Investments

103Portfolio Exits

12Funds

3Service Providers

1About LG Technology Ventures

LG Technology Ventures venture capital for the LG Group of South Korea. It invests broadly in early-stage information technology, life sciences, automotive, manufacturing, energy, and advanced materials companies. The company was founded in 2018 and is based in Santa Clara, California.

Research containing LG Technology Ventures

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned LG Technology Ventures in 1 CB Insights research brief, most recently on Feb 4, 2025.

Feb 4, 2025 report

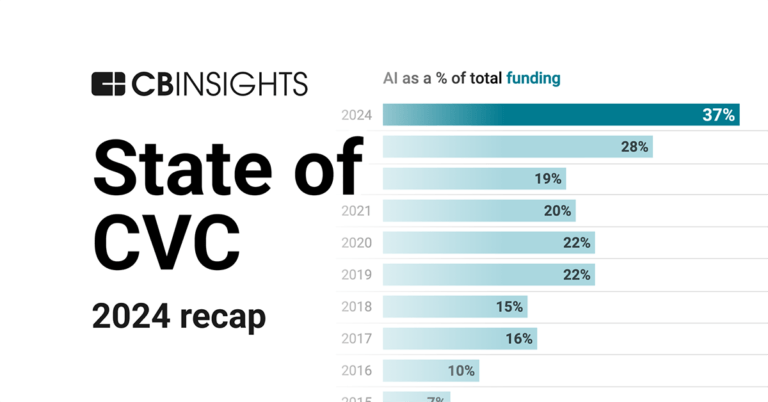

State of CVC 2024 ReportLatest LG Technology Ventures News

Sep 16, 2025

September 16, 2025 Dyna Robotics has closed a $120 million Series A funding round, led by Robostrategy, CRV, and First Round Capital, with participation from Salesforce Ventures, NVentures (Nvidia’s venture capital arm), the Amazon Industrial Innovation Fund, Samsung Next, and LG Technology Ventures. The new capital will be used to expand its world-class research and engineering team and accelerate the development of its next-generation foundation model as the company works to deliver high performance general-purpose robots in commercial environments. Dyna has made rapid progress since raising a $23.5 million seed round in March, including launching its DYNA-1 model, a breakthrough robotics foundation model that pushed the performance of robots to a 99+ percent success rate in 24 hours of non-stop operation. After just six months, Dyna’s robots were running 16 hours a day at hotels, restaurants, laundromats, and gyms. Dyna is the first to build a single-weight, general-purpose foundation model that can perform diverse daily tasks at commercial scale across varied environments. Its model has been deployed at multiple customer sites, supporting the model’s generalization commercial viability and continuing to learn and improve rapidly from on-the-job experience. Lindon Gao, co-founder and CEO of Dyna Robotics, says: “A strong foundation model is key to scalable distribution. “Our models continuously improve with each customer deployment, generating high-quality data. We are observing true generalization as our robot enters new environments; it simply works out of the box, with no additional data.” “Our first principle is to design robot foundation models that attain both generalization and performance,” says co-founder Jason Ma, a former DeepMind research scientist who has focused his career on developing foundation models for robotics. “Scalable real-world robot learning systems need to master and generalize many manipulation skills. To achieve the best performance on complex tasks, Dyna’s foundation models are developed to enable general world understanding while learning from the models’ own experience for rapid online learning.” Dyna co-founders Lindon Gao and York Yang teamed up with Ma after seeing the potential to advance AI through real-world applications first-hand while building Caper AI, which combined software and hardware to bring AI-powered smart carts to retailers worldwide. Their product made rapid advancements as soon as it went into production, and the company exited in 2021 for $350 million. By combining their experience creating practical, production-ready AI with deep research expertise and building a world-class team of researchers and operators, they are building embodied AI robots that are useful for businesses now, using that “on-the-job” experience to build toward physical AGI. York Yang, co-founder, says: “Right now, three forces are colliding at once: AI breakthroughs are maturing, hardware is accelerating, and the demand for labor has never been higher. That convergence has created a once-in-a-generation opportunity. “Dyna has made rapid progress over 12 months and we believe our ultimate goal, achieving physical AGI, is not far off.” Andrew Kang, CEO, RoboStrategy, says: “Dyna’s team and mission bridges research excellence and real world commercial applications. The demand for robotic automation spans almost every industry, and we believe Dyna will be at the forefront in meeting it with their state of the art general-purpose robot foundation model. “We’re thrilled to co-lead this Series A and support the team’s ambitious roadmap of driving mass adoption of general-purpose robots.” Max Gazor, general partner, CRV, says: “Dyna Robotics is at the forefront of embodied AI, delivering foundation models that combine generalization and commercial-level performance. We invested in the company from day one and are excited to double down on leading Dyna’s Series A. “Lindon, York, and Jason bring together the rare combination of proven entrepreneurial success, deep technical expertise, and the operational know-how to scale AI in the real world. We couldn’t be more excited to back the best team positioned to lead the physical AGI revolution.” Bill Trenchard, partner, First Round Capital, says: “At First Round, we back exceptional founders tackling massive problems, and Dyna Robotics checks every box. Their early results are remarkable. “In just one year, Dyna has pushed the boundaries of embodied AI with unprecedented generalization and commercial-grade performance. We’re thrilled to lead their Seed and Series A to fuel Lindon, York, and Jason’s vision to power the future of the physical economy.” Share this:

LG Technology Ventures Investments

103 Investments

LG Technology Ventures has made 103 investments. Their latest investment was in Figure as part of their Series C on September 16, 2025.

