Investments

1324Portfolio Exits

291Funds

32Partners & Customers

10Service Providers

3About Insight Partners

Insight Partners is a global software investor focused on technology, software, and Internet startup and ScaleUp companies. The company provides venture capital investment and growth-stage funding, as well as initial public offer (IPO) advisory services. It serves the technology sector and supports companies during their investment journey. Insight Partners was formerly known as Insight Venture Partners. It was founded in 1995 and is based in New York, New York.

Expert Collections containing Insight Partners

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Find Insight Partners in 7 Expert Collections, including Store tech (In-store retail tech).

Store tech (In-store retail tech)

56 items

Startups aiming work with retailers to improve brick-and-mortar retail operations.

Travel Technology (Travel Tech)

39 items

Tech-enabled companies offering services and products focused on tourism. This collection includes booking services, search platforms, on-demand travel and recommendation sites, among others.

Education Technology (Edtech)

58 items

CB Insights Smart Money Investors

25 items

CB Insights Fintech Smart Money Investors - 2020

25 items

CB Insights Consumer Smart Money Investors - 2020

25 items

Track the world's top-performing VC investors in consumer. Firms are presented in alphabetical order.

Research containing Insight Partners

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Insight Partners in 3 CB Insights research briefs, most recently on Feb 27, 2024.

