Neko Health

Founded Year

2018Stage

Series B | AliveTotal Raised

$331.25MValuation

$0000Last Raised

$260M | 8 mos agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+138 points in the past 30 days

About Neko Health

Neko Health is a health-tech company focused on preventive healthcare and early detection within the medical sector. The company offers health scans that utilize sensors and AI to provide health data collection, enabling results and health analysis. Neko Health serves individuals seeking preventive health measures and health monitoring. Neko Health was formerly known as HJN Sverige. It was founded in 2018 and is based in Stockholm, Sweden.

Loading...

ESPs containing Neko Health

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The virtual & hybrid longevity clinics market leverages technology to provide remote consultations, monitoring, and treatment for individuals looking to optimize their health and prevent the effects of aging. This market consists of companies pairing different solutions like personalized treatment plans and diagnostics with in-person or remote consultations with medical professionals. The market i…

Neko Health named as Challenger among 12 other companies, including Fountain Life, Human Longevity, and Function Health.

Loading...

Research containing Neko Health

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Neko Health in 1 CB Insights research brief, most recently on Apr 17, 2025.

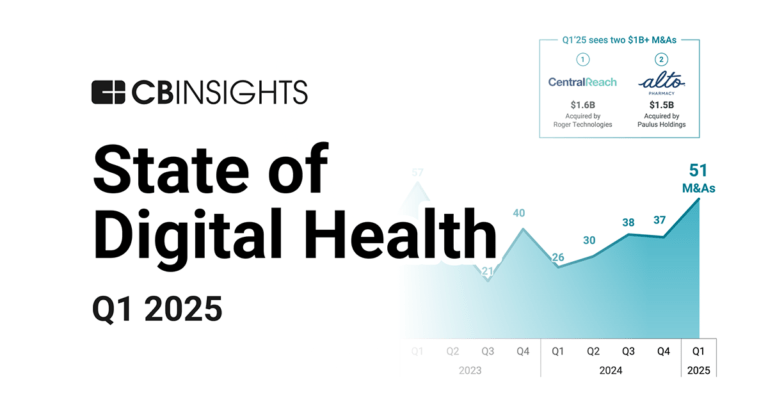

Apr 17, 2025 report

State of Digital Health Q1’25 ReportExpert Collections containing Neko Health

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Neko Health is included in 3 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,286 items

Artificial Intelligence

12,998 items

Companies developing artificial intelligence solutions, including cross-industry applications, industry-specific products, and AI infrastructure solutions.

Digital Health

11,439 items

The digital health collection includes vendors developing software, platforms, sensor & robotic hardware, health data infrastructure, and tech-enabled services in healthcare. The list excludes pureplay pharma/biopharma, sequencing instruments, gene editing, and assistive tech.

Neko Health Patents

Neko Health has filed 1 patent.

The 3 most popular patent topics include:

- cardiac arrhythmia

- cardiac electrophysiology

- cardiovascular physiology

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

5/5/2022 | Radio frequency propagation, Waves, Cardiac electrophysiology, Cardiac arrhythmia, Cardiovascular physiology | Application |

Application Date | 5/5/2022 |

|---|---|

Grant Date | |

Title | |

Related Topics | Radio frequency propagation, Waves, Cardiac electrophysiology, Cardiac arrhythmia, Cardiovascular physiology |

