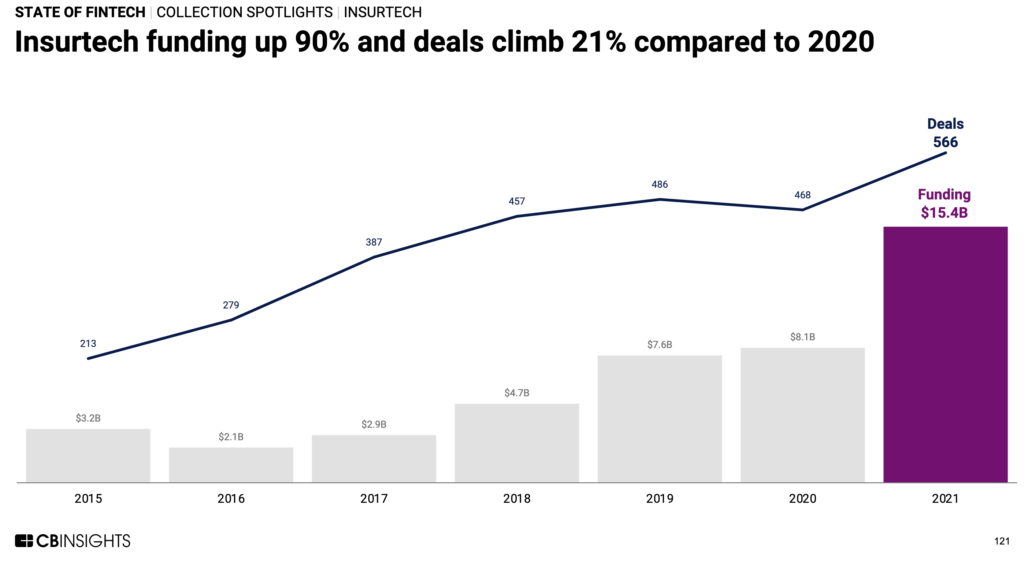

Insurtech funding soared to an all-time high of $15.4B in 2021 — up nearly 2x compared to the year prior — across 566 deals.

This torrent of capital is already reshaping the future of the insurance industry. Below, we look at some of the emerging insurtech trends, including:

- US- and Asia-based startups drove insurtech’s mammoth Q4’21. As a result of regulatory and cultural differences, insurtech startups tend to primarily work in the regions and countries in which they are founded.

- Investors placed big bets on later-stage, more established insurtech companies in 2021. While early-stage rounds still make up the majority of the deals, their decline in overall deal share signals that the insurtech space is maturing.

- Life and health insurance mega-rounds provided a lot of funding momentum in Q4’21 — 2 big deals alone made up nearly half of all insurtech funding in Q4’21.