Investments

1002Portfolio Exits

346Funds

20Partners & Customers

3About SV Angel

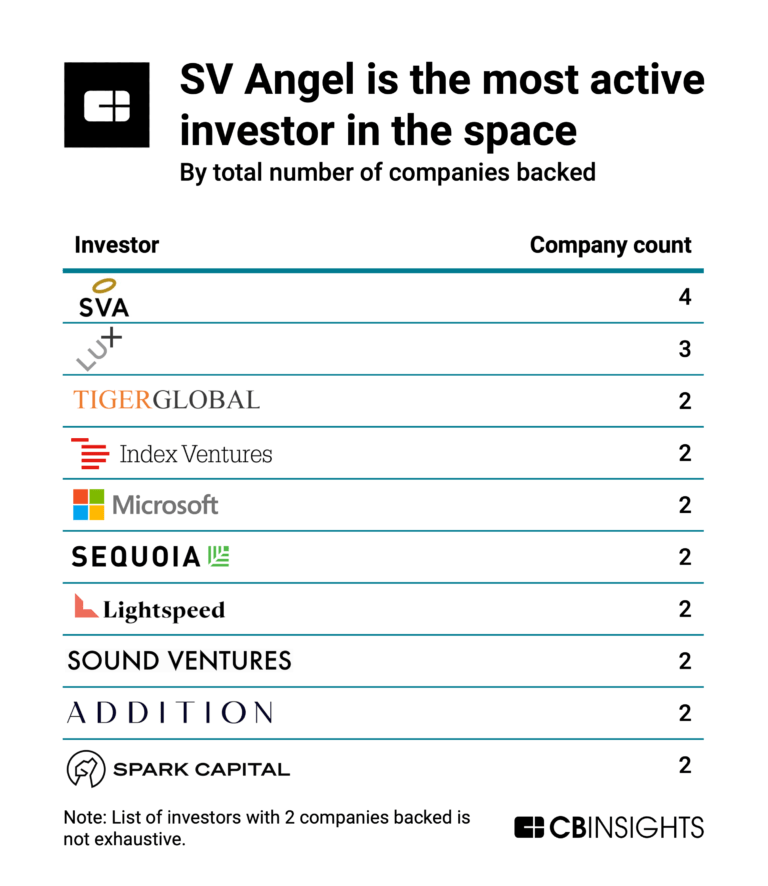

Ron Conway is a Silicon Valley-based angel investor, and founding partner of SV Angel. As founder and Managing Partner of the Angel Investors LP funds, he was an early stage investor in Google, Ask Jeeves and PayPal, which was sold to online auctioneers eBay in July 2002 for $1.5 billion. Conway previously worked with National Semiconductor Corporation in marketing positions (1973 - 1979), Altos Computer Systems, as a co-founder, President and CEO, (1979 - 1990) and Personal Training Systems (PTS) as CEO (1991 - 1995).

Expert Collections containing SV Angel

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Find SV Angel in 3 Expert Collections, including Travel Technology (Travel Tech).

Travel Technology (Travel Tech)

39 items

Tech-enabled companies offering services and products focused on tourism. This collection includes booking services, search platforms, on-demand travel and recommendation sites, among others.

Digital Lending

34 items

This collection contains alternative means for obtaining a loan for personal or business use. Companies included in the application, underwriting, funding, or collection process is included in the collection.

Wellness Tech

31 items

Consumers are increasingly seeking products and experiences that promote well-being and healthy habits, with modern-day “wellness” referring to holistic healthy living characterized by physical, mental, social, and spiritual well-being.This collection includes categories across h

Research containing SV Angel

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned SV Angel in 2 CB Insights research briefs, most recently on Mar 5, 2024.

Mar 5, 2024 report

The top 20 venture investors in North America

Jul 14, 2023

The state of LLM developers in 6 chartsLatest SV Angel News

Feb 19, 2025

Suzuki Motor Corporation (hereinafter, Suzuki) has invested in the fund “SV Angel Growth II”, which is managed by SV Angel, a venture capital based in San Francisco, United States, through Suzuki’s corporate venture capital fund “Suzuki Global Ventures” (hereinafter, “SGV”) Suzuki Motor Corporation (hereinafter, Suzuki) has invested in the fund “SV Angel Growth II”, which is managed by SV Angel, a venture capital based in San Francisco, United States, through Suzuki’s corporate venture capital fund “Suzuki Global Ventures” (hereinafter, “SGV”). SV Angel is a venture capital with a lot of record of investment and has a wide network and portfolio. The SV Angel Growth II, in which SGV invested, focuses mainly on investments into technology and AI start-ups in growing stage. Suzuki launched SGV in 2022 to provide values that customers demand, and we are creating new businesses and business models through co-creation activities with start-ups. Through the investment into SV Angel, SGV will accelerate new business and technology development by meeting new partners and investment targets through SV Angel’s extensive network and building partnerships with a diverse range of startups.

