Investments

2106Portfolio Exits

479Funds

48Partners & Customers

10Service Providers

2About Kleiner Perkins

Kleiner Perkins serves as a venture capital firm with a focus on technology and life sciences sectors. The company invests in innovative and forward-thinking startups, offering financial support and strategic partnerships to help them grow. Kleiner Perkins primarily serves sectors such as software, biotechnology, healthcare, and internet technology. It was founded in 1972 and is based in Menlo Park, California.

Expert Collections containing Kleiner Perkins

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Find Kleiner Perkins in 12 Expert Collections, including Direct-To-Consumer Brands (Non-Food).

Direct-To-Consumer Brands (Non-Food)

37 items

Startups selling their own branded products directly to consumers via online/mobile channels, rather than relying on department stores or big online marketplaces.

E-Commerce

22 items

Store tech (In-store retail tech)

56 items

Startups aiming work with retailers to improve brick-and-mortar retail operations.

Synthetic Biology

382 items

Food & Beverage

123 items

Travel Technology (Travel Tech)

39 items

Tech-enabled companies offering services and products focused on tourism. This collection includes booking services, search platforms, on-demand travel and recommendation sites, among others.

Research containing Kleiner Perkins

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Kleiner Perkins in 2 CB Insights research briefs, most recently on May 8, 2025.

