time after the closing of the Business Combination; risks related to increased competition in the industries in which Trump Media Group CRO Strategy, Inc. will operate; risks relating to significant legal, commercial, regulatory and technical uncertainty regarding CRO; risks relating to the treatment of crypto assets for U.S. and foreign tax purposes; risks that after consummation of the Business Combination, Trump Media Group CRO Strategy, Inc. experiences difficulties managing its growth and expanding operations; the risks that growing Trump Media Group CRO Strategy, Inc.’s validator operations could be difficult; challenges in implementing our business plan including operating a Cronos validator, due to operational challenges, significant competition and regulation; being considered to be a “shell company” by any stock exchange on which Yorkville Acquisition Corp.’s Class A common stock will be listed or by the SEC, which may impact our ability to list Yorkville Acquisition Corp.’s Class A common stock and restrict reliance on certain rules or forms in connection with the offering, sale or resale of securities; the outcome of any potential legal proceedings that may be instituted against Yorkville Acquisition Corp. or others following announcement of the Business Combination, and those risk factors discussed in documents that Yorkville Acquisition Corp filed, or that will be filed, with the SEC. The foregoing list of risk factors is not exhaustive. You should carefully consider the foregoing factors and the other risks and uncertainties described in the “Risk Factors” section of the final prospectus of Yorkville Acquisition Corp. dated as of June 26, 2025 and filed by Yorkville Acquisition Corp. with the SEC on June 30, 2025, Yorkville Acquisition Corp.’s Quarterly Reports on Form 10-Q, the Registration Statement that will be filed by Yorkville Acquisition Corp. and the Proxy Statement/Prospectus contained therein, and other documents filed by Yorkville Acquisition Corp. from time to time with the SEC. These filings do or will identify and address other important risks and uncertainties that could cause actual events and results to differ materially from those contained in the forward-looking statements. There may be additional risks that Yorkville Acquisition Corp. presently knows or that Yorkville Acquisition Corp. currently believes are immaterial that could also cause actual results to differ from those contained in the forward-looking statements. Forward-looking statements speak only as of the date they are made. Readers are cautioned not to put undue reliance on forward-looking statements, and Yorkville Acquisition Corp. assumes no obligation and does not intend to update or revise these forward-looking statements, whether as a result of new information, future events, or otherwise. Yorkville Acquisition Corp. gives no assurance that Yorkville Acquisition Corp. will achieve its expectations. The inclusion of any statement in this communication does not constitute an admission by Yorkville Acquisition Corp. or any other person that the events or circumstances described in such statement are material. Investor Relations Contact

Crypto.com Frequently Asked Questions (FAQ)

When was Crypto.com founded?

Crypto.com was founded in 2016.

What is Crypto.com's latest funding round?

Crypto.com's latest funding round is Angel.

Who are the investors of Crypto.com?

Investors of Crypto.com include Matt Damon.

Who are Crypto.com's competitors?

Competitors of Crypto.com include Ledn, Bit2Me, Circle, Revolut, Binance and 7 more.

What products does Crypto.com offer?

Crypto.com's products include Crypto.com App and 4 more.

Loading...

Compare Crypto.com to Competitors

Binance develops a cryptocurrency exchange platform. It specializes in trading various digital assets. The company offers services such as spot market trading, futures and options trading, as well as peer-to-peer transactions. Binance also provides tools for margin trading, automated trading bots, and educational resources. It was founded in 2017 and is based in George Town, Cayman Islands.

Kraken focuses on digital currency exchange. The company provides a platform for trading various digital currencies, including bitcoin. Kraken primarily serves the financial technology industry. It was founded in 2011 and is based in San Francisco, California.

Metallicus works as a company building a digital asset banking network using blockchain technology. Its offerings include digital asset banking services, a stablecoin index treasury called Metal Dollar and a proprietary blockchain named Proton that allows for payment solutions. Metallicus serves individual users, corporations, and banks seeking integration with digital assets and blockchain. It was founded in 2016 and is based in San Francisco, California.

BlockFi is a financial services company that offers wealth management products for cryptocurrency investors, operating within the fintech and blockchain technology sectors. The company provides USD loans backed by cryptocurrency, interest-earning accounts for digital assets, and a platform for trading various cryptocurrencies. It was founded in 2017 and is based in Jersey City, New Jersey.

BitPay provides cryptocurrency payment processing and digital wallet services within the financial technology (fintech) sector. It offers a platform for individuals and businesses to buy, store, swap, sell, and spend cryptocurrencies and tools for merchants to accept cryptocurrency payments. Its services are available to various sectors, including e-commerce and real estate technology. It was founded in 2011 and is based in Atlanta, Georgia.

KuCoin offers a global cryptocurrency exchange platform that offers a wide range of services in the digital asset industry. The company provides a platform for trading various cryptocurrencies, including spot and futures trading, as well as staking and lending services. KuCoin serves a diverse customer base, including retail and institutional investors in the cryptocurrency market. It was founded in 2017 and is based in Mahe, Seychelles.

Loading...