Melio

Founded Year

2018Stage

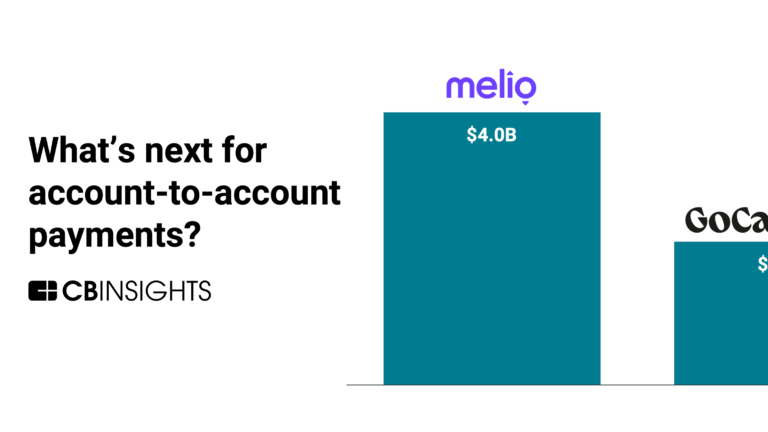

Acquired | AcquiredTotal Raised

$654MValuation

$0000Revenue

$0000About Melio

Melio develops accounts payable solutions. The company offers services that allow businesses to pay bills, send invoices, and receive payments online, as well as make international payments and automate their bill payment process. Its accountant dashboard enables integrations, team management, easy bill capture, and more. It primarily serves the business-to-business (B2B) payments in logistics, healthcare, construction, non-profit, and retail industries. It was founded in 2018 and is based in New York, New York. In June 2025, Melio was acquired by Xero at a valuation between $2.5B and $3B.

Loading...

Melio's Products & Differentiators

Accounts Payable

Melio offers advanced payment methods at different delivery speeds—instant payments, same-day bank transfers, and fast checks. Businesses, and their accountants, can pay vendors via ACH bank transfers or credit cards and vendors can receive a check or bank transfer. Businesses can improve their payment process and save hours each month with capabilities like approval workflows, recurring payments, and combined payments. Melio can automatically sync to accounting software and provides AI-powered bill capture so that bills, vendors, and payments are up-to-date on both their accounting software and Melio.

Loading...

Research containing Melio

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Melio in 8 CB Insights research briefs, most recently on Jul 17, 2025.