LG Technology Ventures Investments Activity

Date | Round | Company | Amount | New? | Co-Investors | Sources |

|---|---|---|---|---|---|---|

9/16/2025 | Series C | Figure | $1,000M | Yes | Align Ventures, Brookfield Asset Management, Intel Capital, Macquarie Capital, NVIDIA, Parkway VC, Qualcomm Ventures, Salesforce, T-Mobile Ventures, and Tamarack Global | 4 |

9/15/2025 | Series A | DYNA | $120M | Yes | Amazon Industrial Innovation Fund, Charles River Ventures, First Round Capital, NVentures, RoboStrategy, Salesforce Ventures, Samsung NEXT, and Undisclosed Investors | 5 |

8/3/2025 | Series B | Strand Therapeutics | $153M | Yes | Alderline Group, Amgen Ventures, ANRI, Eli Lilly and Company, FPV Ventures, Gradiant, ICONIQ Capital, JIC Venture Growth Investments, Kinnevik, Playground Global, Potentum Partners, and Regeneron Ventures | 4 |

5/21/2025 | Series D | |||||

3/18/2025 | Series B |

Date | 9/16/2025 | 9/15/2025 | 8/3/2025 | 5/21/2025 | 3/18/2025 |

|---|---|---|---|---|---|

Round | Series C | Series A | Series B | Series D | Series B |

Company | Figure | DYNA | Strand Therapeutics | ||

Amount | $1,000M | $120M | $153M | ||

New? | Yes | Yes | Yes | ||

Co-Investors | Align Ventures, Brookfield Asset Management, Intel Capital, Macquarie Capital, NVIDIA, Parkway VC, Qualcomm Ventures, Salesforce, T-Mobile Ventures, and Tamarack Global | Amazon Industrial Innovation Fund, Charles River Ventures, First Round Capital, NVentures, RoboStrategy, Salesforce Ventures, Samsung NEXT, and Undisclosed Investors | Alderline Group, Amgen Ventures, ANRI, Eli Lilly and Company, FPV Ventures, Gradiant, ICONIQ Capital, JIC Venture Growth Investments, Kinnevik, Playground Global, Potentum Partners, and Regeneron Ventures | ||

Sources | 4 | 5 | 4 |

LG Technology Ventures Portfolio Exits

12 Portfolio Exits

LG Technology Ventures has 12 portfolio exits. Their latest portfolio exit was Humane on February 18, 2025.

Date | Exit | Companies | Valuation Valuations are submitted by companies, mined from state filings or news, provided by VentureSource, or based on a comparables valuation model. | Acquirer | Sources |

|---|---|---|---|---|---|

2/18/2025 | Acquired | 6 | |||

2/13/2025 | IPO | Public | 4 | ||

1/24/2025 | Corporate Majority | 7 | |||

Date | 2/18/2025 | 2/13/2025 | 1/24/2025 | ||

|---|---|---|---|---|---|

Exit | Acquired | IPO | Corporate Majority | ||

Companies | |||||

Valuation | |||||

Acquirer | Public | ||||

Sources | 6 | 4 | 7 |

LG Technology Ventures Fund History

3 Fund Histories

LG Technology Ventures has 3 funds, including LG Technology Ventures II.

Closing Date | Fund | Fund Type | Status | Amount | Sources |

|---|---|---|---|---|---|

8/3/2023 | LG Technology Ventures II | $192M | 1 | ||

6/4/2018 | LG Technology Ventures | ||||

Energy Transition Fund |

Closing Date | 8/3/2023 | 6/4/2018 | |

|---|---|---|---|

Fund | LG Technology Ventures II | LG Technology Ventures | Energy Transition Fund |

Fund Type | |||

Status | |||

Amount | $192M | ||

Sources | 1 |

LG Technology Ventures Service Providers

1 Service Provider

LG Technology Ventures has 1 service provider relationship

Service Provider | Associated Rounds | Provider Type | Service Type |

|---|---|---|---|

Counsel | General Counsel |

Service Provider | |

|---|---|

Associated Rounds | |

Provider Type | Counsel |

Service Type | General Counsel |

Partnership data by VentureSource

Loading...