Investments

73Portfolio Exits

4Funds

1About Prosperity7 Ventures

Prosperity7 Ventures is a venture capital firm focused on supporting the development of next-generation technologies and business models across various sectors. The company invests globally in startups, providing them with funding and connections to scale quickly, enter new and emerging markets, and attain global reach. It primarily serves sectors such as medtech, fintech, B2B SaaS, and others. It was founded in 2019 and is based in Dhahran, Saudi Arabia. Prosperity7 Ventures is the venture capital fund of Saudi Arabian company Aramco.

Research containing Prosperity7 Ventures

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Prosperity7 Ventures in 1 CB Insights research brief, most recently on Apr 29, 2025.

Apr 29, 2025 report

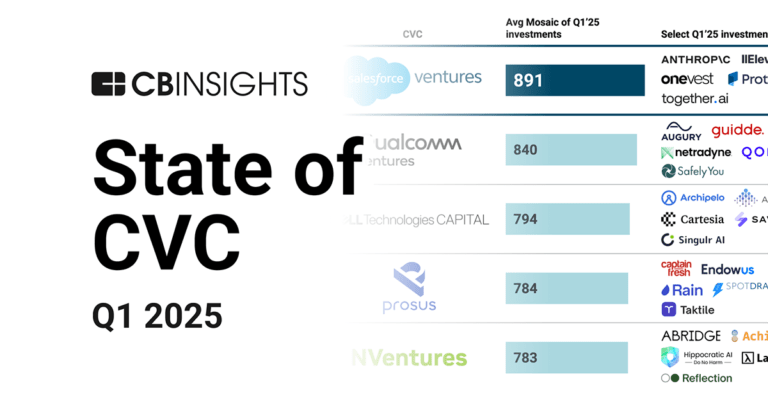

State of CVC Q1’25 ReportLatest Prosperity7 Ventures News

May 19, 2025

TensorWave, an emerging leader in AMD-powered AI infrastructure solutions, announced it has raised $100 million in Series A funding. Magnetar and AMD Ventures led the round, with continued support from Maverick Silicon, Nexus Venture Partners, and new investor Prosperity7. This funding round builds on the company’s earlier SAFE round and positions TensorWave to capitalize on the growing demand for next-gen AI compute infrastructure. The investment also aligns with TensorWave’s deployment of over 8,000 AMD Instinct MI325X GPUs for a dedicated training cluster, establishing the company as a key player in the AI infrastructure ecosystem. And TensorWave is on track to close the year with a revenue run rate exceeding $100 million — a 20 times year-over-year increase. What the funding will be used for: The new funding will fuel TensorWave’s operational growth, team expansion, and the accelerated deployment of its Instinct MI325X-powered training cluster. This growth comes at a pivotal moment, as demand for AI computing resources continues to outstrip supply and organizations seek alternatives to limited infrastructure options. KEY QUOTES: “This $100 million funding propels TensorWave’s mission to democratize access to cutting-edge AI compute. Our 8,192 Instinct MI325X GPU cluster marks just the beginning as we establish ourselves as the emerging AMD-powered leader in the rapidly expanding AI infrastructure market.” Darrick Horton, CEO of TensorWave “The $100 million we’ve secured will transform how enterprises access AI computing resources. Through careful cultivation of strategic partnerships and investor relationships, we’ve positioned TensorWave to solve the critical infrastructure bottleneck facing AI adoption. Our Instinct MI325X cluster deployment isn’t just about adding capacity, it’s about creating an entirely new category of enterprise-ready AI infrastructure that delivers both the memory headroom and performance reliability that next-generation models demand.” Piotr Tomasik, President of TensorWave “Our focus is to continue to expand the ecosystem and support developers with the tools, infrastructure, and performance they need to create, scale, and ship production-ready AI.” Jeff Tatarchuk, TensorWave’s Chief Growth Officer “TensorWave is a key player in the growing AMD AI ecosystem. Their expanding portfolio of AI and enterprise customers coupled with their expertise in deploying AMD compute infrastructure is driving demand for access to their cutting-edge AI compute services. We’re excited to support their next phase of growth.” Mathew Hein, SVP Chief Strategy Officer & Corporate Development, AMD “We continue to be highly impressed by what the TensorWave team has built in just a short period of time. TensorWave is not just bringing more compute but rather an entirely new class of compute to a capacity-constrained market. We think this will be highly beneficial to the AI infrastructure ecosystem writ large, and we’re thrilled to continue our support of the company.” Kenneth Safar, Managing Director at Maverick Silicon Pulse 2.0 focuses on business news, profiles, and deal flow coverage.

