Investments

291Portfolio Exits

38Partners & Customers

1About Gradient Ventures

Gradient Ventures is a seed fund focused on artificial intelligence within the technology sector. The company provides investments and support to AI startups, maintaining a founder-centric and collaborative approach. It was founded in 2017 and is based in San Francisco, California.

Expert Collections containing Gradient Ventures

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Find Gradient Ventures in 1 Expert Collection, including Fortune 500 Investor list.

Fortune 500 Investor list

590 items

This is a collection of investors named in the 2019 Fortune 500 list of companies. All CB Insights profiles for active investment arms of a Fortune 500 company are included.

Research containing Gradient Ventures

Get data-driven expert analysis from the CB Insights Intelligence Unit.

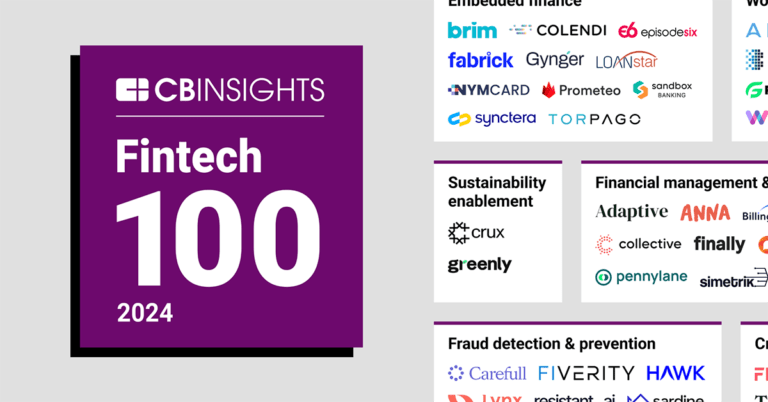

CB Insights Intelligence Analysts have mentioned Gradient Ventures in 1 CB Insights research brief, most recently on Oct 24, 2024.

Oct 24, 2024 report

Fintech 100: The most promising fintech startups of 2024Latest Gradient Ventures News

Jun 27, 2025

Jun 27, 2025 • Yoana Cholteeva The early-stage corporate venture unit is raising its fifth AI-focused fund. Gradient Ventures, a corporate venturing unit of Alphabet , the owner of search engine Google, is raising $200 million for its fifth fund, according to a regulatory filing with the US Securities and Exchange Commission. Backed by Google, Gradient Ventures has more than $1bn under management and has backed more than 150 AI-focused startups, investing at seed and series A stage. The CVC unit is raising for a new AI fund approximately a year after its last, $200m fund, according to PitchBook data, as it seeks to expand its investments in artificial intelligence startups, its main investing area since its founding in 2017. Its parent Google has invested heavily in AI, mirroring the large-scale investments made by the other big tech companies. Its chatbot and search companion Gemini was launched in 2023. Headquartered in San Francisco, Gradient Ventures focuses on seed to early-stage investments in AI, software and IT sectors in North America and Europe. Gradient Ventures’ latest investments include supply-chain logistics automation platform BackOps.ai, open-source platform for managing sensitive data and credentials Infisical, and German developer of an autonomous AI legal agent for enterprise teams Flank.

Gradient Ventures Investments

291 Investments

Gradient Ventures has made 291 investments. Their latest investment was in Freckle as part of their Seed VC on September 08, 2025.

Gradient Ventures Investments Activity

Date | Round | Company | Amount | New? | Co-Investors | Sources |

|---|---|---|---|---|---|---|

9/8/2025 | Seed VC | Freckle | $4M | Yes | 1984 Ventures, Co Ventures, Liquid 2 Ventures, and Mintaka Ventures | 2 |

8/1/2025 | Seed | Jitty | $3.8M | No | Goodwater Capital, Joe Cross, Lenny Picardo, REA Group, and True Global Ventures | 6 |

7/15/2025 | Series B - II | Fondeadora | $5.18M | No | IGNIA, and Portage Ventures | 1 |

