Effectiv

Founded Year

2021Stage

Acquired | AcquiredTotal Raised

$8.5MValuation

$0000About Effectiv

Effectiv is a real-time fraud and risk management platform specializing in services for financial institutions and fintech companies. The company offers AI-driven solutions that facilitate business and customer onboarding, transaction monitoring, and other authentication events without the need for coding. Effectiv was formerly known as Abra Innovations Inc. It was founded in 2021 and is based in San Francisco, California. In October 2024, Effectiv was acquired by Socure.

Loading...

Effectiv's Product Videos

Effectiv's Products & Differentiators

Fraud Transaction Monitoring

Fraud Transaction Monitoring Software designed for enterprises aiming to mitigate fraudulent transactions. It conducts real-time transaction analysis, promptly pinpointing anomalous activities and potential risks. Its machine learning capabilities enhance detection precision by constantly adapting to distinctive transaction patterns. Effectiv complies with global security standards, employing advanced encryption techniques for data protection. The easy-to-navigate dashboard delivers in-depth analytics, simplifying risk management procedures.

Loading...

Research containing Effectiv

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Effectiv in 1 CB Insights research brief, most recently on Jan 14, 2025.

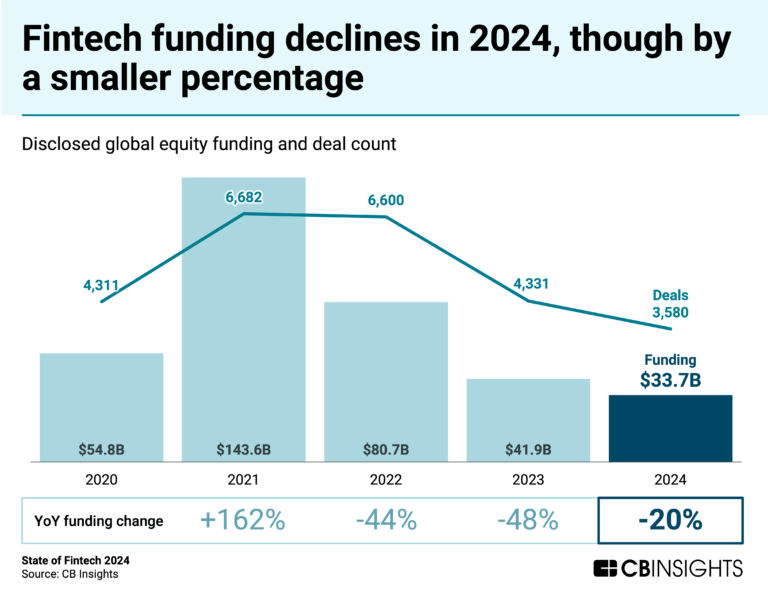

Jan 14, 2025 report

State of Fintech 2024 ReportExpert Collections containing Effectiv

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Effectiv is included in 3 Expert Collections, including Cybersecurity.

Cybersecurity

11,029 items

These companies protect organizations from digital threats.

Fintech

9,777 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Artificial Intelligence

10,402 items

Latest Effectiv News

Nov 26, 2024

Video: Socure at Money20/20 USA 2024 – Powering ID verification and risk decisioning in financial services Sponsored by Socure 26th November 2024 At the Money20/20 USA 2024 conference in Las Vegas, FinTech Futures sat down with Johnny Ayers, founder and CEO of Socure , to discuss the evolution of the digital identity verification landscape, the motivation behind Socure’s recent $136 million deal to acquire AI-powered risk decisioning platform Effectiv, and what’s next for the company in the near future. Watch the full video interview below: You can find out more about Socure and its products and services here .

Effectiv Frequently Asked Questions (FAQ)

When was Effectiv founded?

Effectiv was founded in 2021.

Where is Effectiv's headquarters?

Effectiv's headquarters is located at 355 Bryant Street, San Francisco.

What is Effectiv's latest funding round?

Effectiv's latest funding round is Acquired.

How much did Effectiv raise?

Effectiv raised a total of $8.5M.

Who are the investors of Effectiv?

Investors of Effectiv include Socure, Accel, Better Tomorrow Ventures, BHG VC and REV Venture Partners.

Who are Effectiv's competitors?

Competitors of Effectiv include Sardine, H3M Analytics, Unit21, DataVisor, Fraud.net and 7 more.

What products does Effectiv offer?

Effectiv's products include Fraud Transaction Monitoring and 4 more.

Who are Effectiv's customers?

Customers of Effectiv include BHG Financial, Cardless and BigCart.

Loading...

Compare Effectiv to Competitors

Sift operates in the fields of cybersecurity and financial technology. Its main offerings include a platform that uses machine learning and user identity verification to address fraud, including account takeover, payment fraud, and policy abuse. Sift serves sectors that require digital trust solutions, such as e-commerce, fintech, and online marketplaces. Sift was formerly known as Sift Science. It was founded in 2011 and is based in San Francisco, California.

Fraud.net focuses on AI-driven fraud detection and enterprise risk management in the financial and commerce sectors. The company has a platform that includes transaction monitoring, entity risk assessment, and compliance management to address fraud and regulatory requirements. Fraud.net serves the payments and financial services industries. It was founded in 2015 and is based in New York, New York.

Signifyd provides e-commerce fraud protection and prevention services. The company offers services, including revenue protection, abuse prevention, and payment compliance, all aimed at maximizing conversion and eliminating fraud and consumer abuse. Its services primarily cater to the e-commerce industry. Signifyd was founded in 2011 and is based in San Jose, California.

Forter specializes in identity intelligence for digital commerce, focusing on fraud prevention and customer security across digital platforms. The company provides services including fraud management, payment optimization, chargeback recovery, identity protection, and abuse prevention, aimed at improving security and efficiency in online transactions. Forter's solutions are utilized by sectors within the digital commerce industry to support processes for businesses and consumers. Forter was formerly known as Ryzyco. It was founded in 2013 and is based in New York, New York.

Shield is a device-first risk AI platform that specializes in fraud prevention and risk intelligence within the digital business sector. The company offers solutions to identify and eliminate fraudulent activities through global standard device identification and actionable risk intelligence. Shield primarily serves industries such as ride-hailing, social media, e-commerce, digital banking, and gaming. Shield was formerly known as CashShield. It was founded in 2008 and is based in Singapore.

Sardine is a technology company that focuses on fraud prevention and compliance in the financial services sector. The company's platform utilizes behavior-based fraud prevention, device intelligence, and behavioral biometrics to identify and address various forms of financial crime, such as identity theft, payment fraud, and money laundering. Sardine offers services including identity verification, AML monitoring, KYC and KYB compliance, and case management tools. It was founded in 2020 and is based in Miami, Florida.

Loading...