Feb 27, 2024

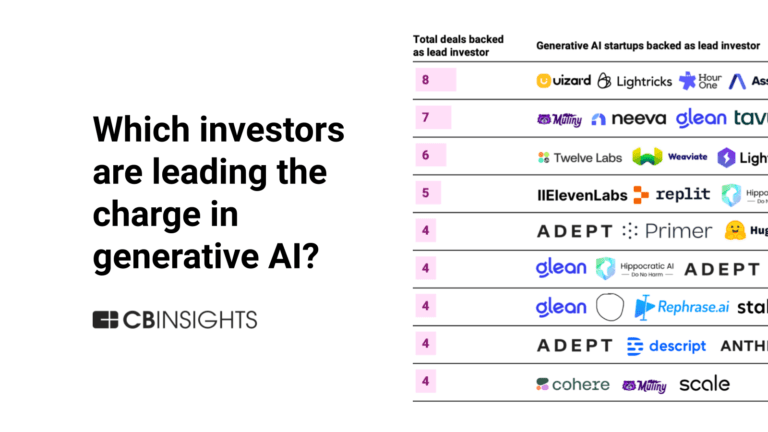

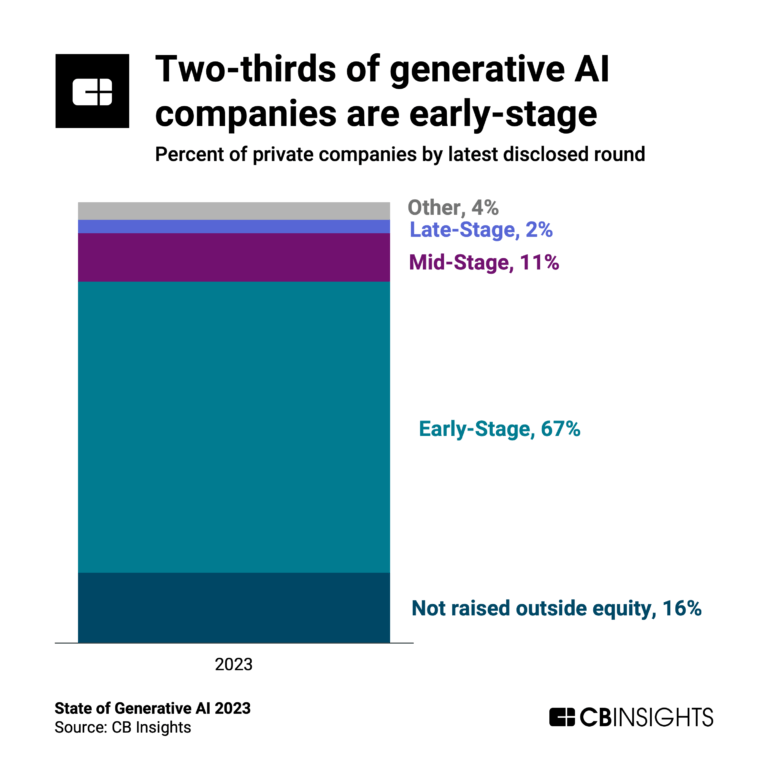

The generative AI boom in 6 chartsLatest Insight Partners News

Sep 16, 2025

Walgreens, O'Reilly Auto Parts, and TD Bank are among the Fortune 500 companies using GreenLite's AI-driven Private Plan Review for permitting efficiency NEW YORK, September 15, 2025-- GreenLite, the construction technology company accelerating permit timelines by 75% through AI-powered plan review and compliance solutions, today announced a Series B funding round of $49.5M, led by global software investor Insight Partners with participation from Energize Capital, as well as existing investors Craft Ventures, LiveOak Ventures, and Chicago Ventures. GreenLite will utilize the new capital to expand its go-to-market efforts and enter new verticals, including lodging, industrial and logistics, clean energy infrastructure, and residential development, while further advancing its AI-powered technology platform. As demand for construction surges, jurisdictions and building departments face unprecedented challenges, including labor shortages, limited adoption of technology, and rising backlogs. This strain is renewing focus on technologies and policies for permitting solutions, including Private Plan Review (PPR), where qualified third-party experts conduct official code compliance reviews instead of the city. Nearly a quarter of U.S. states have advanced legislation for PPR in the past three years, aiming to reduce delays and streamline development. Today, GreenLite is the only Private Provider combining regulatory expertise with AI to deliver PPR at a national scale. "The permitting backlog is holding back America's ability to build at the scale and speed we need," said James Gallagher, Co-Founder and CEO of GreenLite. "By combining a growing database of proprietary compliance comments with advanced automation, we're catching violations faster and providing builders, developers, and jurisdictions with the predictability and transparency they need to move projects forward, dramatically transforming the plan review and construction code compliance process." GreenLite's AI-powered digital plan review tool, LiteTable, rapidly ingests plan sets, identifies compliance flags and code requirements, and surfaces relevant guidance from GreenLite's extensive comment library based on compliance patterns within specific jurisdictions. Today, GreenLite is trusted by nearly a hundred Fortune 500 customers, including retailers, REITs, quick service restaurants, industrial owner-developers, and production home builders to advance permitting nationwide. The company is expanding into lodging, logistics, multifamily, and additional verticals this year. "GreenLite's full-stack Private Plan Review approach delivers building permits in days, not months, and is driving growth in America's local communities and economies," said Jeff Horing, Co-founder and Managing Director at Insight Partners. "We're thrilled to back GreenLite as it continues to partner with the commercial sector and local governments to power the future of construction permitting." GreenLite was founded in 2022 by James Gallagher and Ben Allen, former Gopuff executives. The company has 50 full-time employees today, and is actively hiring across engineering, product, sales, marketing, operations, and executive roles. To learn more about GreenLite's AI-powered permitting and private plan review capabilities, please visit: https://greenlite.com/. About GreenLite: GreenLite is transforming how America builds by streamlining the permitting process for developers, builders, and local governments. GreenLite pioneered AI-powered Private Plan Review (PPR), where third-party experts, supported by proprietary software, conduct official code compliance reviews instead of cities. Its technology accelerates approvals by scanning plan sets, identifying code violations, and surfacing jurisdiction-specific guidance from a large and growing proprietary database of compliance comments. With a team of in-house architects, engineers, and plan examiners, GreenLite helps customers reduce revisions, avoid delays, and cut weeks or months off their permitting timelines. Trusted by nearly 100 national brands, GreenLite is reshaping the future of permitting across industries from retail and banking to logistics, lodging, and multifamily development. Learn more at https://www.greenlite.com. About Insight Partners: Insight Partners is a global software investor partnering with high-growth technology, software, and Internet startup and ScaleUp companies that are driving transformative change in their industries. As of December 31, 2024, the firm has over $90B in regulatory assets under management. Insight Partners has invested in more than 800 companies worldwide and has seen over 55 portfolio companies achieve an IPO. Headquartered in New York City, Insight has offices in London, Tel Aviv, and the Bay Area. Insight's mission is to find, fund, and work successfully with visionary executives, providing them with tailored, hands-on software expertise along their growth journey, from their first investment to IPO. For more information on Insight and all its investments, visit insightpartners.com or follow us on X @insightpartners.

Insight Partners Investments

1,324 Investments

Insight Partners has made 1,324 investments. Their latest investment was in GreenLite as part of their Series B on September 15, 2025.