Jul 17, 2025 report

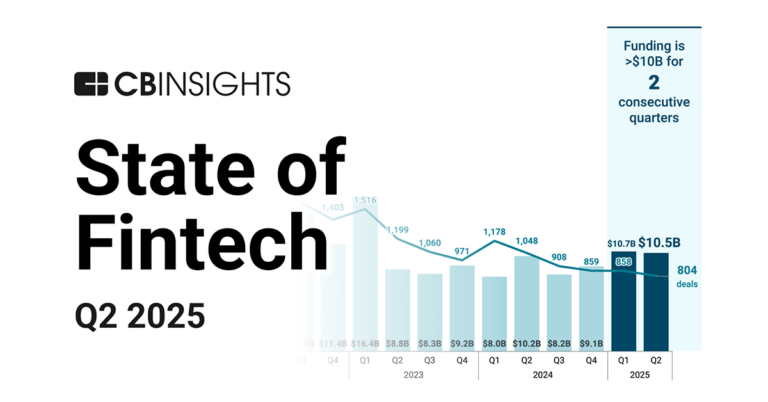

State of Fintech Q2’25 Report

Jun 6, 2025

The SMB fintech market map

Jan 14, 2025 report

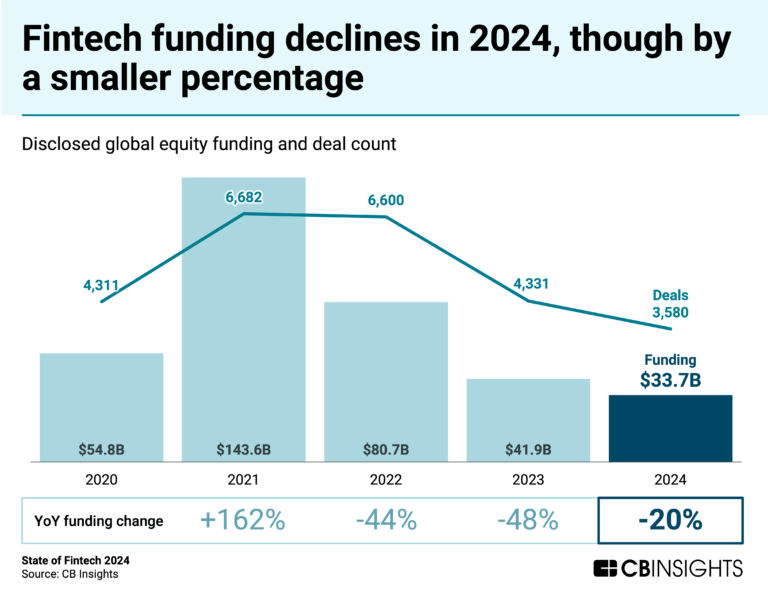

State of Fintech 2024 Report

Dec 14, 2023

Cross-border payments market mapExpert Collections containing Melio

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Melio is included in 7 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,286 items

SMB Fintech

1,648 items

Payments

3,199 items

Companies in this collection provide technology that enables consumers and businesses to pay, collect, automate, and settle transfers of currency, both online and at the physical point-of-sale.

Fintech

9,685 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Fintech 100

499 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Silicon Valley Bank's Fintech Network

88 items

We mapped out some of SVB's biggest clients, partnerships, and sectors that it serves using CB Insights’ business relationship data from SVB’s profile to uncover just how important it is to the fintech universe. The list is not exhaustive.

Melio Patents

Melio has filed 5 patents.

The 3 most popular patent topics include:

- antibiotics

- biotechnology

- lactobacillales

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

9/8/2023 | 12/17/2024 | Molecular biology, Yeasts, Antibiotics, Biotechnology, Lactobacillales | Grant |

Application Date | 9/8/2023 |

|---|---|

Grant Date | 12/17/2024 |

Title | |

Related Topics | Molecular biology, Yeasts, Antibiotics, Biotechnology, Lactobacillales |

Status | Grant |

Latest Melio News

Sep 5, 2025

Providing a comprehensive accounts payable solution with streamlined cash flow management, enhanced bill pay capabilities with industry-leading flexible payment options, and the ability to easily sync with accounting software, it’s all seamlessly integrated into the U.S. Bank online banking platform. The accounts payable solution, called U.S. Bank bill pay for business, is now available for new users with any U.S. Bank business checking account, providing a one-stop hub where small business owners can manage their finances in less time with more confidence. As small business owners juggle multiple digital solutions to manage their operations, research shows that nearly three-quarters feel cash flow management and invoice/bill payment are ongoing pain points for their business.* Additionally, nine in 10 (88%) owners say the ability to centralize all bills/invoices into a single process is important.** U.S. Bank is responding to this need with bill pay for business, which enables business owners to: Use a single solution to manage payments and maintain records all in one place – within the existing business banking dashboard Make payments flexibly with the ability to set up recurring payments and make partial or multiple payments at once Streamline workflow by automating vendor invoices, auto-creating bills, and creating and managing payment approval workflows Seamlessly sync bills, vendors, and expenses with select accounting software Gain better visibility into cash flow with real-time updates on available funds and payments status Receive notifications to help avoid missing a payment due date or confirm a payment was received Manage finances anytime, anywhere with mobile-friendly tools in addition to desktop Have peace of mind with multistep fraud detection and secure transactions “With U.S. Bank bill pay, small business owners have access to an all-in-one cash flow management solution that works as hard as they do,” said Shruti Patel, Chief Product Officer, Business Banking, at U.S. Bank. “This is our latest offering that brings together interconnected capabilities from across the bank in a seamless experience for our clients. Business owners can simplify and automate their accounts payable workflow, integrated with their checking account, so they can manage their finances with confidence and reduced anxiety – making it easier to run their business.” U.S. Bank collaborated with two fintechs to bring this solution to life, integrating Fiserv’s CashFlow Central℠ solution, built in partnership with Melio, within the U.S. Bank online banking platform. “Fiserv is proud to partner with U.S. Bank to provide this essential payments capability to its small business community, empowering them to operate their businesses more efficiently with less complexity,” said Matt Wilcox, Deputy Head, Financial Solutions and President of Digital Payments at Fiserv. “CashFlow Central is an end-to-end solution that helps power the bank’s central hub for all payment and banking needs, deepening their relationships with their valued small business customers.” U.S. Bank serves more than 1.4 million small business clients with a comprehensive and integrated suite of banking, payments and digital solutions backed by support from experienced bankers. The bank offers a wide range of deposit accounts; merchant services products, including Elavon point of sale systems; loan products; credit cards; and treasury management services. *CashFlow Central Research Report – 2024; Fiserv Primary Research **The Small Business Perspective: Leading Through Change, Shaping a Legacy – 2025; U.S. Bank

