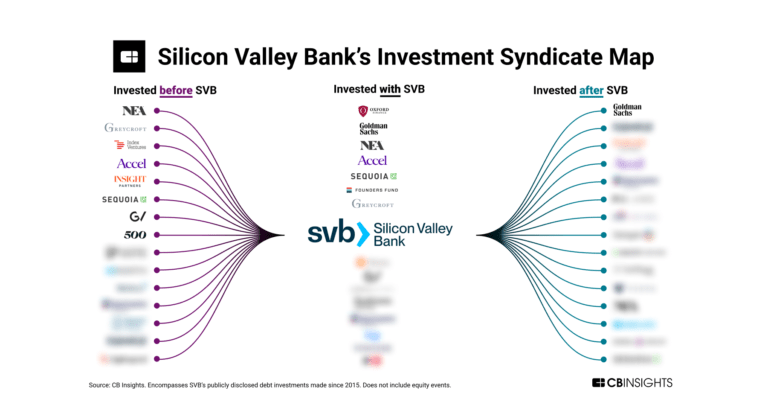

Investments

886Portfolio Exits

358Funds

5Partners & Customers

10Service Providers

2About SVB Financial Group

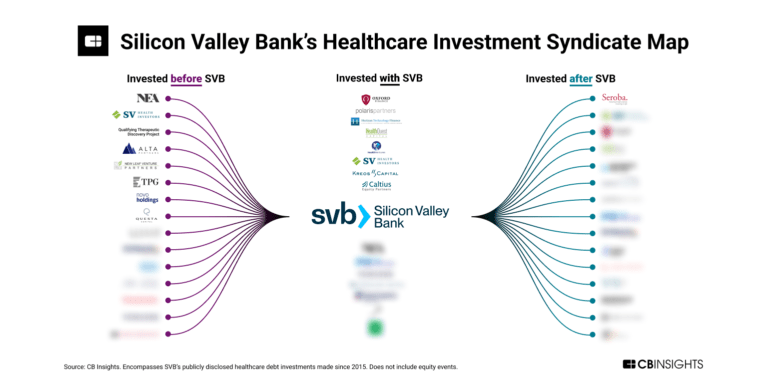

SVB Financial Group is a financial institution that serves the innovation economy, providing services for technology, life sciences, and venture capital sectors. The company offers banking solutions including startup banking, venture capital and private equity fund banking, and corporate banking for growth companies. SVB Financial Group also provides insights and research to support decision-making for businesses and investors within the innovation ecosystem. It was founded in 1983 and is based in Santa Clara, California. In March 2023 SVB Financial Group filed for bankruptcy.

Expert Collections containing SVB Financial Group

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Find SVB Financial Group in 1 Expert Collection, including Synthetic Biology.

Synthetic Biology

382 items

Research containing SVB Financial Group

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned SVB Financial Group in 7 CB Insights research briefs, most recently on May 15, 2023.