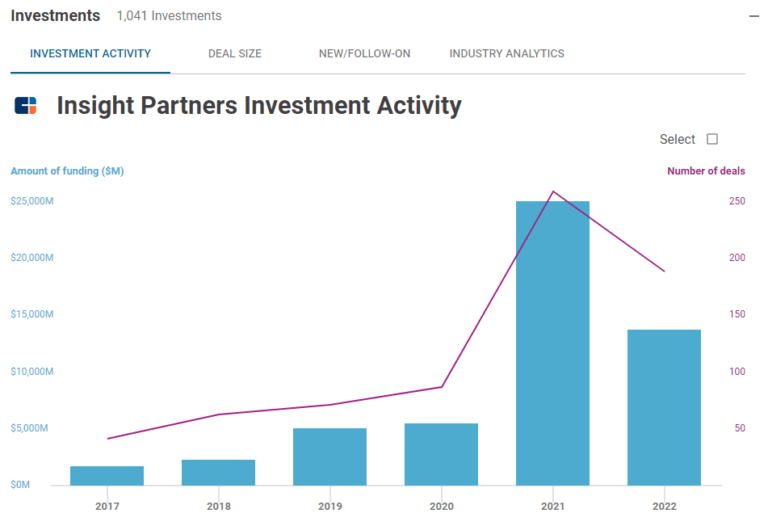

Insight Partners Investments Activity

Date | Round | Company | Amount | New? | Co-Investors | Sources |

|---|---|---|---|---|---|---|

9/15/2025 | Series B | GreenLite | $49.5M | Yes | 3 | |

9/9/2025 | Seed VC - II | Runware | $13M | Yes | 3 | |

9/3/2025 | Series C | Shift5 | $75M | No | 645 Ventures, AE Industrial Partners, Booz Allen Ventures, Center15 Capital, CSP Associates, Disruptive, Hedosophia, Moore Strategic Ventures, Savano Capital, and Squadra Ventures | 3 |

9/2/2025 | Series F | |||||

8/27/2025 | Series A |

Date | 9/15/2025 | 9/9/2025 | 9/3/2025 | 9/2/2025 | 8/27/2025 |

|---|---|---|---|---|---|

Round | Series B | Seed VC - II | Series C | Series F | Series A |

Company | GreenLite | Runware | Shift5 | ||

Amount | $49.5M | $13M | $75M | ||

New? | Yes | Yes | No | ||

Co-Investors | 645 Ventures, AE Industrial Partners, Booz Allen Ventures, Center15 Capital, CSP Associates, Disruptive, Hedosophia, Moore Strategic Ventures, Savano Capital, and Squadra Ventures | ||||

Sources | 3 | 3 | 3 |

Insight Partners Portfolio Exits

291 Portfolio Exits

Insight Partners has 291 portfolio exits. Their latest portfolio exit was Valimail on September 16, 2025.

Date | Exit | Companies | Valuation Valuations are submitted by companies, mined from state filings or news, provided by VentureSource, or based on a comparables valuation model. | Acquirer | Sources |

|---|---|---|---|---|---|

9/16/2025 | Acquired | 2 | |||

9/10/2025 | Management Buyout | 2 | |||

9/8/2025 | Acq - Fin | 2 | |||

Date | 9/16/2025 | 9/10/2025 | 9/8/2025 | ||

|---|---|---|---|---|---|

Exit | Acquired | Management Buyout | Acq - Fin | ||

Companies | |||||

Valuation | |||||

Acquirer | |||||

Sources | 2 | 2 | 2 |

Insight Partners Acquisitions

45 Acquisitions

Insight Partners acquired 45 companies. Their latest acquisition was OptoScale on May 05, 2025.

Date | Investment Stage | Companies | Valuation Valuations are submitted by companies, mined from state filings or news, provided by VentureSource, or based on a comparables valuation model. | Total Funding | Note | Sources |

|---|---|---|---|---|---|---|

5/5/2025 | Seed / Angel | $4.76M | Acq - Fin | 2 | ||

12/2/2024 | Series C | $24.24M | Acq - Fin | 2 | ||

10/28/2024 | Series C | $51.22M | Acq - Fin | 2 | ||

12/19/2023 | Other | |||||

3/19/2023 | Series C |

Date | 5/5/2025 | 12/2/2024 | 10/28/2024 | 12/19/2023 | 3/19/2023 |

|---|---|---|---|---|---|

Investment Stage | Seed / Angel | Series C | Series C | Other | Series C |

Companies | |||||

Valuation | |||||

Total Funding | $4.76M | $24.24M | $51.22M | ||

Note | Acq - Fin | Acq - Fin | Acq - Fin | ||

Sources | 2 | 2 | 2 |

Insight Partners Fund History

32 Fund Histories

Insight Partners has 32 funds, including Insight Partners Continuation Fund III.

Closing Date | Fund | Fund Type | Status | Amount | Sources |

|---|---|---|---|---|---|

10/15/2024 | Insight Partners Continuation Fund III | $1,500M | 1 | ||

5/18/2024 | Insight Partners Opportunities Fund II | $1,300M | 2 | ||

8/23/2023 | Insight Partners Fund XIII | $12,500M | 3 | ||

7/6/2023 | Vision Capital 2020 | ||||

3/18/2023 | Insight Partners Continuation Fund II |

Closing Date | 10/15/2024 | 5/18/2024 | 8/23/2023 | 7/6/2023 | 3/18/2023 |

|---|---|---|---|---|---|

Fund | Insight Partners Continuation Fund III | Insight Partners Opportunities Fund II | Insight Partners Fund XIII | Vision Capital 2020 | Insight Partners Continuation Fund II |

Fund Type | |||||

Status | |||||

Amount | $1,500M | $1,300M | $12,500M | ||

Sources | 1 | 2 | 3 |

Insight Partners Partners & Customers

10 Partners and customers

Insight Partners has 10 strategic partners and customers. Insight Partners recently partnered with Statzon on March 3, 2021.

