ZestyAI

Founded Year

2015Stage

Line of Credit | AliveTotal Raised

$76.97MLast Raised

$15M | 3 mos agoRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+15 points in the past 30 days

About ZestyAI

ZestyAI provides AI-powered risk assessment solutions for the property and casualty insurance industry. The company offers peril-specific risk models for natural disasters and environmental hazards, along with property insights to assist in underwriting and pricing decisions. ZestyAI's services are used by the insurance sector for risk management and decision-making. ZestyAI was formerly known as PowerScout. It was founded in 2015 and is based in San Francisco, California.

Loading...

ESPs containing ZestyAI

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The flood intelligence market provides solutions to mitigate flood losses caused by climate change and increase global insurance coverage for flood disasters. The market offers historical data and near-real-time monitoring to underwrite parametric flood policies and insure more of the world against flooding. Companies in this market leverage satellite imagery, AI, and machine learning to deliver a…

ZestyAI named as Challenger among 14 other companies, including Moody's, Verisk, and Guidewire.

ZestyAI's Products & Differentiators

Z-FIRE™

Z-FIRE is an AI-powered wildfire risk model that evaluates structure- and neighborhood-level risk across the contiguous U.S. It generates two scores: L1 predicts the likelihood a property will fall within a wildfire perimeter; L2 estimates the chance of structural damage if it does. Built on 20+ years of claims data from 1,500+ wildfires, it uses Gradient Boosted Trees trained on 200B+ datapoints, including aerial imagery, vegetation within 0–30 ft zones, roof material, slope, topography, spacing, and local climatology. Scores update multiple times per year and are available via API, batch (Z-PORTFOLIO), or web (Z-VIEW).

Loading...

Research containing ZestyAI

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned ZestyAI in 6 CB Insights research briefs, most recently on Feb 13, 2025.