Latest SVB Financial Group News

Dec 16, 2024

News provided by Share this article Share toX RALEIGH, N.C., Dec. 16, 2024 /PRNewswire/ -- Matt Snow has been appointed to the board of directors of First Citizens BancShares, Inc. ("BancShares") and its subsidiary, First-Citizens Bank & Trust Company ("First Citizens Bank"), effective Jan. 2, 2025. Matt Snow has been appointed to the board of directors of First Citizens BancShares, Inc. and its subsidiary, First-Citizens Bank & Trust Company, effective Jan. 2, 2025. For the past two years, Snow has served as chairman of the governing board of Forvis Mazars, LLP ("Forvis Mazars") in the United States, a top 10 U.S. accounting firm that provides assurance, tax and consulting services. He also has served as the vice chairman of the governing board of Forvis Mazars Global, Ltd., a global network of accounting firms, since June 2024. Snow is expected to retire from Forvis Mazars and the related board positions in May 2025. "I am pleased to welcome Matt to our board of directors," said Frank B. Holding Jr., chairman and CEO of First Citizens Bank. "In his more than 30-year career, Matt has led and worked with clients ranging from start-up organizations to large national and global organizations. His considerable experience leading a top accounting firm as well as audits of a wide range of client businesses will provide invaluable insight to our Board." Prior to his role as chairman of Forvis Mazars, Snow was a partner and served as Chief Executive Officer of Dixon Hughes Goodman LLP ("DHG"), one of Forvis Mazars' predecessors, from June 2014 to May 2022. Before Forvis Mazars and DHG, Snow served as an audit partner at KPMG, where he spent more than 20 years working with public companies in the financial services, manufacturing and restaurant industries. While at KPMG, he served a rotation in the national department of professional practice and was later named an SEC partner through which he served in a technical review role on public company audit engagements. Snow previously served as the chairman of the Audit and Finance Committee of the board of directors of the American Institute of CPAs (the "AICPA") and as the chairman of the AICPA's Major Firms Group. He also previously served on the board of visitors for the Wake Forest University School of Business and as the chairman of the Finance Committee of the United Way of Central Carolinas' board of directors. A graduate of Wake Forest University, with a bachelor's degree in accounting, Snow has also completed Harvard University's Executive Education Program, "Leading Professional Services Firms." Snow will serve on the joint audit committee of BancShares and First Citizens Bank as well as First Citizens Bank's trust committee. ABOUT FIRST CITIZENS BANCSHARES First Citizens BancShares, Inc. (Nasdaq: FCNCA ), a top 20 U.S. financial institution with more than $200 billion in assets and a member of the Fortune 500TM, is the financial holding company for First Citizens Bank. Headquartered in Raleigh, N.C., First Citizens Bank has built a unique legacy of strength, stability and long-term thinking that has spanned generations. First Citizens offers an array of general banking services including a network of more than 500 branches and offices in 30 states; commercial banking expertise delivering best-in-class lending, leasing and other financial services coast to coast; innovation banking serving businesses at every stage; personalized service and resources to help grow and manage wealth; and a nationwide direct bank. Discover more at firstcitizens.com. Contact:

SVB Financial Group Investments

886 Investments

SVB Financial Group has made 886 investments. Their latest investment was in BILT as part of their Series B on December 16, 2024.

SVB Financial Group Investments Activity

Date | Round | Company | Amount | New? | Co-Investors | Sources |

|---|---|---|---|---|---|---|

12/16/2024 | Series B | BILT | $21M | Yes | 2 | |

12/12/2024 | Debt | Legion | $50M | Yes | 2 | |

11/19/2024 | Debt - III | SQUIRE | $35M | Yes | 4 | |

10/31/2024 | Debt | |||||

10/8/2024 | Debt |

Date | 12/16/2024 | 12/12/2024 | 11/19/2024 | 10/31/2024 | 10/8/2024 |

|---|---|---|---|---|---|

Round | Series B | Debt | Debt - III | Debt | Debt |

Company | BILT | Legion | SQUIRE | ||

Amount | $21M | $50M | $35M | ||

New? | Yes | Yes | Yes | ||

Co-Investors | |||||

Sources | 2 | 2 | 4 |

SVB Financial Group Portfolio Exits

358 Portfolio Exits

SVB Financial Group has 358 portfolio exits. Their latest portfolio exit was Mission on December 02, 2024.

Date | Exit | Companies | Valuation Valuations are submitted by companies, mined from state filings or news, provided by VentureSource, or based on a comparables valuation model. | Acquirer | Sources |

|---|---|---|---|---|---|

12/2/2024 | Acquired | 8 | |||

11/1/2024 | Acquired | 4 | |||

10/28/2024 | Acq - Fin | 2 | |||

Date | 12/2/2024 | 11/1/2024 | 10/28/2024 | ||

|---|---|---|---|---|---|

Exit | Acquired | Acquired | Acq - Fin | ||

Companies | |||||

Valuation | |||||

Acquirer | |||||

Sources | 8 | 4 | 2 |

SVB Financial Group Acquisitions

7 Acquisitions

SVB Financial Group acquired 7 companies. Their latest acquisition was MoffettNathanson on December 13, 2021.

Date | Investment Stage | Companies | Valuation Valuations are submitted by companies, mined from state filings or news, provided by VentureSource, or based on a comparables valuation model. | Total Funding | Note | Sources |

|---|---|---|---|---|---|---|

12/13/2021 | Acquired | 16 | ||||

7/1/2021 | ||||||

11/30/2020 | ||||||

11/30/2020 | ||||||

11/13/2018 | Other |

Date | 12/13/2021 | 7/1/2021 | 11/30/2020 | 11/30/2020 | 11/13/2018 |

|---|---|---|---|---|---|

Investment Stage | Other | ||||

Companies | |||||

Valuation | |||||

Total Funding | |||||

Note | Acquired | ||||

Sources | 16 |

SVB Financial Group Fund History

5 Fund Histories

SVB Financial Group has 5 funds, including Strategic Investors Fund X.