7/6/2025 | Seed VC | |||||

7/2/2025 | Pre-Seed |

Date | 9/8/2025 | 8/1/2025 | 7/15/2025 | 7/6/2025 | 7/2/2025 |

|---|---|---|---|---|---|

Round | Seed VC | Seed | Series B - II | Seed VC | Pre-Seed |

Company | Freckle | Jitty | Fondeadora | ||

Amount | $4M | $3.8M | $5.18M | ||

New? | Yes | No | No | ||

Co-Investors | 1984 Ventures, Co Ventures, Liquid 2 Ventures, and Mintaka Ventures | Goodwater Capital, Joe Cross, Lenny Picardo, REA Group, and True Global Ventures | IGNIA, and Portage Ventures | ||

Sources | 2 | 6 | 1 |

Gradient Ventures Portfolio Exits

38 Portfolio Exits

Gradient Ventures has 38 portfolio exits. Their latest portfolio exit was Syrup Tech on September 09, 2025.

Date | Exit | Companies | Valuation Valuations are submitted by companies, mined from state filings or news, provided by VentureSource, or based on a comparables valuation model. | Acquirer | Sources |

|---|---|---|---|---|---|

9/9/2025 | Acquired | 2 | |||

7/23/2025 | Acquired | 2 | |||

6/27/2025 | Acquired | 4 | |||

Date | 9/9/2025 | 7/23/2025 | 6/27/2025 | ||

|---|---|---|---|---|---|

Exit | Acquired | Acquired | Acquired | ||

Companies | |||||

Valuation | |||||

Acquirer | |||||

Sources | 2 | 2 | 4 |

Gradient Ventures Partners & Customers

1 Partners and customers

Gradient Ventures has 1 strategic partners and customers. Gradient Ventures recently partnered with Parker Remick on .

Date | Type | Business Partner | Country | News Snippet | Sources |

|---|---|---|---|---|---|

Vendor | United States | 1 |

Date | |

|---|---|

Type | Vendor |

Business Partner | |

Country | United States |

News Snippet | |

Sources | 1 |

Gradient Ventures Team

6 Team Members

Gradient Ventures has 6 team members, including current Founder, Managing Partner, Anna Patterson.

Compare Gradient Ventures to Competitors

BootstrapLabs is the Venture Capital Group of Ares Management, and operates as a firm that focuses on applied artificial intelligence across various sectors. The firm provides seed-stage investments and acts as a lead investor, offering follow-on funding during growth stages to support founders. BootstrapLabs concentrates on AI applications in areas such as the future of work, mobility, health, financial infrastructure, digital infrastructure, and energy/climate solutions. It was founded in 2008 and is based in San Francisco, California.

NexaTech Ventures is a venture capital firm focused on AI and technology innovation within the investment sector. It offers strategic funding, equity investments, mentorship, technical support, and human resources development to early-stage and growth-stage AI companies. It primarily serves the technology startup industry emphasizing AI-driven companies. It was founded in 2024 and is based in London, United Kingdom.

Zetta Venture Partners focuses on venture capital investments in the AI sector, specifically targeting startups within the intelligent enterprise software industry. The company provides funding to startups that develop software to analyze and predict outcomes. Zetta primarily invests in companies that create AI applications and infrastructure. It was founded in 2013 and is based in San Francisco, California.

Sequoia Capital is a venture capital firm that focuses on supporting startups from inception to initial-public offering (IPO) within sectors. They provide investment funding and strategic support to help companies grow and succeed. Sequoia Capital primarily serves technology-driven sectors and businesses aiming to become market leaders. It was founded in 1972 and is based in Menlo Park, California.

Microsoft ScaleUp is a startup support program within the technology sector that provides cloud services and development tools. The program provides Azure credits and access to artificial-intelligence (AI) models and development tools. Microsoft ScaleUp primarily serves the technology startup community. Microsoft ScaleUp was formerly known as Microsoft Accelerator. It was founded in 2012 and is based in Seattle, Washington. Microsoft ScaleUp operates as a subsidiary of Microsoft for Startups Founders Hub.

Microsoft for Startups Founders Hub is a program designed to accelerate startup innovation and growth within the technology sector. The program offers startups free access to artificial intelligence (AI) services, Azure credits, and a suite of development tools, along with expert guidance and mentorship. It primarily serves startups in various sectors looking to leverage cloud computing and AI technologies. Microsoft Founder's Hub Startup Program was formerly known as Microsoft BizSpark. It was founded in 2018 and is based in Redmond, Washington.

Loading...