Livestreaming has been the next big thing in online shopping for several years.

In China, the shopping mode — where consumers can interact with a live video in real time and buy products — gained speed just before the pandemic. Now, nearly 500M people in China reportedly visit livestream sites on a regular basis, and their purchases on the platforms are driving 10% of e-commerce sales in China, according to McKinsey.

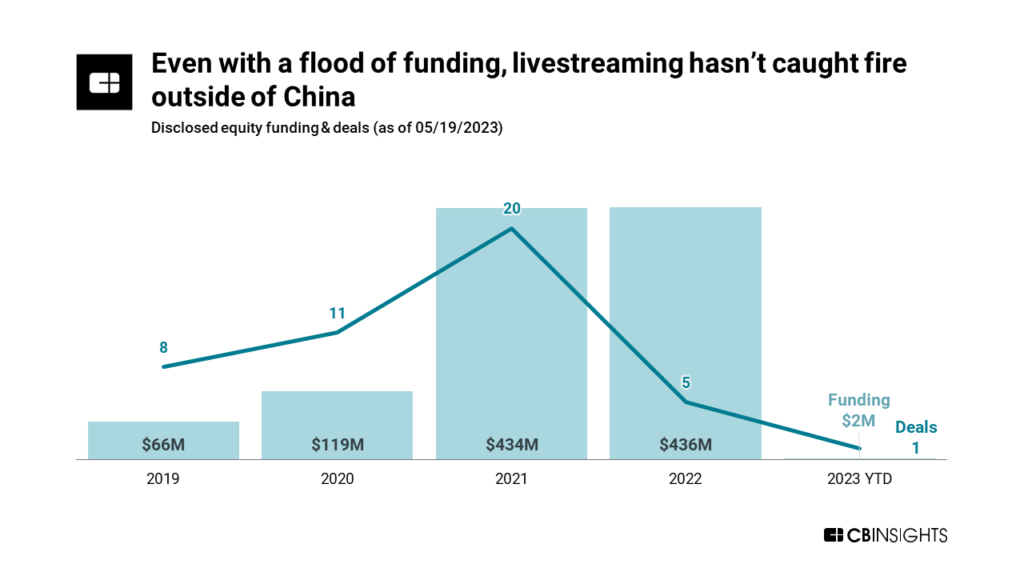

Retailers, brands, and investors anticipated it would explode similarly in North America and elsewhere. Non-China-based startups in the livestream shopping market, which includes B2B livestream tech as well as consumer-facing livestream platforms, raised more than $430M across 5 deals in 2022.

For more data on the livestream e-commerce market, visit our Market Report.

But in practice, livestreaming hasn’t expanded as expected outside of China. So far in 2023, only one livestream company has raised — US-based Immerss, which offers livestream as well as digital clienteling tools, announced a $2M seed round in January. Companies like Meta have abandoned livestream shopping programs. And while estimates have livestream shopping surpassing $65B in sales in the US by 2026, doubling projected 2023 levels, it is still only expected to account for 5% of forecasted e-commerce sales.

So what’s next for livestream shopping outside of China?