Xero

Founded Year

2006Stage

PIPE - V | IPOMarket Cap

26.73BStock Price

158.89Revenue

$0000About Xero

Xero is a cloud-based accounting software company that provides financial tools for small businesses and solopreneurs. The company offers tools for financial record keeping, invoicing, expense tracking, and payroll management. Xero's services cater to sectors such as construction, real estate, and retail. It was founded in 2006 and is based in Wellington, New Zealand.

Loading...

ESPs containing Xero

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

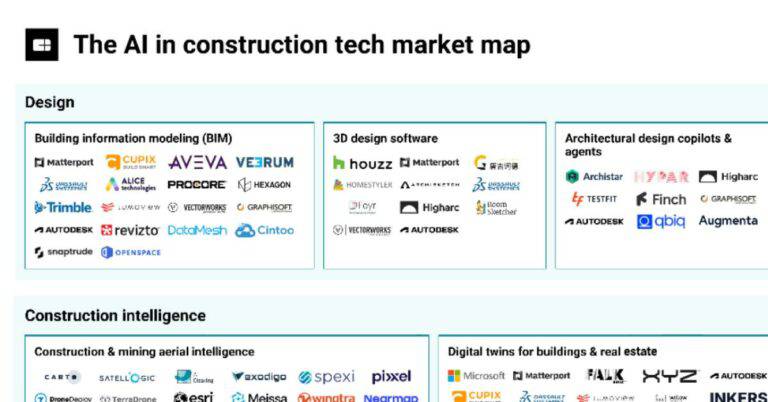

The construction accounting software market provides specialized financial management and accounting solutions designed for the unique needs of the construction industry. These platforms address project-based accounting requirements including job costing, progress billing, retention management, and multi-project financial tracking. Construction accounting software differs from general accounting s…

Xero named as Highflier among 15 other companies, including Sage, Procore, and Acumatica.

Loading...

Research containing Xero

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Xero in 3 CB Insights research briefs, most recently on Aug 27, 2025.

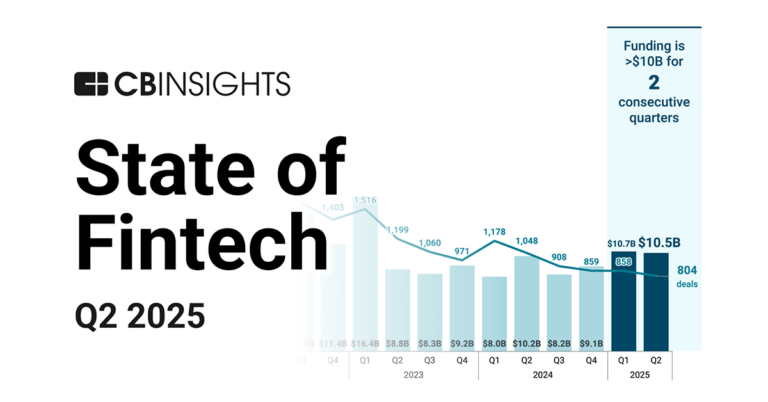

Jul 17, 2025 report

State of Fintech Q2’25 ReportExpert Collections containing Xero

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Xero is included in 4 Expert Collections, including SMB Fintech.

SMB Fintech

1,648 items

Conference Exhibitors

5,302 items

Fintech

14,013 items

Excludes US-based companies

Silicon Valley Bank's Fintech Network

88 items

We mapped out some of SVB's biggest clients, partnerships, and sectors that it serves using CB Insights’ business relationship data from SVB’s profile to uncover just how important it is to the fintech universe. The list is not exhaustive.

Xero Patents

Xero has filed 85 patents.

