Gemini

Founded Year

2015Stage

IPO | IPOTotal Raised

$450MDate of IPO

9/12/2025About Gemini

Gemini provides a cryptocurrency exchange and acts as a custodian in the financial technology sector. The company facilitates the buying, selling, and trading of various digital assets, including Bitcoin and Solana, while also offering services such as crypto staking and a cryptocurrency credit card. Gemini's platform serves individual and institutional investors for digital asset management. It was founded in 2015 and is based in New York, New York.

Loading...

ESPs containing Gemini

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

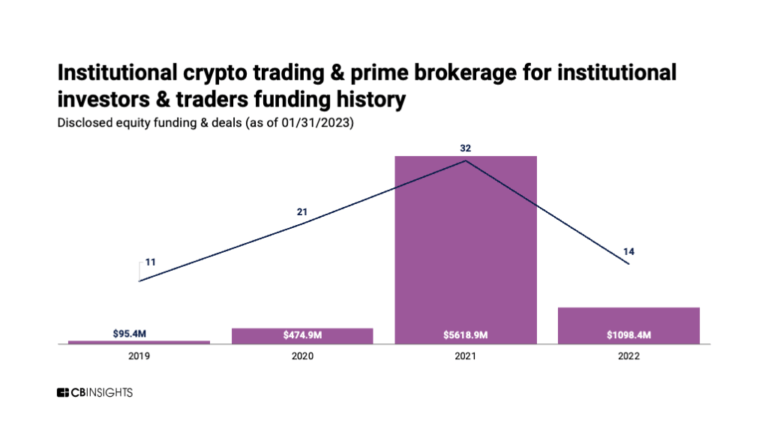

The institutional staking market provides enterprise-grade staking infrastructure and services to institutional investors, investment funds, exchanges, and crypto platforms seeking to earn yield on their digital assets. Companies in this market offer non-custodial and custodial staking solutions with institutional-grade security, compliance frameworks, multi-asset support, and specialized reportin…

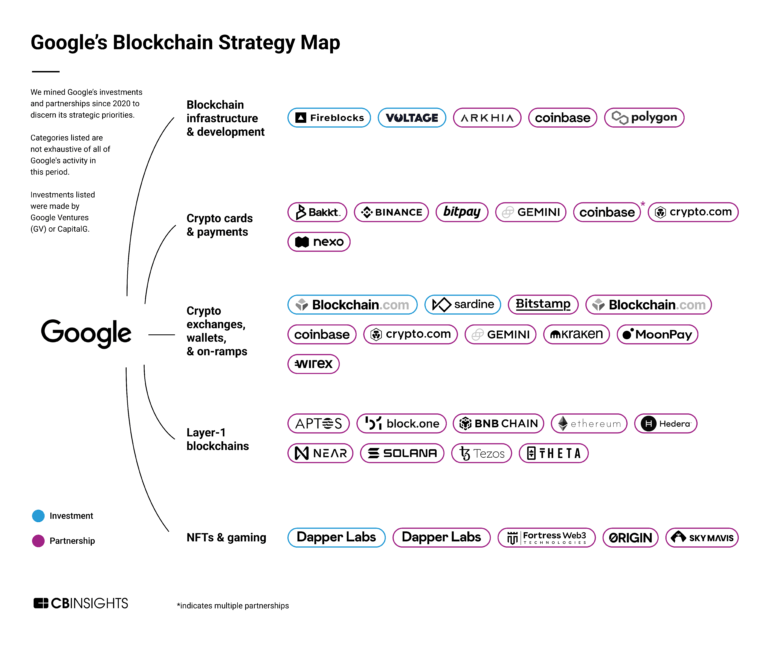

Gemini named as Highflier among 15 other companies, including BitGo, Fireblocks, and Blockdaemon.

Loading...

Research containing Gemini

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Gemini in 6 CB Insights research briefs, most recently on May 8, 2024.

Expert Collections containing Gemini

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Gemini is included in 6 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,286 items

Blockchain

11,347 items

Companies in this collection build, apply, and analyze blockchain and cryptocurrency technologies for business or consumer use cases. Categories include blockchain infrastructure and development, crypto & DeFi, Web3, NFTs, gaming, supply chain, enterprise blockchain, and more.