Status | Application |

Latest Neko Health News

Sep 11, 2025

Tech.eu Tech.eu Insights creates insight and guides strategies with its comprehensive content and reports. Browse popular Insights content. Europe's 10 biggest healthtech deals in H1 2025 Europe’s healthtech sector raised €4 billion in H1 2025, led by the UK, showing strong investor appetite for biotech, digital health, and medical devices. Healthtechcontinued to demonstrate its strength in Europe in the first half of 2025,attracting €4 billion in funding, around 12 per cent of the €33.7 billion raisedacross all European tech sectors. Although healthtech accounted for just 237 deals out of 1,923 totaltech transactions (about 12 per cent), it delivered someof the largest rounds of the year, underscoring investor appetite forinnovation in biotech, digital health, and medical devices. The top ten healthtech deals alone brought inover €2.1 billion, more than half of the sector’s total. The UKdominated the rankings with five of the ten biggest rounds, while Sweden andthe Netherlands also stood out. Spain, Switzerland, and Ireland eachcontributed major rounds. This concentration of capital signals both the maturity of Europeanhealthtech and its growing role in tackling global challenges, from AI-drivendrug discovery to obesity treatment, surgical robotics, and digital-first caredelivery. Here are the 10 biggest healthtech deals in H1 2025. 1 Isomorphic Labs is a company with the mission to “solve all diseases.” Building on DeepMind’s AlphaFold, it combines advanced AI and drug discovery expertise to model biological complexity digitally. By creating predictive and generative models, the company designs novel molecules, predicts drug behaviour, and accelerates the development of new therapies. Its approach aims to transform how humanity understands, treats, and ultimately cures diseases. In March, Isomorphic Labs raised $600 million in its first external funding round to accelerate its AI drug design engine and advance therapies into the clinic. 2 Amount raised in H1 2025: $411M Verdiva Bio is a company on a mission to transform the lives of millions living with obesity and related cardiometabolic disorders by developing next-generation, more patient-friendly therapies. Its lead asset, VRB-101, is an oral, once-weekly GLP-1 peptide with promising efficacy and dosing convenience demonstrated in a Phase 1 study. Verdiva also advances a robust pipeline of oral and injectable amylin agonists, both alone and in combination, designed for enhanced efficacy, tolerability, affordability, and access. Leveraging gut-brain biology and a team with proven drug-development expertise, Verdiva is poised to address significant unmet needs in obesity and cardiometabolic care. In January, Verdiva Bio launched with a $411 million Series A financing round, backing development of its next-gen oral and injectable obesity and cardiometabolic treatments. 3 Amount raised in H1 2025: $260M Neko Health is a preventive healthtech company headquartered in Stockholm, with clinics in Stockholm and London. The company delivers a groundbreaking health check, the Neko Body Scan, that uses non-invasive, AI-enabled technology to capture millions of data points (skin imaging, cardiovascular metrics, bloodwork, etc.) in under an hour. Clients receive instant results and an unhurried doctor consultation, empowering early detection and personalised care to shift healthcare from reactive to proactive. The team spans over 100 doctors, researchers, and engineers across Europe. Neko Health secured $260 million in Series B funding in January to fuel US and European expansion and boost R&D in its preventive health scanning technology. 4 Amount raised in H1 2025: $200M CMR Surgical is a British medical device company founded in 2014 and headquartered in Cambridge, UK. Their flagship product, Versius, is a compact, modular, and portable robotic system designed to advance minimal access surgery, also known as keyhole surgery, by enhancing precision, surgeon ergonomics, and operational flexibility. Versius seamlessly integrates into existing operating-room workflows without requiring infrastructure changes, accelerating surgeon adoption through familiar port placements. CMR's mission centres on expanding access to robotic-assisted surgery globally, leveraging innovative deployment and financing models to benefit both patients and healthcare systems. In April, CMR Surgical raised over $200 million in a financing round (combining equity and debt) to drive global expansion and innovation. 5 Amount raised in H1 2025: €150M Cera is a digital-first home healthcare provider. It enables longer, healthier lives at home by shifting services like nursing, telehealth, repeat prescriptions, and in-home care out of hospitals. Powered by AI and machine learning, its platform empowers carers with smarter planning and early detection tools, predicting and preventing deterioration up to 30 times faster than traditional methods, significantly reducing hospitalisations. With nearly 10,000 carers delivering over 60,000 daily in-home visits across the UK, Cera is shaping the future of connected, preventative healthcare. In January, Cera secured $150 million in a combined debt and equity financing round to scale its AI-driven home healthcare platform. 6 Amount raised in H1 2025: €132M Azafaros is a company developing new treatments for rare genetic diseases called lysosomal storage disorders. Its lead medicine, nizubaglustat, is an oral drug designed to reach the brain and target the underlying cause of diseases such as GM1/GM2 gangliosidoses and Niemann-Pick type C. Founded in 2018 and based in the Netherlands, Azafaros is backed by European investors and is preparing to start Phase 3 clinical trials to bring the first disease-modifying therapy to patients in need. In May, Azafaros raised €132 million in an oversubscribed Series B round to advance its lead therapy. 7 Amount raised in H1 2025: $135M SpliceBio is a clinical-stage genetic medicines company based in Barcelona, pioneering Protein Splicing, an innovative gene therapy platform, to deliver large genes that exceed the limitations of traditional AAV vectors. Its lead program, SB-007, is a dual AAV therapy currently in Phase 1/2 trials for Stargardt disease, aiming to restore full-length protein expression in retinal cells. With a strong, experienced team and a growing pipeline across ophthalmology and neurology, SpliceBio seeks to broaden the impact of gene therapy where there are no current options. In June, SpliceBio closed a $135 million Series B financing to advance its lead gene therapy candidate for Stargardt disease and expand its genetic medicine pipeline. 8 Amount raised in H1 2025: $130M GlycoEra is a pioneering biotech company based in Switzerland and the US, transforming autoimmune disease treatment through its novel CustomGlycan platform. By engineering bispecific biologics that selectively target and degrade disease-driving circulating proteins, especially autoantibodies like IgG4, it offers unmatched speed, precision, and safety compared to traditional immunosuppressive therapies. In. May, GlycoEra closed an oversubscribed $130 million Series B financing to advance its lead IgG4-targeted protein degrader into human trials, bring a second program into the clinic, and expand its precision immunology pipeline. 9 Amount raised in H1 2025: $120M CeQur is a diabetes technology company simplifying mealtime insulin delivery with its innovative CeQur Simplicity™, a discreet, wearable patch that eliminates the need for injections. Based in Switzerland, with US, CeQur offers injection-free mealtime dosing using a flexible cannula, enabling convenient one-click insulin delivery for up to four days per patch. Clinically shown to reduce A1C and boost time-in-range, it enhances adherence and helps people with type 1 and type 2 diabetes manage their health more easily. CeQur closed a $120 million equity financing round in January to accelerate commercial growth. 10