The 3 most popular patent topics include:

- payment systems

- data management

- machine learning

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

11/11/2022 | 3/11/2025 | Graphical user interface elements, Graphical user interfaces, Graphical control elements, Graphical user interface testing, Dracula | Grant |

Application Date | 11/11/2022 |

|---|---|

Grant Date | 3/11/2025 |

Title | |

Related Topics | Graphical user interface elements, Graphical user interfaces, Graphical control elements, Graphical user interface testing, Dracula |

Status | Grant |

Latest Xero News

Sep 5, 2025

Accounting software platform Xero has wrapped its annual Xerocon summit, and SmartCompany was on the ground in Brisbane to hear more about its AI updates and new tools for business advisors. Here are seven insights from the event, gleaned from the expo floor and conversations with its leading executives. Downplaying AI anxiety Behind every claim of AI innovation is the fear that new technology will displace real workers. The accounting profession is central to that conversation . This puts businesses offering new AI tools to accountants and bookkeepers in an interesting position: those updates must be helpful, without erasing the value humans provide. Angad Soin, Xero's global chief strategy officer and managing director for Australia and New Zealand, said jobs are still safe . And Diya Jolly, Xero's chief product and technology officer, said workers in the field are calling for backup. “We have clearly heard, even at Xerocon, one of the biggest problems the accounting profession is struggling with is the lack of enough new workers across the board,” she said. “That's a fact. There are massive talent shortages.” Smarter business news. Straight to your inbox. For startup founders, small businesses and leaders. Build sharper instincts and better strategy by learning from Australia's smartest business minds. Sign up for free. As a whole, small businesses might not become financially literate to the point where flesh-and-blood advisors become obsolete, she added. Xero users are not wholly fearful of being replaced, she said. “The fear we've heard is, ‘is the work correct? And how do I sign off?' Which is why, at every point, we're doing the compliance training, the sign-offs.” Don't expect AI-generated tax advice any time soon The Australian Taxation Office (ATO) is working closely with accounting software providers to improve the tax experience for small businesses. Enhancing the digital experience for small businesses is on its latest corporate plan And, speaking just yesterday at the Tax Institute's annual summit, ATO commissioner Rob Heferen said, “We're exploring ways to integrate tax administration into small businesses' natural systems to reduce errors and strengthen system integrity”. ‘Natural systems' here includes ‘accounting platforms'. What does that look like in practice, beyond the existing digital tools available to accountants? For Xero, it means using JAX to provide answers derived from information shared across the ATO's website. But don't expect full-on tax advice, or creative interpretations of the underlying legislation, from Xero AI any time soon. “We will not provide tax advice,” said Jolly. “I don't think we will go there, not in the near future, well, ever, because I think it's contextual, right? Tax advice applied to a small business is very contextual.” AI tools a new factor in Xero pricing Xero introduced new subscription tiers last year, which saw some users pay more compared to their old plans. According to Xero's FY25 annual report, those price changes played a role in its Australian operating revenue jumping 24% to nearly $185 million. The cost of some subscriptions increased further in July this year. Xero's formal partnership with OpenAI will expose the accounting software business to new costs of its own. When asked about the knock-on effect for users, Soin said those AI tools will shape Xero's pricing strategy into the future. “If anyone is telling you they know how to price AI, they are kidding themselves,” he said. “We are learning. Our focus right now is adoption. Get it into our customers' hands, see what they value. As we think about strategy, again, it's about value. The job we think they really want, they might not value.” Different tasks may have different compute loads — a heavier burden on Xero's backend partnership with OpenAI — added Soin. “So for us now it's a learning exercise,” he said. “I think in every pricing strategy, every year, we say, ‘Is there more value for the customer? If so, are we appropriately pricing for that?'” Payroll pressures identified If you ever doubted the cash flow crunch facing construction businesses, Xero had the exhibit for you. Regulatory right-sizing Simplifying the rules facing Australian businesses is en vogue . ASIC is doing it, claiming to have slashed more than 9,000 pages of regulation since the start of 2025. The ACCC, too, with chair Gina Cass-Gottlieb, on Thursday declared regulation should be “proportionate where burdens risk stifling progress”. And new Minister for Small Business Anne Aly feels the same way about excess red tape, according to Soin. Ahead of last month's economic roundtable in Canberra, Aly held her own small business roundtable, gathering insight from key stakeholders. Soin was in the room. “The collective ask from everyone around the table to the Small Business Minister to take forward was, ‘Think about the ecosystem. Small businesses have to work with multiple government agencies, multiple definitions [of small business]. Can you simplify it?'” “I think she got that message. The other thing was really around simplifying regulation and red tape. And I think, generally, on the Productivity Commission, that's a place they are heading.” Scope 3 emission reporting no cause for panic Australia's climate reporting regime has begun, with the nation's biggest companies now required to disclose their emissions. This includes Scope 3 emissions caused by their supply chain. Although not directly affected, major corporations may ask their small business suppliers and business partners for emissions data to fill in those reports. The prevailing message at Xerocon: small businesses, and their advisors, have no reason to panic. Nobody is expecting those emission reports to be flawless from the outset, said Hamish Purcell, head of customer success at emissions reporting startup Sumday. Speaking to attendees, he said businesses up and down the supply chain should trust the corporate regulator not to hammer businesses trying their best. “The concept of proportionality is really important to grasp,” he said. The Sumday team argued accountants are best placed to help small businesses meet their reporting requirements by adapting their own advisory services. “We see small businesses being a bit freaked out,” said Lindsay Ellis, Sumday founder. “Certainly, as accountants you have a role to play as being that first point of contact… Maybe they're not perfect the first year or even the second year, but you can start having those conversations.” The pickleball takeover is real Any doubts of pickleball's stranglehold on the technology sector were dismissed at Xerocon, where accountants and bookkeepers duked it out across multiple courts. With the Brisbane 2032 Olympics only a few years away, the city is already warming up. Note: The author attended the event as a guest of Xero. Stay in the know Never miss a story: sign up to SmartCompany's free daily newsletter and find our best stories on LinkedIn

