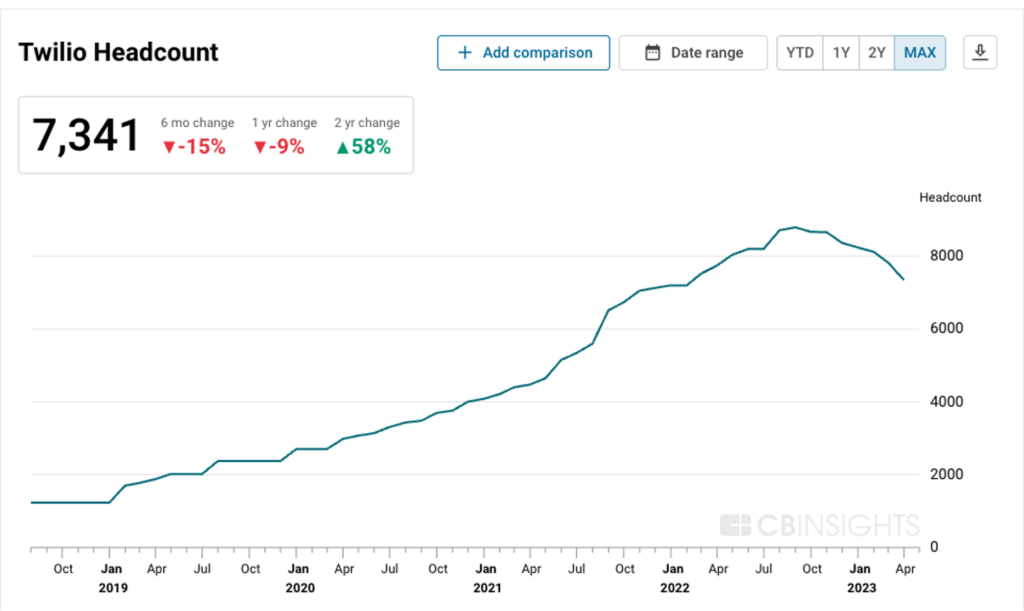

Twilio, a leading player in the communications platform-as-a-service (CPaaS) space, recently underwent 2 rounds of layoffs.

The company has been downsizing to reduce costs after multiple acquisitions and a hiring spree drove Twilio’s headcount up to nearly 9,000 employees in summer 2022. That figure has since dropped 15% over the past 6 months.

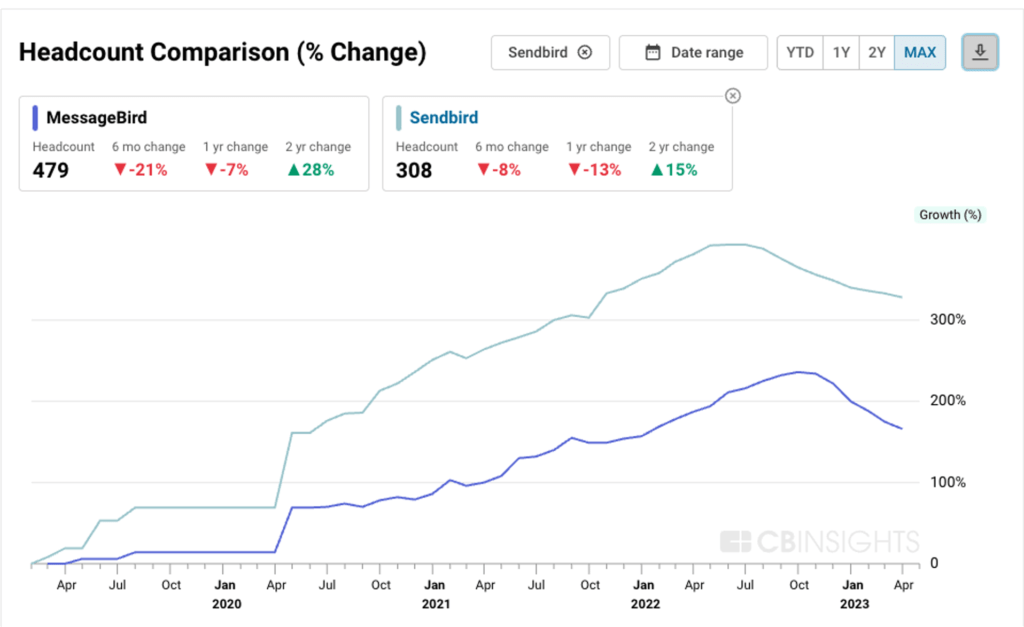

Other CPaaS players such as MessageBird and Sendbird — both unicorns with $1B+ valuations — have also been reducing their headcount recently. This raises questions about whether or not they can maintain their current valuations.

In this brief, we’ll take a look at headcount trends in the CPaaS space — including breakdowns of valuation and revenue per employee — to assess whether these players deserve their current valuations.

Headcount trends

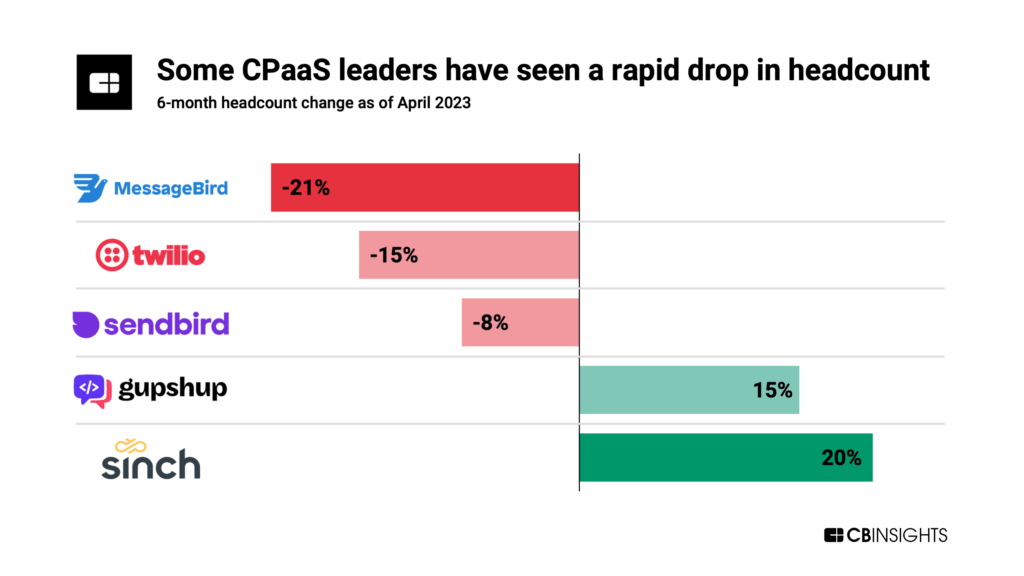

Twilio, MessageBird, and Sendbird — along with many other tech companies — have recently seen dramatic headcount reductions.

But other CPaaS players have kept hiring.

Both GupShup and Sinch, for instance, have seen strong headcount growth in the past 6 months.

In fact, from April 2021 to April 2023, GupShup quadrupled its number of employees to nearly 900. Sinch doubled its workforce to over 2,900 during the same time frame.