Feb 13, 2025

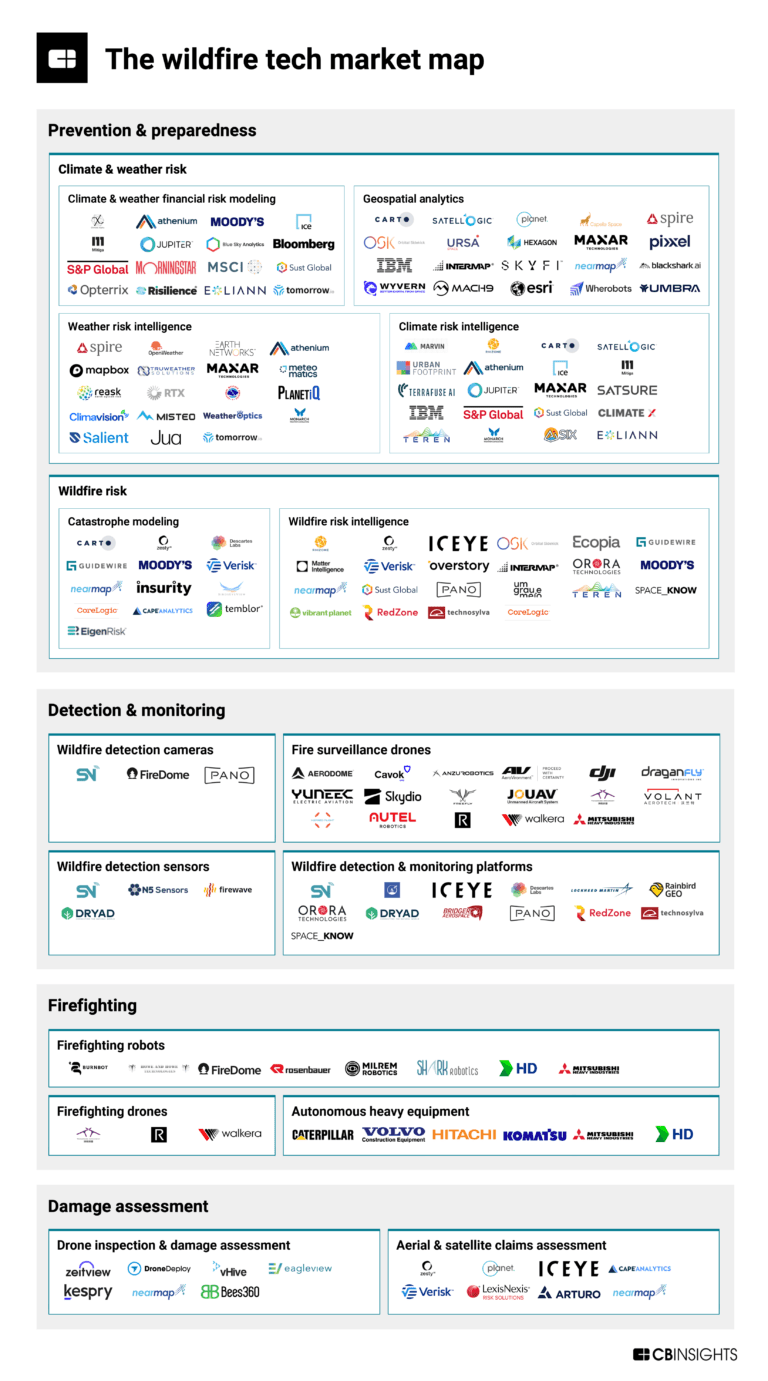

The wildfire tech market map

Mar 1, 2024

The satellite & geospatial tech market map

Nov 3, 2022

3 insurance trends to watch in Q4’22Expert Collections containing ZestyAI

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

ZestyAI is included in 8 Expert Collections, including Real Estate Tech.

Real Estate Tech

2,494 items

Startups in the space cover the residential and commercial real estate space. Categories include buying, selling and investing in real estate (iBuyers, marketplaces, investment/crowdfunding platforms), and property management, insurance, mortgage, construction, and more.

Insurtech

4,594 items

Companies and startups that use technology to improve core and ancillary insurance operations. Companies in this collection are creating new product architectures, improving underwriting models, accelerating claims and creating a better customer experience

Fintech

9,685 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Decarbonization Tech

2,372 items

Companies in the Decarbonization & ESG space, including those working on enterprise and cross-industry decarbonization and emissions monitoring solutions, as well as ESG monitoring and carbon accounting.

Aerospace & Space Tech

4,018 items

These companies provide a variety of solutions, ranging from industrial drones to electrical vertical takeoff vehicles, space launch systems to satellites, and everything in between

Insurtech 50

50 items

ZestyAI Patents

ZestyAI has filed 5 patents.

The 3 most popular patent topics include:

- radar meteorology

- severe weather and convection

- storm

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

9/9/2016 | Energy storage, Battery electric vehicle manufacturers, Renewable energy, Photovoltaics, Wind turbine manufacturers | Application |

Application Date | 9/9/2016 |

|---|---|

Grant Date | |

Title | |

Related Topics | Energy storage, Battery electric vehicle manufacturers, Renewable energy, Photovoltaics, Wind turbine manufacturers |

Status | Application |

Latest ZestyAI News

Aug 28, 2025

The move is set to enhance the precision of storm risk evaluation across states prone to weather-related damages. August 28, 2025 The latest move follows Steadily’s initial rollout in 2024. Credit: Triff/Shutterstock.com. Rental property insurer Steadily has expanded its collaboration with analytics company ZestyAI, aiming to refine its underwriting process by incorporating hail and wind risk models. The move is designed to enhance the precision of storm risk evaluation across various states that are prone to such weather-related damages. Go deeper with GlobalData This follows the insurer’s initial rollout in 2024. The insurer initially applied ZestyAI’s Z-HAIL and Z-WIND models in a select number of states with incidence of severe convective storms. In the coming months, it plans to expand the rollout to more states. ZestyAI models predict storm-related claims by examining the interaction between local weather patterns and specific property features. ZestyAI’s models, which have received regulatory approval in 19 states, enable a detailed assessment of storm risk at an individual property level. GlobalData Strategic Intelligence US Tariffs are shifting - will you react or anticipate? Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis. By GlobalData Factors such as the condition of the roof, the complexity of the building structure, past loss history and exposure to local storms are all considered to determine the potential risk. Steadily co-founder & COO Datha Santomieri stated: “Expanding our use of ZestyAI’s hail and wind models reaffirms our commitment to precision and efficiency in landlord underwriting. These insights help us make informed decisions quickly and manage exposure with greater confidence.” ZestyAI founder and CEO Attila Toth said: “Steadily is modernising a critical segment of the market with their customer-centric, tech-forward approach. We are proud to support their growth with AI-driven insights that enable better pricing, smarter underwriting and more resilient portfolios.” In June, Kin Insurance integrated ZestyAI’s wildfire risk assessment model, Z-FIRE, to evaluate property-level wildfire exposure in California. Sign up for our daily news round-up! Give your business an edge with our leading industry insights.