May 8, 2025 report

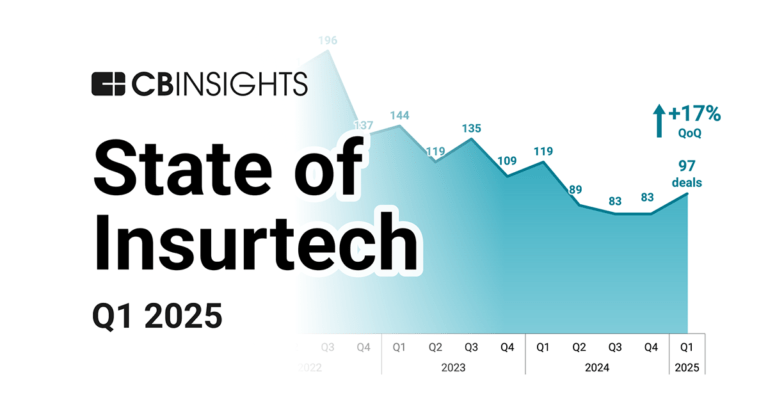

State of Insurtech Q1’25 ReportLatest Kleiner Perkins News

Aug 18, 2025

EINPresswire.com / -- The global Venture Capital Market has witnessed exponential growth in recent years and is poised for remarkable expansion over the coming decade. In 2023, the market size was estimated at USD 250.26 billion and is expected to grow from USD 300.56 billion in 2024 to an impressive USD 1,283.27 billion by 2032, reflecting a robust compound annual growth rate (CAGR) of 20.1% during the forecast period (2024–2032). The growth is primarily driven by increasing startup investments, technological innovation, and expanding funding opportunities across emerging and developed economies. Key Drivers Of Market Growth Rising Startup Investments- Venture capital is fueling the growth of innovative startups worldwide. Entrepreneurs are increasingly relying on VC funding to scale operations, develop new products, and enter global markets. Technological Advancements- Emerging technologies such as artificial intelligence, blockchain, fintech, and biotech are attracting significant venture capital investments. Investors are seeking high-growth opportunities in technology-driven sectors. Expansion of Funding Opportunities- Government initiatives, incubators, accelerators, and crowdfunding platforms are enhancing access to venture capital for startups. This ecosystem supports early-stage and high-potential businesses in securing essential financing. Globalization of Venture Capital- Venture capital investments are no longer confined to traditional hubs like the U.S. and Europe. Asia-Pacific, Latin America, and the Middle East are seeing increasing VC activity, driven by entrepreneurial growth and supportive regulatory frameworks. Get a FREE Sample Report – https://www.marketresearchfuture.com/sample_request/24699 Key Companies in the Venture Capital Market Include • Sequoia Capital • Accel Partners • Andreessen Horowitz • Kleiner Perkins • Benchmark Capital • Bessemer Venture Partners • Index Ventures • SoftBank Vision Fund • General Catalyst • Lightspeed Venture Partners • Felix Capital • NEA (New Enterprise Associates) • IVP (Institutional Venture Partners) • Union Square Ventures • Insight Partners, among others Browse In-depth Market Research Report: https://www.marketresearchfuture.com/reports/venture-capital-market-24699 Market Segmentation To provide a comprehensive analysis, the Venture Capital market is segmented based on type, stage, application, and region. 1. By Type • Equity Financing: Direct investments in exchange for ownership stakes. • Convertible Debt Financing: Loans that convert to equity under specific conditions. • Mezzanine Financing: Hybrid financing combining debt and equity features. 2. By Stage • Seed Stage: Initial funding to validate business ideas and prototypes. • Early Stage: Investment for product development and market entry. • Growth Stage: Funding to scale operations and expand market reach. • Late Stage: Investments in mature companies preparing for exit strategies or IPOs. 3. By Application • Technology: AI, fintech, SaaS, blockchain, and IoT startups. • Healthcare & Biotechnology: Pharmaceutical, medical devices, and digital health ventures. • Consumer Goods & Services: Retail, e-commerce, and lifestyle startups. • Industrial & Manufacturing: Advanced manufacturing and industrial innovation. 4. By Region • North America: Dominates due to mature startup ecosystems and strong VC networks. • Europe: Growth driven by technology hubs, government incentives, and cross-border investments. • Asia-Pacific: Fastest-growing region, fueled by entrepreneurship, digital adoption, and emerging markets. • Rest of the World (RoW): Increasing VC activity in Latin America, the Middle East, and Africa due to rising startup ecosystems. Purchase Complete Research Report Now: https://www.marketresearchfuture.com/checkout?currency=one_user-USD&report_id=24699 The global Venture Capital market is on a trajectory of extraordinary growth, driven by technology innovation, startup proliferation, and global investment opportunities. As entrepreneurs and investors continue to capitalize on emerging markets and disruptive technologies, the Venture Capital market is set to play a critical role in shaping the future of global business funding through 2032. Top Trending Research Report : Car Insurance Aggregators Market - https://www.marketresearchfuture.com/reports/car-insurance-aggregators-market-23929 Cargo Insurance Market - https://www.marketresearchfuture.com/reports/cargo-insurance-market-23895 Accidental Death Insurance Market - https://www.marketresearchfuture.com/reports/accidental-death-insurance-market-23901 Aerospace Insurance Market - https://www.marketresearchfuture.com/reports/aerospace-insurance-market-23909 Agricultural Insurance Market - https://www.marketresearchfuture.com/reports/agricultural-insurance-market-23918 Agriculture Reinsurance Market - https://www.marketresearchfuture.com/reports/agriculture-reinsurance-market-23926 Insurance Bpo Services Industry Market - https://www.marketresearchfuture.com/reports/insurance-bpo-services-industry-market-24181 Iot Banking Financial Services Market - https://www.marketresearchfuture.com/reports/iot-banking-financial-services-market-24183 Instant Grocery Market - https://www.marketresearchfuture.com/reports/instant-grocery-market-24063 About Market Research Future At Market Research Future (MRFR), we enable our customers to unravel the complexity of various industries through our Cooked Research Report (CRR), Half-Cooked Research Reports (HCRR), Raw Research Reports (3R), Continuous-Feed Research (CFR), and Market Research Consulting Services. The MRFR team have a supreme objective to provide the optimum quality market research and intelligence services for our clients. Our market research studies by Components, Application, Logistics and market players for global, regional, and country level market segments enable our clients to see more, know more, and do more, which help to answer all their most important questions. Sagar Kadam Market Research Future + +1 628-258-0071 Visit us on social media:

Kleiner Perkins Investments

2,106 Investments

Kleiner Perkins has made 2,106 investments. Their latest investment was in Convoke as part of their Seed VC on August 19, 2025.