Closing Date | Fund | Fund Type | Status | Amount | Sources |

|---|---|---|---|---|---|

12/30/2020 | Strategic Investors Fund X | $1,015M | 4 | ||

7/14/2020 | Latin America Growth Lending Fund | ||||

6/9/2017 | Qualified Investors Fund V | ||||

Qualified Investors Fund VI | |||||

Cap. Partners V |

Closing Date | 12/30/2020 | 7/14/2020 | 6/9/2017 | ||

|---|---|---|---|---|---|

Fund | Strategic Investors Fund X | Latin America Growth Lending Fund | Qualified Investors Fund V | Qualified Investors Fund VI | Cap. Partners V |

Fund Type | |||||

Status | |||||

Amount | $1,015M | ||||

Sources | 4 |

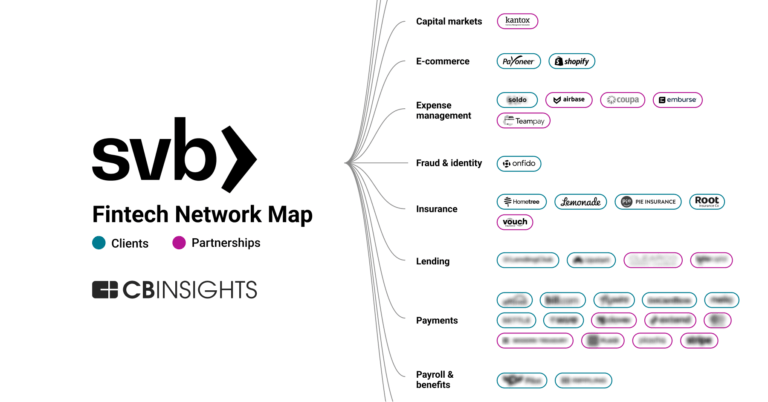

SVB Financial Group Partners & Customers

10 Partners and customers

SVB Financial Group has 10 strategic partners and customers. SVB Financial Group recently partnered with Finexio on March 3, 2023.

Date | Type | Business Partner | Country | News Snippet | Sources |

|---|---|---|---|---|---|

3/14/2023 | Partner | United States | A Note From Finexio CEO on SVB and the Safety of Payables. Finexio can confidently share that we have no exposure nor business relationship with Silicon Valley Bank . | 1 | |

3/13/2023 | Partner | United Kingdom | 1 | ||

3/10/2023 | Vendor | United States | 15:38 ET BioLife Solutions Reports Immaterial Financial Exposure to Silicon Valley Bank BOTHELL , Wash. , March 10 , 2023 / PRNewswire / -- BioLife Solutions , Inc. , a leading supplier of class-defining bioproduction tools and services for the cell and gene therapies and broader biopharma markets , today provided commentary on its current banking relationship with Silicon Valley Bank . | 2 | |

11/11/2022 | Partner | ||||

6/28/2022 | Partner |

Date | 3/14/2023 | 3/13/2023 | 3/10/2023 | 11/11/2022 | 6/28/2022 |

|---|---|---|---|---|---|

Type | Partner | Partner | Vendor | Partner | Partner |

Business Partner | |||||

Country | United States | United Kingdom | United States | ||

News Snippet | A Note From Finexio CEO on SVB and the Safety of Payables. Finexio can confidently share that we have no exposure nor business relationship with Silicon Valley Bank . | 15:38 ET BioLife Solutions Reports Immaterial Financial Exposure to Silicon Valley Bank BOTHELL , Wash. , March 10 , 2023 / PRNewswire / -- BioLife Solutions , Inc. , a leading supplier of class-defining bioproduction tools and services for the cell and gene therapies and broader biopharma markets , today provided commentary on its current banking relationship with Silicon Valley Bank . | |||

