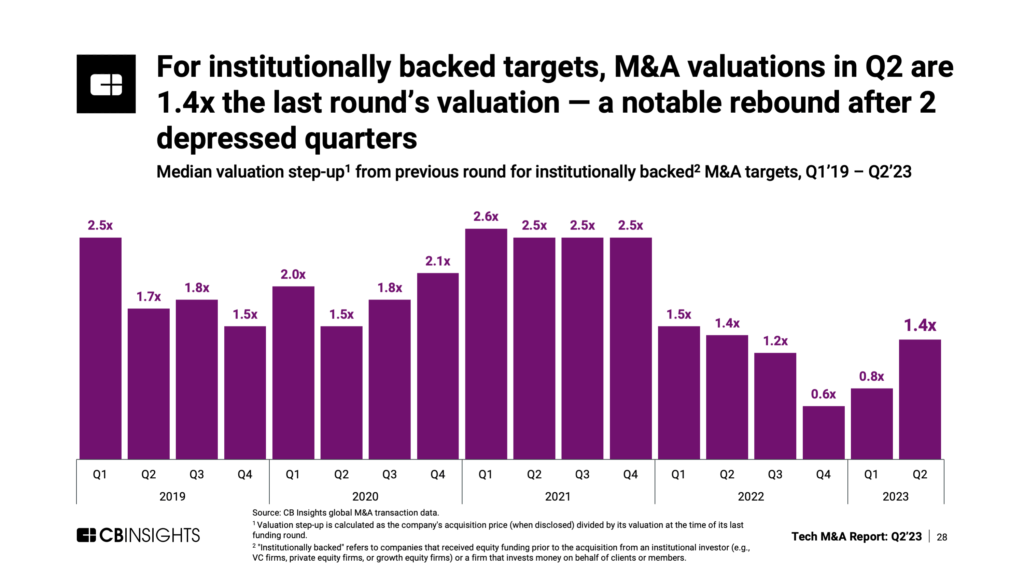

Institutional investors like VCs and PE firms hope their portfolio companies will not only reach an exit but also appreciate in value along the way. However, that’s not a given.

After the boom times of 2021 and early 2022, valuations had a long way to fall when the market turned sour. By Q4’22, the median M&A valuation for institutionally backed companies was just 0.6x the valuation of their previous round. This rebounded slightly in Q1’23 to 0.8x — still a discount vs. the prior round and a potential loss for any later-stage investors.

Institutional investors likely breathed a sigh of relief in Q2’23, when M&A targets saw a median valuation step-up of 1.4x over their previous round, according to the CB Insights Tech M&A Q2’23 Report.

For those in corporate development, venture capital, or private equity, you can dig into more acquisition data and trends — from global M&A deal volume to big tech buying trends — in our full Tech M&A Q2’23 Report.

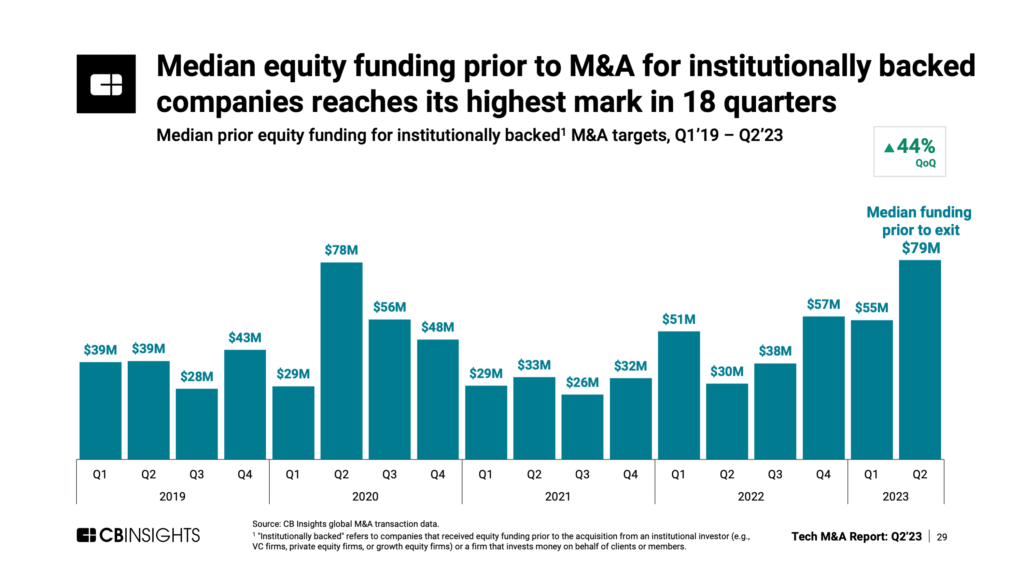

Meanwhile, the amount of equity funding that institutionally backed companies raised prior to M&A grew 44% quarter-over-quarter to reach $79M in Q2’23 — its highest level in over 4 years.

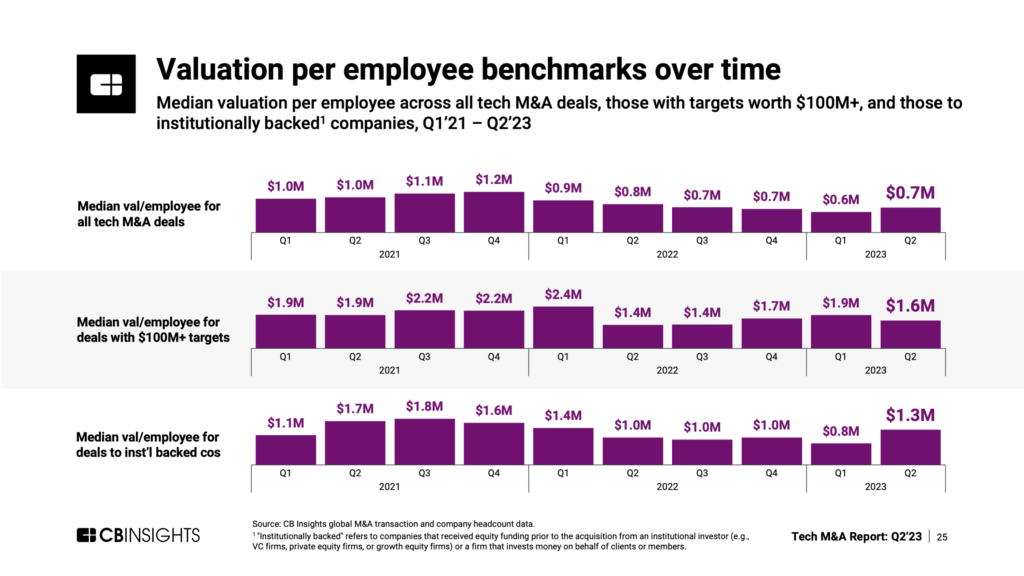

Further, the valuation per employee for institutionally backed M&A targets is increasing.

After trending down for 6 consecutive quarters, the median valuation per employee surged to $1.3M in Q2’23 — another positive shift for these targets’ prior institutional investors.

To dig into more global tech M&A trends, including a breakdown of strategic vs. financial buyers, download the entire Tech M&A Q2’23 Report here.