Date | Type | Business Partner | Country | News Snippet | Sources |

|---|---|---|---|---|---|

3/19/2021 | Distributor | Finland | `` The Insight Partners and Statzon have many synergies and this partnership will open up our niche targeted and meaningful strategic Industry insights and forecasts including the impact of Covid 19 to Statzon users . | 1 | |

3/18/2021 | Partner | United Kingdom | |||

3/5/2021 | Partner | Canada | NEW YORK - March 5,2021 - HBC and leading growth capital investor , Insight Partners , have entered into a partnership that establishes Saks Fifth Avenue 's ecommerce business as a standalone entity , which will be known as Saks Fifth Avenue . | 2 | |

2/1/2021 | Partner | ||||

10/23/2017 | Partner |

Date | 3/19/2021 | 3/18/2021 | 3/5/2021 | 2/1/2021 | 10/23/2017 |

|---|---|---|---|---|---|

Type | Distributor | Partner | Partner | Partner | Partner |

Business Partner | |||||

Country | Finland | United Kingdom | Canada | ||

News Snippet | `` The Insight Partners and Statzon have many synergies and this partnership will open up our niche targeted and meaningful strategic Industry insights and forecasts including the impact of Covid 19 to Statzon users . | NEW YORK - March 5,2021 - HBC and leading growth capital investor , Insight Partners , have entered into a partnership that establishes Saks Fifth Avenue 's ecommerce business as a standalone entity , which will be known as Saks Fifth Avenue . | |||

Sources | 1 | 2 |

Insight Partners Service Providers

4 Service Providers

Insight Partners has 4 service provider relationships

Service Provider | Associated Rounds | Provider Type | Service Type |

|---|---|---|---|

J.P. Morgan Securities | Take Private | Other | Financial Advisor |

Service Provider | J.P. Morgan Securities | ||

|---|---|---|---|

Associated Rounds | Take Private | ||

Provider Type | Other | ||

Service Type | Financial Advisor |

Partnership data by VentureSource

Insight Partners Team

140 Team Members

Insight Partners has 140 team members, including current Founder, Managing Director, Jeffrey L. Horing.

Name | Work History | Title | Status |

|---|---|---|---|

Jeffrey L. Horing | Founder, Managing Director | Current | |

Name | Jeffrey L. Horing | ||||

|---|---|---|---|---|---|

Work History | |||||

Title | Founder, Managing Director | ||||

Status | Current |

Compare Insight Partners to Competitors

Accel is a venture capital firm that invests in and partners with teams from the inception of private companies through their growth phases, primarily in the technology sector. Accel was formerly known as Accel Partners. It was founded in 1983 and is based in Palo Alto, California.

Sequoia Capital is a venture capital firm that focuses on supporting startups from inception to initial-public offering (IPO) within sectors. They provide investment funding and strategic support to help companies grow and succeed. Sequoia Capital primarily serves technology-driven sectors and businesses aiming to become market leaders. It was founded in 1972 and is based in Menlo Park, California.

Bessemer Venture Partners invests in technology sectors and supports entrepreneurs in building companies. The company provides funding and guidance to startups at various growth stages, particularly in the enterprise, consumer, and healthcare areas. Its investment portfolio includes sectors such as artificial intelligence (AI) and machine learning (ML), biotechnology, cloud computing, consumer products, cybersecurity, fintech, and vertical software. It was founded in 1911 and is based in San Francisco, California.

Index Ventures operates as a global venture capital firm. It invests in the commercial services, media, retail, and information technology sectors. It was founded in 1996 and is based in London, United Kingdom.

Kleiner Perkins serves as a venture capital firm with a focus on technology and life sciences sectors. The company invests in innovative and forward-thinking startups, offering financial support and strategic partnerships to help them grow. Kleiner Perkins primarily serves sectors such as software, biotechnology, healthcare, and internet technology. It was founded in 1972 and is based in Menlo Park, California.

Battery Ventures operates as a technology-focused investment firm across many sectors, including application software, infrastructure software, consumer internet, and industrial technologies. The firm provides capital and support services, including business development and talent recruitment, to its portfolio companies. Battery Ventures invests in businesses at various stages, from seed to growth and private equity, with a global investment strategy. It was founded in 1983 and is based in Boston, Massachusetts.

Loading...