Figure

Founded Year

2018Stage

IPO | IPOTotal Raised

$1.718BDate of IPO

9/11/2025About Figure

Figure provides home equity lines of credit and other lending solutions. The company offers products including HELOCs, debt consolidation loans, solar panel financing, business funding, and education financing, all through a technology platform that supports loan processing. Figure serves homeowners looking to utilize their home equity. It was founded in 2018 and is based in Charlotte, North Carolina.

Loading...

ESPs containing Figure

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The real estate asset tokenization market converts physical real estate properties into digital tokens on blockchain networks, enabling fractional ownership and trading of property rights. These platforms allow investors to purchase token-based shares in residential, commercial, and mixed-use properties, receiving proportional rental income and capital appreciation. Key features include smart cont…

Figure named as Highflier among 15 other companies, including Securitize, Fireblocks, and GreatX.

Loading...

Research containing Figure

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Figure in 1 CB Insights research brief, most recently on Apr 10, 2025.

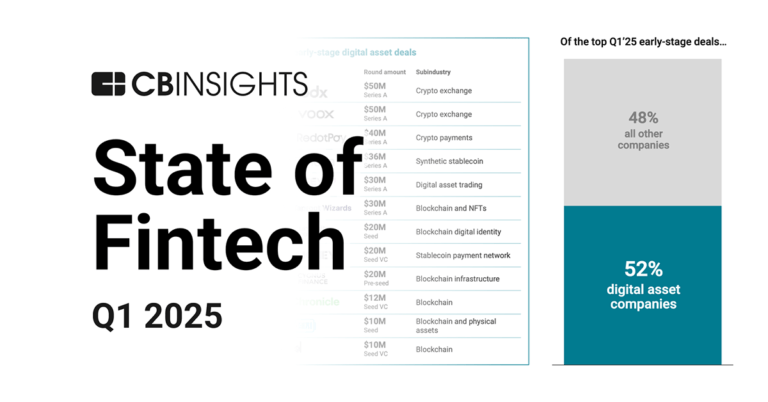

Apr 10, 2025 report

State of Fintech Q1’25 ReportExpert Collections containing Figure

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Figure is included in 7 Expert Collections, including Mortgage Tech.

Mortgage Tech

218 items

Companies here streamline and digitize the mortgage lending process. Collection includes direct lenders, mortgage brokers, process optimization technologies for lenders, as well as tools that support borrowers throughout the search and application phases.

Real Estate Tech

2,798 items

Startups in the space cover the residential and commercial real estate space. Categories include buying, selling and investing in real estate (iBuyers, marketplaces, investment/crowdfunding platforms), and property management, insurance, mortgage, construction, and more.

Blockchain

9,699 items

Companies in this collection build, apply, and analyze blockchain and cryptocurrency technologies for business or consumer use cases. Categories include blockchain infrastructure and development, crypto & DeFi, Web3, NFTs, gaming, supply chain, enterprise blockchain, and more.

Digital Lending

2,464 items

This collection contains companies that provide alternative means for obtaining a loan for personal or business use and companies that provide software to lenders for the application, underwriting, funding or loan collection process.

Fintech

9,695 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Fintech 100

250 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Figure Patents

Figure has filed 17 patents.

The 3 most popular patent topics include:

- artificial intelligence

- bipedal humanoid robots

- humanoid robots

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

3/1/2013 | 1/31/2023 | Job scheduling, Commerce websites, Social networking services, Information technology management, Software architecture | Grant |

Application Date | 3/1/2013 |

|---|---|

Grant Date | 1/31/2023 |

Title | |

Related Topics | Job scheduling, Commerce websites, Social networking services, Information technology management, Software architecture |