SV Angel Investments

1,002 Investments

SV Angel has made 1,002 investments. Their latest investment was in Vigil Labs as part of their Seed VC on August 20, 2025.

SV Angel Investments Activity

Date | Round | Company | Amount | New? | Co-Investors | Sources |

|---|---|---|---|---|---|---|

8/20/2025 | Seed VC | Vigil Labs | $5.7M | Yes | Cyan Banister, Jack Altman, Kevin Hartz, Lux Capital, Micky Malka, Nova, Pantera Capital, Soma Capital, Undisclosed Angel Investors, and Valor Equity Partners | 1 |

8/18/2025 | Series A | Basic Capital | $25M | Yes | BoxGroup, Forerunner Ventures, Henry Kravis, HOF Capital, Inspired Capital, and Lux Capital | 2 |

8/12/2025 | Seed VC | Mecka AI | $8M | Yes | A* Capital, Cade & Associates, Framework Ventures, Mechanism Capital, Neo, Offline Ventures, Tangent, Timeless Capital, and Undisclosed Investors | 3 |

8/7/2025 | Series A | |||||

7/29/2025 | Seed VC |

Date | 8/20/2025 | 8/18/2025 | 8/12/2025 | 8/7/2025 | 7/29/2025 |

|---|---|---|---|---|---|

Round | Seed VC | Series A | Seed VC | Series A | Seed VC |

Company | Vigil Labs | Basic Capital | Mecka AI | ||

Amount | $5.7M | $25M | $8M | ||

New? | Yes | Yes | Yes | ||

Co-Investors | Cyan Banister, Jack Altman, Kevin Hartz, Lux Capital, Micky Malka, Nova, Pantera Capital, Soma Capital, Undisclosed Angel Investors, and Valor Equity Partners | BoxGroup, Forerunner Ventures, Henry Kravis, HOF Capital, Inspired Capital, and Lux Capital | A* Capital, Cade & Associates, Framework Ventures, Mechanism Capital, Neo, Offline Ventures, Tangent, Timeless Capital, and Undisclosed Investors | ||

Sources | 1 | 2 | 3 |

SV Angel Portfolio Exits

346 Portfolio Exits

SV Angel has 346 portfolio exits. Their latest portfolio exit was SingleStore on September 10, 2025.

Date | Exit | Companies | Valuation Valuations are submitted by companies, mined from state filings or news, provided by VentureSource, or based on a comparables valuation model. | Acquirer | Sources |

|---|---|---|---|---|---|

9/10/2025 | Management Buyout | 2 | |||

9/3/2025 | Acquired | 2 | |||

8/27/2025 | Acquired | 4 | |||

Date | 9/10/2025 | 9/3/2025 | 8/27/2025 | ||

|---|---|---|---|---|---|

Exit | Management Buyout | Acquired | Acquired | ||

Companies | |||||

Valuation | |||||

Acquirer | |||||

Sources | 2 | 2 | 4 |

SV Angel Fund History

20 Fund Histories

SV Angel has 20 funds, including HT Acorn.

Closing Date | Fund | Fund Type | Status | Amount | Sources |

|---|---|---|---|---|---|

12/11/2020 | HT Acorn | $6.5M | 1 | ||

7/27/2020 | HT Raven II | $3.84M | 1 | ||

2/6/2020 | HT Finch | $1.03M | 1 | ||

1/16/2020 | HT Eagle | ||||

5/30/2019 | HT Alpine II |

Closing Date | 12/11/2020 | 7/27/2020 | 2/6/2020 | 1/16/2020 | 5/30/2019 |

|---|---|---|---|---|---|

Fund | HT Acorn | HT Raven II | HT Finch | HT Eagle | HT Alpine II |

Fund Type | |||||

Status | |||||

Amount | $6.5M | $3.84M | $1.03M | ||

Sources | 1 | 1 | 1 |

SV Angel Partners & Customers

3 Partners and customers

SV Angel has 3 strategic partners and customers. SV Angel recently partnered with Capchase on July 7, 2021.

SV Angel Team

4 Team Members

SV Angel has 4 team members, including current Chief Operating Officer, Zachary Miller.

Name | Work History | Title | Status |

|---|---|---|---|

Zachary Miller | Chief Operating Officer | Current | |

Name | Zachary Miller | |||

|---|---|---|---|---|

Work History | ||||

Title | Chief Operating Officer | |||

Status | Current |

Loading...