ZestyAI Frequently Asked Questions (FAQ)

When was ZestyAI founded?

ZestyAI was founded in 2015.

Where is ZestyAI's headquarters?

ZestyAI's headquarters is located at 548 Market Street, San Francisco.

What is ZestyAI's latest funding round?

ZestyAI's latest funding round is Line of Credit.

How much did ZestyAI raise?

ZestyAI raised a total of $76.97M.

Who are the investors of ZestyAI?

Investors of ZestyAI include CIBC Innovation Banking, Brex, Centana Growth Partners, Paycheck Protection Program, Zurich Insurance Group and 7 more.

Who are ZestyAI's competitors?

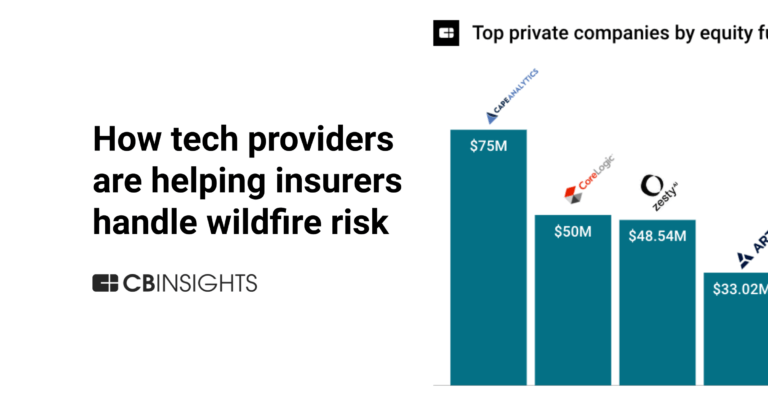

Competitors of ZestyAI include Acclym, ICEYE, Pinpoint Predictive, DONNA.ai, Cape Analytics and 7 more.

What products does ZestyAI offer?

ZestyAI's products include Z-FIRE™ and 4 more.

Loading...

Compare ZestyAI to Competitors

Arturo specializes in property intelligence and offers solutions in the insurance sector. The company provides an artificial intelligence-based platform that facilitates insurance underwriting, risk management, and claims processing by leveraging data analytics and computer vision models. Arturo primarily serves the insurance industry, enhancing decision-making processes for insurers. Arturo was formerly known as Deep Image Analytics. It was founded in 2018 and is based in Denver, Colorado.

Atidot provides AI and predictive analytics solutions for the life insurance sector. The company offers a cloud-based platform that combines internal data with external sources to support decision-making for insurers. Atidot's technology is utilized by various stakeholders in the life insurance industry, including executives, marketing teams, policy distributors, and actuaries, focusing on improving profitability, lead generation, policy accuracy, and risk analysis. It was founded in 2016 and is based in Palo Alto, California.

GeoX specializes in property intelligence and focuses on the real estate and insurance sectors. The company offers instant access to 3D property data and analytics, powered by artificial intelligence and aerial imagery, to provide detailed insights into commercial and residential properties across the United States. GeoX primarily serves the insurance industry with data-driven solutions for claims processing and underwriting. It was founded in 2018 and is based in Givatayim, Israel.

Cotality provides property data analytics and market insights within the real estate, insurance, and finance sectors. It offers products, including property valuation systems, insurance claims estimation tools, and mortgage verification workflows. It serves sectors such as mortgage, banking and finance, property insurance, residential real estate, and government agencies with its data-driven solutions. It was formerly known as CoreLogic. It is based in Irvine, California.

SpaceKnow focuses on satellite data analysis and AI-driven insights in the defense, intelligence, construction, and environmental sectors. The company provides a platform that integrates data from different satellite providers and uses AI algorithms to extract information, along with monitoring and early warning systems. SpaceKnow serves sectors that require surveillance and construction progress monitoring. It was founded in 2013 and is based in San Francisco, California.

Akur8 provides pricing and reserving platforms for the insurance industry. The company offers a suite of software solutions that utilize machine learning and predictive analytics for actuarial pricing and reserving processes. Akur8's platforms aim to support insurance pricing and reserving for personal and commercial lines insurers, managing general agents, insurers, and health insurers. It was founded in 2019 and is based in Paris, France.

Loading...