Status | Grant |

Latest Figure News

Sep 11, 2025

The shares of Class A common stock are expected to begin trading on the Nasdaq Global Select Market on September 11, 2025 under the ticker symbol “FIGR.” The offering is expected to close on September 12, 2025, subject to satisfaction of customary closing conditions. The offering consists of 23,506,605 shares of Class A common stock offered by Figure and 7,993,395 shares of Class A common stock offered by certain of Figure's existing stockholders. In addition, Figure has granted the underwriters a 30-day option to purchase up to an additional 4,725,000 shares of its Class A common stock at the initial public offering price, less underwriting discounts and commissions. Figure will not receive any proceeds from the sale of shares by the selling stockholders. Goldman Sachs & Co. LLC, Jefferies and BofA Securities are acting as joint lead bookrunning managers for the offering. Societe Generale, Keefe, Bruyette & Woods, A Stifel Company and Mizuho are acting as bookrunners for the offering. Texas Capital Securities, Needham & Company, Piper Sandler, FT Partners, KKR and Roberts & Ryan are acting as co-managers for the offering. The offering is being made only by means of a prospectus. When available, a copy of the final prospectus related to the offering may be obtained from Goldman Sachs & Co. LLC, Attention: Prospectus Department, 200 West Street, New York, New York 10282, by telephone at 1-866-471-2526, or by email at prospectus-ny@ny.email.gs.com ; Jefferies LLC, Attention: Equity Syndicate Prospectus Department, 520 Madison Avenue, New York, New York 10022, by telephone at 1-877-821-7388, or by email at prospectus_department@jefferies.com ; and BofA Securities, Attention: Prospectus Department, NC1-022-02-25, 201 North Tryon Street, Charlotte, North Carolina 28255-0001 or by email at dg.prospectus_requests@bofa.com A registration statement relating to these securities has been declared effective by the Securities and Exchange Commission on September 10, 2025. This press release shall not constitute an offer to sell or the solicitation of an offer to buy these securities, nor shall there be any sale of these securities in any state or jurisdiction in which such offer, solicitation, or sale would be unlawful prior to registration or qualification under the securities laws of any such state or jurisdiction. About Figure Technology Solutions Figure Technology Solutions, Inc. is a blockchain-native capital marketplace that seamlessly connects origination, funding, and secondary market activity. More than 160 partners use its loan origination system and capital marketplace. Collectively, Figure and its partners have originated over $16 billion of home equity to date, among other products, making Figure's ecosystem the largest non-bank provider of home equity financing. The fastest growing components are Figure Connect, its consumer credit marketplace, and Democratized Prime, Figure's on-chain lend-borrow marketplace. Figure's ecosystem also includes DART (Digital Asset Registry Technology) for asset custody and lien perfection, and YLDS, an SEC-registered yield-bearing stablecoin that operates as a tokenized money market fund.

Figure Frequently Asked Questions (FAQ)

When was Figure founded?

Figure was founded in 2018.

Where is Figure's headquarters?

Figure's headquarters is located at 650 South Tryon Street, Charlotte.

What is Figure's latest funding round?

Figure's latest funding round is IPO.

How much did Figure raise?

Figure raised a total of $1.718B.

Who are the investors of Figure?

Investors of Figure include Victory Park Capital, Sixth Street Partners, Jefferies, J.P. Morgan, Goldman Sachs and 34 more.

Who are Figure's competitors?

Competitors of Figure include 1X, Amount, Percent, Point, Hometap and 7 more.

Loading...

Compare Figure to Competitors

Hometap is a financial services company that specializes in home equity investments as an alternative to traditional loans. The company offers homeowners the ability to access the equity in their homes without the burden of monthly payments or debt, providing funds that can be used for a variety of personal and financial goals. Hometap's services are primarily utilized by individuals seeking financial solutions for education, home improvements, debt consolidation, business funding, retirement, and investment opportunities. It was founded in 2017 and is based in Boston, Massachusetts.

Unlock is a financial services company that provides home equity agreements to American homeowners. Its main offering is a home equity agreement (HEA) designed to help families with financial challenges. The company serves homeowners seeking solutions to traditional home equity tapping methods. It was founded in 2019 and is based in Scottsdale, Arizona.

Domochi provides shared home equity lending within the financial services sector. The company offers products that enable homeowners to use their home equity without traditional mortgage solutions. Domochi's services focus on individuals seeking financing options for their real estate needs. It was founded in 2020 and is based in New York, New York.

Kiavi provides lending solutions for real estate investors. The company offers various financing products including bridge loans, fix-and-flip loans, rental property financing, and new construction loans, aimed at assisting investors in acquiring and rehabilitating investment properties. Kiavi serves the residential real estate investment sector, offering financial solutions to individual and professional investors. Kiavi was formerly known as LendingHome. It was founded in 2013 and is based in Pittsburgh, Pennsylvania.

Point specializes in home equity investments and offers financial solutions within the fintech sector. The company's flagship product, the home equity investment (HEI), allows homeowners to access funds by sharing a portion of their home's future appreciation without the need for monthly payments. It primarily serves homeowners looking to leverage their home equity for debt elimination, home improvements, and personal growth without the financial burden of traditional loans. It was founded in 2015 and is based in Palo Alto, California.

Unlock specializes in blockchain-based smart contract protocols for memberships and subscription services within the technology sector. The company offers smart contracts that allow for time constraints, recurring payments, and pricing updates, catering to developers who need to manage memberships and subscriptions efficiently. Unlock primarily serves sectors that require membership management and subscription-based business models, such as content creators, software developers, and various online platforms. It was founded in 2018 and is based in New York, New York.

Loading...