Kleiner Perkins Investments Activity

Date | Round | Company | Amount | New? | Co-Investors | Sources |

|---|---|---|---|---|---|---|

8/19/2025 | Seed VC | Convoke | $8.6M | Yes | ACME, Audacious Capital, Comma Capital, Dimension Capital Management, Erik Torenberg, Liquid 2 Ventures, Lux Capital, Not Boring Capital, Qasar Younis, and Undisclosed Angel Investors | 2 |

8/12/2025 | Series B | Profound | $35M | No | 2 | |

7/30/2025 | Series G | Motive | $150M | No | AllianceBernstein, and Undisclosed Investors | 5 |

7/29/2025 | Series C | |||||

7/15/2025 | Series D |

Date | 8/19/2025 | 8/12/2025 | 7/30/2025 | 7/29/2025 | 7/15/2025 |

|---|---|---|---|---|---|

Round | Seed VC | Series B | Series G | Series C | Series D |

Company | Convoke | Profound | Motive | ||

Amount | $8.6M | $35M | $150M | ||

New? | Yes | No | No | ||

Co-Investors | ACME, Audacious Capital, Comma Capital, Dimension Capital Management, Erik Torenberg, Liquid 2 Ventures, Lux Capital, Not Boring Capital, Qasar Younis, and Undisclosed Angel Investors | AllianceBernstein, and Undisclosed Investors | |||

Sources | 2 | 2 | 5 |

Kleiner Perkins Portfolio Exits

479 Portfolio Exits

Kleiner Perkins has 479 portfolio exits. Their latest portfolio exit was Tecton on August 22, 2025.

Date | Exit | Companies | Valuation Valuations are submitted by companies, mined from state filings or news, provided by VentureSource, or based on a comparables valuation model. | Acquirer | Sources |

|---|---|---|---|---|---|

8/22/2025 | Acquired | 5 | |||

8/19/2025 | Acquired | 7 | |||

7/31/2025 | IPO | Public | 6 | ||

Date | 8/22/2025 | 8/19/2025 | 7/31/2025 | ||

|---|---|---|---|---|---|

Exit | Acquired | Acquired | IPO | ||

Companies | |||||

Valuation | |||||

Acquirer | Public | ||||

Sources | 5 | 7 | 6 |

Kleiner Perkins Acquisitions

3 Acquisitions

Kleiner Perkins acquired 3 companies. Their latest acquisition was FriedolaTECH on November 28, 2012.

Date | Investment Stage | Companies | Valuation Valuations are submitted by companies, mined from state filings or news, provided by VentureSource, or based on a comparables valuation model. | Total Funding | Note | Sources |

|---|---|---|---|---|---|---|

11/28/2012 | Other Venture Capital | $14.26M | Acq - Fin | 1 | ||

3/16/2010 | ||||||

8/1/1992 | Growth Equity |

Date | 11/28/2012 | 3/16/2010 | 8/1/1992 |

|---|---|---|---|

Investment Stage | Other Venture Capital | Growth Equity | |

Companies | |||

Valuation | |||

Total Funding | $14.26M | ||

Note | Acq - Fin | ||

Sources | 1 |

Kleiner Perkins Fund History

48 Fund Histories

Kleiner Perkins has 48 funds, including KP20.

Closing Date | Fund | Fund Type | Status | Amount | Sources |

|---|---|---|---|---|---|

1/11/2022 | KP20 | $800M | 1 | ||

1/11/2022 | The Kleiner Perkins Select Fund II | $1,000M | 1 | ||

4/20/2021 | The Kleiner Perkins Select Fund | $750M | 1 | ||

3/5/2020 | Kleiner Perkins Caufield & Byers XIX | ||||

2/1/2019 | Kleiner Perkins Caufield & Byers XVIII |

Closing Date | 1/11/2022 | 1/11/2022 | 4/20/2021 | 3/5/2020 | 2/1/2019 |

|---|---|---|---|---|---|

Fund | KP20 | The Kleiner Perkins Select Fund II | The Kleiner Perkins Select Fund | Kleiner Perkins Caufield & Byers XIX | Kleiner Perkins Caufield & Byers XVIII |

Fund Type | |||||

Status | |||||

Amount | $800M | $1,000M | $750M | ||

Sources | 1 | 1 | 1 |

Kleiner Perkins Partners & Customers

10 Partners and customers

Kleiner Perkins has 10 strategic partners and customers. Kleiner Perkins recently partnered with Baker McKenzie on October 10, 2024.