Neko Health Frequently Asked Questions (FAQ)

When was Neko Health founded?

Neko Health was founded in 2018.

Where is Neko Health's headquarters?

Neko Health's headquarters is located at Regeringsgatan 61B, Stockholm.

What is Neko Health's latest funding round?

Neko Health's latest funding round is Series B.

How much did Neko Health raise?

Neko Health raised a total of $331.25M.

Who are the investors of Neko Health?

Investors of Neko Health include General Catalyst, Atomico, Lakestar, O.G. Venture Partners, Lightspeed Venture Partners and 6 more.

Who are Neko Health's competitors?

Competitors of Neko Health include Smarter Diagnostics.

Loading...

Compare Neko Health to Competitors

Kitman Labs is a performance intelligence company that operates in the sports and defense sectors. The company offers a suite of software solutions designed to optimize human performance, enhance health and wellness, reduce injury risk, and improve operational efficiencies. Kitman Labs primarily serves professional sports leagues, governing bodies, collegiate sports programs, and defense organizations. It was founded in 2012 and is based in Dublin, Ireland.

Humanity is a health technology company that monitors and analyzes aging biomarkers. The company offers a subscription service that utilizes AI algorithms to track and predict aging processes based on digital and blood biomarkers, and provides insights for users to make lifestyle changes related to aging. Humanity primarily serves the health and wellness industry, with a focus on individuals seeking to improve their health. It was founded in 2019 and is based in Boston, Massachusetts.

Prenuvo provides whole-body Magnetic resonance imaging (MRI) scans for preventative health care, operating within the medical imaging and diagnostic services industry. The company offers health assessments that utilize MRI technology to detect conditions early, without the use of radiation or contrast dyes. Prenuvo's services cater to individuals seeking health monitoring and detection of potential health issues. It was founded in 2018 and is based in Redwood City, California.

Smarter Diagnostics provides AI-powered diagnostics within the healthcare sector, focusing on sports medicine and preventive healthcare. The company offers imaging diagnostic services that analyze MRI data to assist in athletic performance, injury prevention, and health monitoring for athletes and active individuals. Smarter Diagnostics serves professional sports, healthcare providers, employers, and insurance companies. It was founded in 2020 and is based in Warsaw, Poland.

Loading...