Fintech

9,696 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Blockchain 50

100 items

Fintech 100

249 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Stablecoin

450 items

Latest Gemini News

Sep 12, 2025

Nasdaq had committed to a US$50 million investment in a private placement at the time of the IPO. Cryptocurrency firms have seen more activity in the public markets, with Figure Technology and others also raising large sums in recent US IPOs. Gemini and the SEC are still in litigation over an alleged unregistered asset lending program, with a status update due by September 15. Food for thought Implications, context, and why it matters. Crypto IPO momentum reflects broader market recovery after regulatory shifts Gemini's successful pricing above its marketed range signals strong institutional appetite for crypto offerings, with orders exceeding available shares by more than 20 times The company initially planned to price shares at $17-19, but lifted the range to $24-26 before ultimately pricing at $28, demonstrating escalating investor demand throughout the marketing process This follows other successful crypto IPOs including Figure Technology's $787.5 million raise and enlarged offerings from Circle and Bullish earlier this year The timing coincides with the SEC's eased oversight, which has created a more favorable regulatory environment for crypto companies seeking public listings Established crypto firms capitalize on market timing despite ongoing legal uncertainties Gemini proceeded with its IPO even while facing an unresolved SEC lawsuit over its cryptocurrency asset lending program, with a status report due September 15 The Winklevoss twins have moved closer to resolving the SEC case since April, suggesting that partial regulatory progress may be sufficient for investor confidence The company's $3.33 billion valuation reflects investor willingness to bet on crypto infrastructure companies with established track records, despite regulatory overhang This approach mirrors a broader trend where crypto companies are moving forward with public offerings while navigating ongoing regulatory discussions rather than waiting for complete clarity

Gemini Frequently Asked Questions (FAQ)

When was Gemini founded?

Gemini was founded in 2015.

Where is Gemini's headquarters?

Gemini's headquarters is located at 600 3rd Avenue, New York.

What is Gemini's latest funding round?

Gemini's latest funding round is IPO.

How much did Gemini raise?

Gemini raised a total of $450M.

Who are the investors of Gemini?

Investors of Gemini include Nasdaq, 10T Fund, Newflow Partners, Jane Street Group, K5 Global Technology and 15 more.

Who are Gemini's competitors?

Competitors of Gemini include IoniaPay, BurjX, Ledger, BitGo, Alt 5 Sigma (Acquired by JanOne) and 7 more.

Loading...

Compare Gemini to Competitors

Kraken focuses on digital currency exchange. The company provides a platform for trading various digital currencies, including bitcoin. Kraken primarily serves the financial technology industry. It was founded in 2011 and is based in San Francisco, California.

BitGo provides digital asset custody and financial services within the cryptocurrency sector. It offers secure wallet solutions, qualified custody, and financial services including trading, financing, and wealth management. It serves institutional investors, trading firms, investment advisors, exchanges, retail platforms, and developers. It was founded in 2013 and is based in Palo Alto, California.

Copper is a technology company that focuses on providing secure digital asset services to institutional investors within the cryptocurrency sector. The company offers a suite of solutions, including institutional custody, prime brokerage services, and collateral management, all designed to facilitate secure and efficient digital asset transactions. Copper primarily caters to hedge funds, trading firms, foundations, exchanges, ETP providers, venture capital funds, and miners seeking advanced infrastructure for managing digital assets. It was founded in 2018 and is based in Zug, Switzerland.

Fireblocks provides infrastructure for digital asset operations in the financial technology sector. It offers services including custody and management of cryptocurrency operations, wallet solutions, token creation and distribution, and facilitation of blockchain payments. It serves trading firms, financial technologies, financial institutions, and web3 companies. It was founded in 2018 and is based in New York, New York.

Ledger involved in the security and management of digital assets in the cryptocurrency domain. The company offers hardware wallets for storing cryptocurrencies, as well as a companion application for managing and interacting with digital assets. Ledger's products are available for individual consumers and institutional investors, focusing on storage, transaction, and portfolio management. It was founded in 2014 and is based in Paris, France.

Binance develops a cryptocurrency exchange platform. It specializes in trading various digital assets. The company offers services such as spot market trading, futures and options trading, as well as peer-to-peer transactions. Binance also provides tools for margin trading, automated trading bots, and educational resources. It was founded in 2017 and is based in George Town, Cayman Islands.

Loading...