Date | Type | Business Partner | Country | News Snippet | Sources |

|---|---|---|---|---|---|

10/2/2024 | Vendor | United States | 1 | ||

12/19/2023 | Partner | United States | 2 | ||

6/29/2015 | Partner | United States | Amazon swells venturing top-table Amazon move to support nascent Alexa ecosystem echoes groups like Apple looking to kickstart its app store in partnership with venture firm Kleiner Perkins Caufield & Byers , as well as Google Ventures setting up a Glass Collective with Kleiner Perkins Caufield & Byers and venture firm Andreessen Horowitz to invest in deals related to Google Glass . | 2 | |

3/26/2013 | Partner | ||||

8/28/2012 | Partner |

Date | 10/2/2024 | 12/19/2023 | 6/29/2015 | 3/26/2013 | 8/28/2012 |

|---|---|---|---|---|---|

Type | Vendor | Partner | Partner | Partner | Partner |

Business Partner | |||||

Country | United States | United States | United States | ||

News Snippet | Amazon swells venturing top-table Amazon move to support nascent Alexa ecosystem echoes groups like Apple looking to kickstart its app store in partnership with venture firm Kleiner Perkins Caufield & Byers , as well as Google Ventures setting up a Glass Collective with Kleiner Perkins Caufield & Byers and venture firm Andreessen Horowitz to invest in deals related to Google Glass . | ||||

Sources | 1 | 2 | 2 |

Kleiner Perkins Service Providers

2 Service Providers

Kleiner Perkins has 2 service provider relationships

Service Provider | Associated Rounds | Provider Type | Service Type |

|---|---|---|---|

Gunderson Dettmer | Counsel | General Counsel | |

Service Provider | Gunderson Dettmer | |

|---|---|---|

Associated Rounds | ||

Provider Type | Counsel | |

Service Type | General Counsel |

Partnership data by VentureSource

Kleiner Perkins Team

35 Team Members

Kleiner Perkins has 35 team members, including current Founder, Chief Executive Officer, Brook Byers.

Name | Work History | Title | Status |

|---|---|---|---|

Brook Byers | Founder, Chief Executive Officer | Current | |

Name | Brook Byers | ||||

|---|---|---|---|---|---|

Work History | |||||

Title | Founder, Chief Executive Officer | ||||

Status | Current |

Compare Kleiner Perkins to Competitors

Sequoia Capital is a venture capital firm that focuses on supporting startups from inception to initial-public offering (IPO) within sectors. They provide investment funding and strategic support to help companies grow and succeed. Sequoia Capital primarily serves technology-driven sectors and businesses aiming to become market leaders. It was founded in 1972 and is based in Menlo Park, California.

Accel is a venture capital firm that invests in and partners with teams from the inception of private companies through their growth phases, primarily in the technology sector. Accel was formerly known as Accel Partners. It was founded in 1983 and is based in Palo Alto, California.

Bessemer Venture Partners works as a venture capital firm with offices in New York, Silicon Valley, Boston, Mumbai, and Herzliya. Bessemer primarily invests in early-stage opportunities but also participates in late-stage financing and occasionally makes seed-stage investments as well. The firm invests in the following areas: cleantech, data security, financial services, healthcare, online retail, and SaaS. Bessemer Venture Partners typically makes investments in the range of $4M–$10M. It was founded in 1911 and is based in San Francisco, California.

Lightspeed Venture Partners is a venture capital firm that focuses on various sectors including Enterprise, Consumer, Health, and Fintech. The firm provides financial support to startups and emerging companies, with a portfolio that includes companies such as Affirm, Epic Games, and Snap. Lightspeed Venture Partners manages assets and has a presence with investment professionals and advisors across multiple regions. It was founded in 2000 and is based in Menlo Park, California.

New Enterprise Associates operates as a global venture capital firm focused on the technology and healthcare sectors. The company offers funding to entrepreneurs at various stages of company development, from the seed stage to the Initial Public Offering (IPO). It primarily serves the technology and healthcare industries, investing in companies. The company was founded in 1977 and is based in Menlo Park, California.

Greylock Partners is a venture capital firm that focuses on early-stage investments in the technology sector. The company provides funding to AI-focused companies at the pre-seed, seed, and Series A stages. Greylock Partners offers a company-building program to support pre-idea and pre-seed founders in developing their startups. It was founded in 1965 and is based in Menlo Park, California.

Loading...