Xero Frequently Asked Questions (FAQ)

When was Xero founded?

Xero was founded in 2006.

Where is Xero's headquarters?

Xero's headquarters is located at 19-23 Taranaki Street, Wellington.

What is Xero's latest funding round?

Xero's latest funding round is PIPE - V.

Who are the investors of Xero?

Investors of Xero include Matrix Capital Management, Valar Ventures, Peter Thiel, Craig Winkler, Sam Morgan and 5 more.

Who are Xero's competitors?

Competitors of Xero include Ember, Fortnox, Simetrik, PayToMe, Autobooks and 7 more.

Loading...

Compare Xero to Competitors

Intuit QuickBooks provides cloud-based accounting solutions for businesses across various sectors. The company offers financial management tools including invoicing, billing, payroll processing, and financial reporting. Intuit QuickBooks serves small to medium-sized businesses that require accounting and bookkeeping services. It was founded in 1983 and is based in Mountain View, California.

FreshBooks serves as a cloud-based accounting and invoicing software that provides functionalities for invoicing, expense tracking, time tracking, financial reporting, and online payment processing. It is used by freelancers, self-employed professionals, and small to medium-sized businesses across various industries. It was founded in 2003 and is based in Toronto, Canada.

MYOB provides business management software for various sectors. Its offerings include financial management, workforce management, and inventory and distribution management solutions. MYOB's platform serves sole operators, small to medium businesses, and accountants and bookkeepers by providing tools for invoicing, payroll, and tax management. It was founded in 1991 and is based in Cremorne, Australia.

Banana.ch is a software solution company that specializes in the development of accounting software for small businesses, non-profit organizations, and individuals. The company's main product, Banana Accounting Plus, is a user-friendly software that provides professional accounting services including expense and revenue management, VAT management, invoicing, budget planning, inventory management, and time management. The company primarily serves the financial technology industry. It was founded in 1990 and is based in Lugano, Switzerland.

Lili focuses on providing business finance solutions. The company offers a range of services, including business banking, smart bookkeeping, invoice and payment management, and tax planning tools. It primarily serves the fintech industry. The company was founded in 2018 and is based in New York, New York.

Novo is a fintech company that provides online business banking solutions for small businesses. The company offers checking accounts, business credit cards, bookkeeping services, and tools for invoicing, budgeting, and financial integrations. Novo serves small businesses, freelancers, self-employed individuals, and consultants with various financial management tools. It was founded in 2016 and is based in Miami, Florida.

Loading...