Melio Frequently Asked Questions (FAQ)

When was Melio founded?

Melio was founded in 2018.

Where is Melio's headquarters?

Melio's headquarters is located at 124 East 14th Street, New York.

What is Melio's latest funding round?

Melio's latest funding round is Acquired.

How much did Melio raise?

Melio raised a total of $654M.

Who are the investors of Melio?

Investors of Melio include Xero, Accel, Bessemer Venture Partners, Coatue, General Catalyst and 23 more.

Who are Melio's competitors?

Competitors of Melio include Conduit, Autobooks, SumUp, Airwallex, Alternative Payments and 7 more.

What products does Melio offer?

Melio's products include Accounts Payable and 2 more.

Loading...

Compare Melio to Competitors

Paystand is a company that operates within the financial services sector and focuses on B2B payments through a platform built on blockchain technology. The company provides accounts receivable automation, digital payment processing, and integration with ERP systems, which facilitate business transactions. Paystand serves sectors such as healthcare, manufacturing, construction, supply chain, solar energies, retail, and wholesale. It was founded in 2013 and is based in Scotts Valley, California.

Routable is a financial technology company that specializes in accounts payable automation for businesses. The company offers a platform that streamlines invoice processing, vendor payments, and compliance management, while also providing tools for customizable approval workflows, payment reconciliation, and vendor onboarding. Routable's solutions cater to various sectors, including marketplaces, gig economy, insurance, real estate, logistics, manufacturing, and nonprofit organizations. It was founded in 2017 and is based in San Francisco, California.

Tipalti is a finance automation company that focuses on accounts payable and payment management workflows. The company provides solutions for accounts payable automation, mass payments, procurement, and expense management. Tipalti serves sectors including advertising technology, business services, e-commerce, education, financial services, healthcare, gaming, manufacturing, media, non-profits, software, technology, and travel. It was founded in 2010 and is based in Foster City, California.

Billtrust provides accounts receivable automation and order-to-cash solutions within the financial services sector. The company offers services that improve the invoicing process, support multi-channel payments, and allow matching and posting for business-to-business transactions. Billtrust's solutions serve various industries, improving cash application and electronic handling of invoices and payments. It was founded in 2001 and is based in Hamilton, New Jersey.

Balance specializes in business-to-business (B2B) payments and financial technology, offering products for the business transaction lifecycle. The company's offerings include solutions for B2B payments, digital trade credit, accounts receivable management, and marketplace operating systems, aimed at supporting transactions for businesses. Balance primarily serves sectors such as distributors, platforms, and marketplaces within the B2B supply chain. It was founded in 2020 and is based in New York, New York.

CHERRY is a B2B payment processing solution that specializes in integrating accounting software with bank payment platforms. The company offers a plugin that automates payments, streamlines approvals, and facilitates reconciliation, thereby reducing manual processes for businesses. CHERRY primarily serves businesses looking to enhance their accounting and financial workflows through automation. It was founded in 2018 and is based in Brooklyn, New York.

Loading...