Sources | 1 | 1 | 2 |

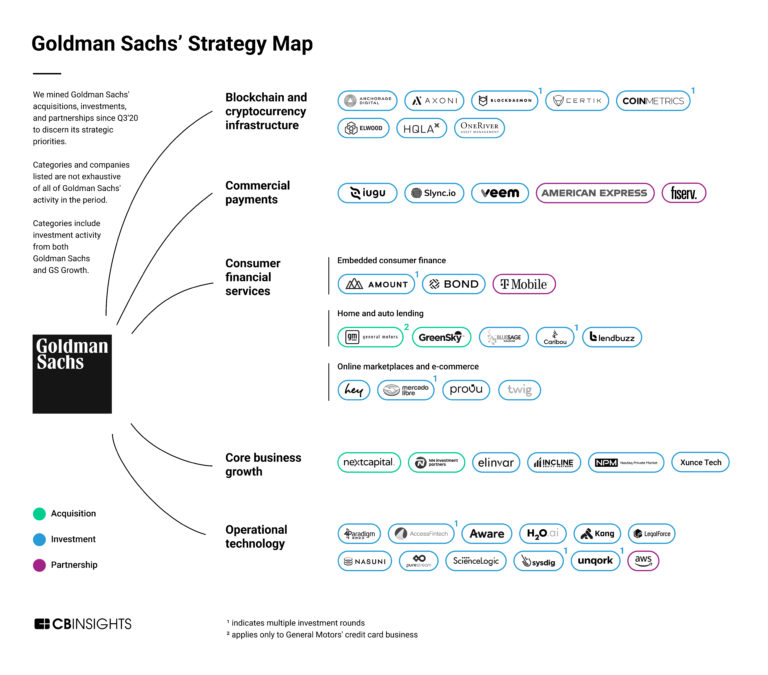

SVB Financial Group Service Providers

2 Service Providers

SVB Financial Group has 2 service provider relationships

Service Provider | Associated Rounds | Provider Type | Service Type |

|---|---|---|---|

Goldman Sachs | Acq - P2P | Investment Bank | Financial Advisor |

Service Provider | Goldman Sachs | |

|---|---|---|

Associated Rounds | Acq - P2P | |

Provider Type | Investment Bank | |

Service Type | Financial Advisor |

Partnership data by VentureSource

Compare SVB Financial Group to Competitors

MidFirst Bank operates as a privately owned financial institution. It offers a broad range of banking services within the banking industry. The company provides personal and commercial banking products, trust and private banking services, as well as mortgage banking solutions. MidFirst Bank caters to both individual customers and businesses, offering tailored financial products and services to meet their diverse needs. It was founded in 1982 and is based in Oklahoma City, Oklahoma.

First United Bank operates as a progressive and innovative community banking organization. The company offers a comprehensive range of financial services including personal and business banking solutions, mortgage lending, and a suite of insurance and investment products. It primarily serves consumers and small-to-mid-sized businesses with its financial products and services. It was founded in 1900 and is based in Durant, Oklahoma.

Cross River provides API-driven financial solutions across various business sectors. The company offers a suite of services, including embedded payments, card issuing, and digital lending for businesses. Cross River serves sectors that require fintech infrastructure, such as digital lenders, merchant acquirers, and neobanks. It was founded in 2008 and is based in Fort Lee, New Jersey. It is a subsidiary of CRB Group, Inc.

Sunrise Bank specializes in providing a comprehensive range of financial services within the banking sector. The company offers personal and business banking solutions, including checking and savings accounts, consumer and business loans, as well as residential mortgages. They also provide specialized accounts such as health savings accounts (HSAs) and individual retirement accounts (IRAs). It was founded in 2005 and is based in Orlando, Florida.

Seattle Bank specializes in providing personalized financial services within the banking sector. The company offers a suite of services including personal and business banking, private banking, digital banking solutions, and specialty mortgage products. It primarily serves individual customers and businesses, offering solutions to meet their financial needs. Seattle Bank was formerly known as Seattle Savings Bank. It was founded in 1944 and is based in Seattle, Washington.

IntraFi provides Federal Deposit Insurance Corporation (FDIC) insured deposit solutions within the financial services industry. The company offers services to manage large cash balances and facilitate deposit placements across its network of banks. IntraFi serves banks, investment firms, fintechs, and depositors. IntraFi was formerly known as Promontory Interfinancial Network. It was founded in 2002 and is based in Arlington, Virginia.

Loading...