Prosperity7 Ventures Investments

73 Investments

Prosperity7 Ventures has made 73 investments. Their latest investment was in SAFE as part of their Series C on July 31, 2025.

Prosperity7 Ventures Investments Activity

Date | Round | Company | Amount | New? | Co-Investors | Sources |

|---|---|---|---|---|---|---|

7/31/2025 | Series C | SAFE | $70M | Yes | Avataar Venture Partners, Eight Roads Ventures, John Chambers, NextEquity, SIG Venture Capital, Sorenson Capital, and Undisclosed Investors | 6 |

7/21/2025 | Seed VC - V | Spirit AI | No | China Internet Investment Fund, Eminence Ventures, Fibonacci VC, Fosun RZ Capital, HighLight Capital, Huafa Group, Huatai Zijin Investment, JD.com, Shunwei Capital, T-Capital, Undisclosed Investors, and Zhejiang Science and Technology Innovation Fund | 2 | |

5/29/2025 | Series D | Snorkel AI | $100M | No | 7 | |

5/14/2025 | Series A | |||||

5/14/2025 | Series B |

Date | 7/31/2025 | 7/21/2025 | 5/29/2025 | 5/14/2025 | 5/14/2025 |

|---|---|---|---|---|---|

Round | Series C | Seed VC - V | Series D | Series A | Series B |

Company | SAFE | Spirit AI | Snorkel AI | ||

Amount | $70M | $100M | |||

New? | Yes | No | No | ||

Co-Investors | Avataar Venture Partners, Eight Roads Ventures, John Chambers, NextEquity, SIG Venture Capital, Sorenson Capital, and Undisclosed Investors | China Internet Investment Fund, Eminence Ventures, Fibonacci VC, Fosun RZ Capital, HighLight Capital, Huafa Group, Huatai Zijin Investment, JD.com, Shunwei Capital, T-Capital, Undisclosed Investors, and Zhejiang Science and Technology Innovation Fund | |||

Sources | 6 | 2 | 7 |

Prosperity7 Ventures Portfolio Exits

4 Portfolio Exits

Prosperity7 Ventures has 4 portfolio exits. Their latest portfolio exit was SingleStore on September 10, 2025.

Date | Exit | Companies | Valuation Valuations are submitted by companies, mined from state filings or news, provided by VentureSource, or based on a comparables valuation model. | Acquirer | Sources |

|---|---|---|---|---|---|

9/10/2025 | Management Buyout | 2 | |||

Date | 9/10/2025 | |||

|---|---|---|---|---|

Exit | Management Buyout | |||

Companies | ||||

Valuation | ||||

Acquirer | ||||

Sources | 2 |

Prosperity7 Ventures Fund History

1 Fund History

Prosperity7 Ventures has 1 fund, including Prosperity7 Ventures Fund I.

Closing Date | Fund | Fund Type | Status | Amount | Sources |

|---|---|---|---|---|---|

Prosperity7 Ventures Fund I | $3,000M | 2 |

Closing Date | |

|---|---|

Fund | Prosperity7 Ventures Fund I |

Fund Type | |

Status | |

Amount | $3,000M |

Sources | 2 |

Prosperity7 Ventures Team

2 Team Members

Prosperity7 Ventures has 2 team members, including current Managing Director, Abhishek Shukla.

Name | Work History | Title | Status |

|---|---|---|---|

Abhishek Shukla | Managing Director | Current | |

Name | Abhishek Shukla | |

|---|---|---|

Work History | ||

Title | Managing Director | |

Status | Current |

Loading...